Constellium SE (CSTM): Price and Financial Metrics

CSTM Price/Volume Stats

| Current price | $14.11 | 52-week high | $19.65 |

| Prev. close | $14.45 | 52-week low | $7.32 |

| Day low | $14.08 | Volume | 1,200,900 |

| Day high | $14.37 | Avg. volume | 1,629,003 |

| 50-day MA | $12.70 | Dividend yield | N/A |

| 200-day MA | $11.66 | Market Cap | 2.02B |

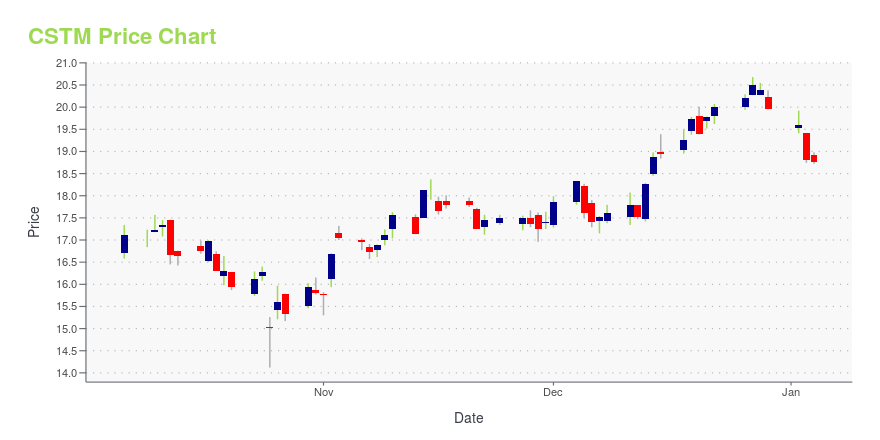

CSTM Stock Price Chart Interactive Chart >

Constellium SE (CSTM) Company Bio

Constellium NV is engaged in the design, manufacture, and sale of specialty rolled and extruded aluminum products for the aerospace, packaging, and automotive end-markets. The company operates in three segments: Aerospace & Transportation, Packaging & Automotive Rolled Products, and Automotive Structures & Industry. The company was incorporated in 2010 and is based in Schiphol-Rijk, the Netherlands.

CSTM Price Returns

| 1-mo | 3.22% |

| 3-mo | 68.18% |

| 6-mo | 30.05% |

| 1-year | -24.34% |

| 3-year | 7.14% |

| 5-year | 62.18% |

| YTD | 37.39% |

| 2024 | -48.55% |

| 2023 | 68.72% |

| 2022 | -33.95% |

| 2021 | 28.02% |

| 2020 | 4.40% |

Continue Researching CSTM

Want to see what other sources are saying about Constellium SE's financials and stock price? Try the links below:Constellium SE (CSTM) Stock Price | Nasdaq

Constellium SE (CSTM) Stock Quote, History and News - Yahoo Finance

Constellium SE (CSTM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...