Comstock Resources, Inc. (CRK): Price and Financial Metrics

CRK Price/Volume Stats

| Current price | $10.40 | 52-week high | $13.39 |

| Prev. close | $10.05 | 52-week low | $7.07 |

| Day low | $10.02 | Volume | 3,486,822 |

| Day high | $10.46 | Avg. volume | 3,890,152 |

| 50-day MA | $10.91 | Dividend yield | N/A |

| 200-day MA | $9.87 | Market Cap | 3.04B |

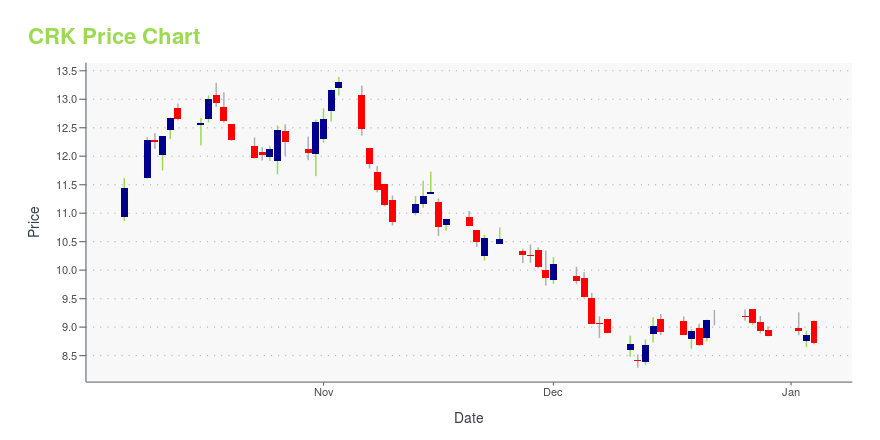

CRK Stock Price Chart Interactive Chart >

Comstock Resources, Inc. (CRK) Company Bio

Comstock Resources, Inc. acquires, develops, explores, and produces oil and natural gas properties in the United States. Its oil and gas operations are primarily located in East Texas/North Louisiana and South Texas. The company was founded in 1919 and is based in Frisco, Texas.

Latest CRK News From Around the Web

Below are the latest news stories about COMSTOCK RESOURCES INC that investors may wish to consider to help them evaluate CRK as an investment opportunity.

Benign Growth For Comstock Resources, Inc. (NYSE:CRK) Underpins Its Share PriceComstock Resources, Inc.'s ( NYSE:CRK ) price-to-earnings (or "P/E") ratio of 4x might make it look like a strong buy... |

Top 25 Natural Gas Producers in the USIn this article, we’ll discuss the top natural gas-producing companies in the US and their current dynamics. If you want to skip our detailed overview of the country’s natural gas sector, read Top 5 Natural Gas Producers in the US. The United States is rich in natural gas resources found in multiple key basins and regions. Firstly, the […] |

Taking A Look At Comstock Resources, Inc.'s (NYSE:CRK) ROEMany investors are still learning about the various metrics that can be useful when analysing a stock. This article is... |

Comstock Resources (NYSE:CRK) Is Due To Pay A Dividend Of $0.125Comstock Resources, Inc. ( NYSE:CRK ) will pay a dividend of $0.125 on the 15th of December. Based on this payment, the... |

Comstock Resources, Inc. (NYSE:CRK) Q3 2023 Earnings Call TranscriptComstock Resources, Inc. (NYSE:CRK) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good day, and thank you for standing by, and welcome to the Q3 2023 Comstock Resources, Inc. Earnings Conference Call. [Operator Instructions]. I would now like to introduce your host for today’s call, Jay Allison, Chairman and CEO. Please go ahead. Miles […] |

CRK Price Returns

| 1-mo | -2.62% |

| 3-mo | 0.78% |

| 6-mo | 30.16% |

| 1-year | -10.12% |

| 3-year | 79.26% |

| 5-year | 72.77% |

| YTD | 17.51% |

| 2023 | -32.37% |

| 2022 | 70.63% |

| 2021 | 85.13% |

| 2020 | -46.90% |

| 2019 | 81.68% |

Loading social stream, please wait...