Chicken Soup for the Soul Entertainment, Inc. - (CSSE): Price and Financial Metrics

CSSE Price/Volume Stats

| Current price | $0.11 | 52-week high | $1.27 |

| Prev. close | $0.12 | 52-week low | $0.09 |

| Day low | $0.10 | Volume | 28,560,800 |

| Day high | $0.12 | Avg. volume | 3,047,637 |

| 50-day MA | $0.28 | Dividend yield | N/A |

| 200-day MA | $0.25 | Market Cap | 3.42M |

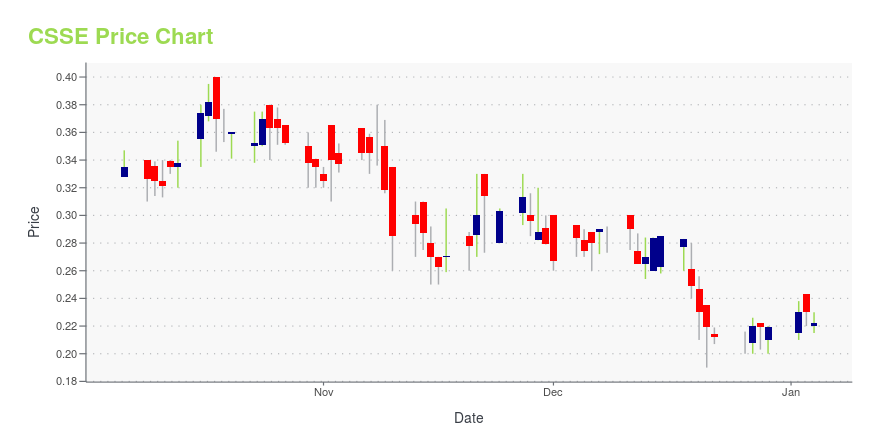

CSSE Stock Price Chart Interactive Chart >

Chicken Soup for the Soul Entertainment, Inc. - (CSSE) Company Bio

Chicken Soup for the Soul Entertainment, Inc. produces, distributes, and licenses video content-television programming, online video content, and motion pictures. It intends to provide its video content to consumers worldwide through television and online networks, including its online affiliate APlus.com. The company was founded in 2014 and is based in Cos Cob, Connecticut.

Latest CSSE News From Around the Web

Below are the latest news stories about CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC that investors may wish to consider to help them evaluate CSSE as an investment opportunity.

CSSE Stock Earnings: Chicken Soup for the Soul Misses EPS, Misses Revenue for Q3 2023CSSE stock results show that Chicken Soup for the Soul missed analyst estimates for earnings per share and missed on revenue for the third quarter of 2023. |

Chicken Soup for the Soul Entertainment, Inc. (CSSE) Reports Q3 Loss, Lags Revenue EstimatesChicken Soup for the Soul Entertainment, Inc. (CSSE) delivered earnings and revenue surprises of -1,038.84% and 34.92%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Carnival (CCL) Reports Q4 Loss, Tops Revenue EstimatesCarnival (CCL) delivered earnings and revenue surprises of 41.67% and 1.50%, respectively, for the quarter ended November 2023. Do the numbers hold clues to what lies ahead for the stock? |

Chicken Soup for the Soul Entertainment Announces Timing of Regular Monthly Dividend for January for Series A Cumulative Redeemable Perpetual Preferred StockCOS COB, Conn., December 18, 2023--Chicken Soup for the Soul Entertainment Inc. (Nasdaq: CSSE, CSSEP, CSSEL, CSSEN), one of the largest providers of premium content to value-conscious consumers, today announced the timing for the payment of its declared regular monthly dividend of $0.2031 per share of its 9.75% Series A Cumulative Redeemable Perpetual Preferred Stock for January 2024. The dividend will be payable on or around January 15, 2024 to holders of record as of December 31, 2023. The div |

Loop Media (LPTV) Reports Q4 Loss, Lags Revenue EstimatesLoop Media (LPTV) delivered earnings and revenue surprises of -7.69% and 0.65%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

CSSE Price Returns

| 1-mo | -47.82% |

| 3-mo | -54.51% |

| 6-mo | -38.51% |

| 1-year | -90.35% |

| 3-year | -99.68% |

| 5-year | -98.70% |

| YTD | -49.86% |

| 2023 | -95.71% |

| 2022 | -63.01% |

| 2021 | -30.77% |

| 2020 | 149.88% |

| 2019 | 6.38% |

Continue Researching CSSE

Want to see what other sources are saying about Chicken Soup for the Soul Entertainment Inc's financials and stock price? Try the links below:Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Price | Nasdaq

Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Quote, History and News - Yahoo Finance

Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...