CoStar Group Inc. (CSGP): Price and Financial Metrics

CSGP Price/Volume Stats

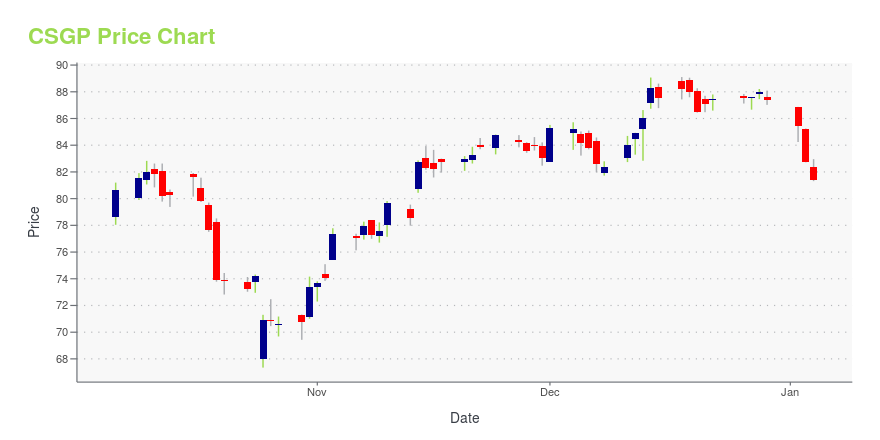

| Current price | $78.51 | 52-week high | $100.38 |

| Prev. close | $77.84 | 52-week low | $67.35 |

| Day low | $77.78 | Volume | 2,360,600 |

| Day high | $79.34 | Avg. volume | 2,325,973 |

| 50-day MA | $77.44 | Dividend yield | N/A |

| 200-day MA | $83.22 | Market Cap | 32.06B |

CSGP Stock Price Chart Interactive Chart >

CoStar Group Inc. (CSGP) Company Bio

CoStar Group, Inc. is a Washington, DC-based provider of information, analytics and marketing services to the commercial property industry in the United States, Canada, the United Kingdom, France, Germany, and Spain. Founded in 1987 by Andrew C. Florance, the company has grown to include online database CoStar and many online marketplaces, including Apartments.com, LoopNet, Lands of America, and BizBuySell. (Source:Wikipedia)

Latest CSGP News From Around the Web

Below are the latest news stories about COSTAR GROUP INC that investors may wish to consider to help them evaluate CSGP as an investment opportunity.

CoStar Group (CSGP) Shares Fell 14% on Plans of Further InvestmentsTimesSquare Capital Management, an equity investment management company, released its “U.S. Mid Cap Growth Strategy” third-quarter investor letter. A copy of the same can be downloaded here. In the third quarter, the strategy outperformed the Russell Midcap Growth Index and returned -4.11% (net) while the index return was -5.22%. The third quarter saw a decline in […] |

CoStar (CSGP) Completes OnTheMarket Deal, Expands in the U.K.CoStar (CSGP) completes the previously announced acquisition of OnTheMarket plc, one of the U.K.'s three most visited residential property portals. |

CoStar Group Completes Acquisition of OnTheMarket.com With Overwhelming 97% Shareholder SupportLONDON, December 12, 2023--CoStar Group, Inc. ("CoStar", NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces, announces the completion of its acquisition of OnTheMarket plc ("OTM"), one of the UK’s three most visited residential property portals. |

Amdocs (DOX) Up 7.8% Since Last Earnings Report: Can It Continue?Amdocs (DOX) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Insider Sell: Director John Hill Sells 3,020 Shares of CoStar Group Inc (CSGP)CoStar Group Inc (NASDAQ:CSGP), a leader in providing commercial real estate information, analytics, and online marketplaces, has recently seen a notable insider sell from one of its directors. |

CSGP Price Returns

| 1-mo | 5.72% |

| 3-mo | -15.26% |

| 6-mo | -9.02% |

| 1-year | -3.88% |

| 3-year | -9.71% |

| 5-year | 24.54% |

| YTD | -10.16% |

| 2023 | 13.08% |

| 2022 | -2.21% |

| 2021 | -14.50% |

| 2020 | 54.48% |

| 2019 | 77.36% |

Continue Researching CSGP

Want to do more research on Costar Group Inc's stock and its price? Try the links below:Costar Group Inc (CSGP) Stock Price | Nasdaq

Costar Group Inc (CSGP) Stock Quote, History and News - Yahoo Finance

Costar Group Inc (CSGP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...