Cerence Inc. (CRNC): Price and Financial Metrics

CRNC Price/Volume Stats

| Current price | $3.27 | 52-week high | $28.10 |

| Prev. close | $3.18 | 52-week low | $2.55 |

| Day low | $3.18 | Volume | 602,863 |

| Day high | $3.32 | Avg. volume | 1,109,358 |

| 50-day MA | $3.26 | Dividend yield | N/A |

| 200-day MA | $12.60 | Market Cap | 136.61M |

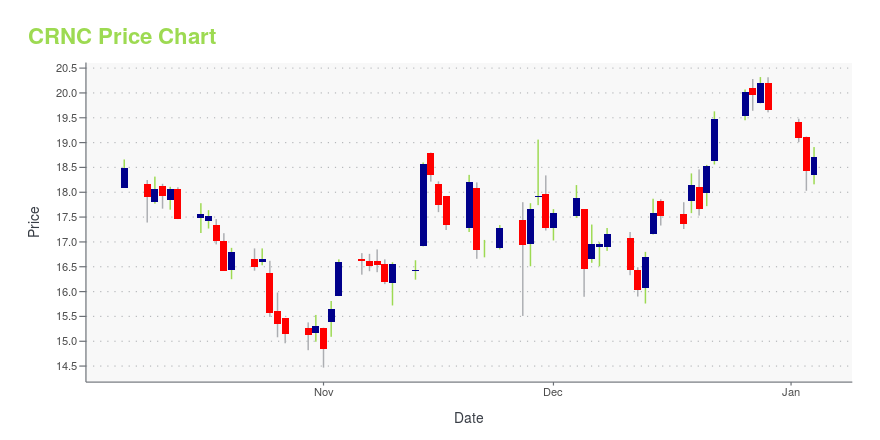

CRNC Stock Price Chart Interactive Chart >

Cerence Inc. (CRNC) Company Bio

Cerence Inc. provides AI-powered assistants and innovations for connected and autonomous vehicles It offers edge software components; cloud-connected components; toolkits; applications; and virtual assistant coexistence and professional services. The company also provides conversational artificial intelligence, including voice recognition, natural language understanding, and artificial intelligence services. Cerence Inc. is headquartered in Burlington, Massachusetts.

Latest CRNC News From Around the Web

Below are the latest news stories about CERENCE INC that investors may wish to consider to help them evaluate CRNC as an investment opportunity.

Cerence Pioneers Automotive-Specific LLM in Collaboration with NVIDIA, Powering the Future of In-Car ExperiencesCerence has created an LLM-based platform leveraging its extensive automotive dataset and tech stack to deliver enhanced experiences for end usersBURLINGTON, Mass., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Cerence Inc. (NASDAQ: CRNC), AI for a world in motion, today introduced a pioneering, automotive-specific large language model, CaLLM™, powered by NVIDIA technology. CaLLM™ (Cerence Automotive Large Language Model) serves as the foundation for Cerence’s next-generation in-car computing platform, runn |

3 Tech Stocks to Pick Up BEFORE the Year-End RallyTech stocks are poised to quickly catalyze in value near the end of the year, and these three could surge even higher. |

Cerence Inc (CRNC) Surpasses Fiscal Year 2023 Revenue and Profitability ForecastsStrong Execution Leads to Revenue Growth and Strategic Design Wins |

Cerence Announces Fourth Quarter and Fiscal Year 2023 ResultsHeadlines Revenue and profitability exceed the high end of the initially guided range for the full fiscal yearFive consecutive quarters of strong executionFourteen strategic design wins in the fiscal year including five competitive winbacksMaintain a leadership position with Cerence penetration staying strong at 54% of global auto productionFine-tuned LLM with Cerence vertical automotive dataset delivered to customers, advancing Destination Next software platform BURLINGTON, Mass., Nov. 27, 2023 |

Insider Sell Alert: EVP, CTO Iqbal Arshad Sells 11,818 Shares of Cerence Inc (CRNC)Cerence Inc (NASDAQ:CRNC), a leader in creating unique, moving experiences for the automotive world, has recently witnessed a significant insider sell from one of its top executives. |

CRNC Price Returns

| 1-mo | 15.14% |

| 3-mo | -66.32% |

| 6-mo | -84.12% |

| 1-year | -87.54% |

| 3-year | -96.90% |

| 5-year | N/A |

| YTD | -83.37% |

| 2023 | 6.10% |

| 2022 | -75.82% |

| 2021 | -23.73% |

| 2020 | 344.01% |

| 2019 | N/A |

Loading social stream, please wait...