Computer Task Group, Incorporated (CTG): Price and Financial Metrics

CTG Price/Volume Stats

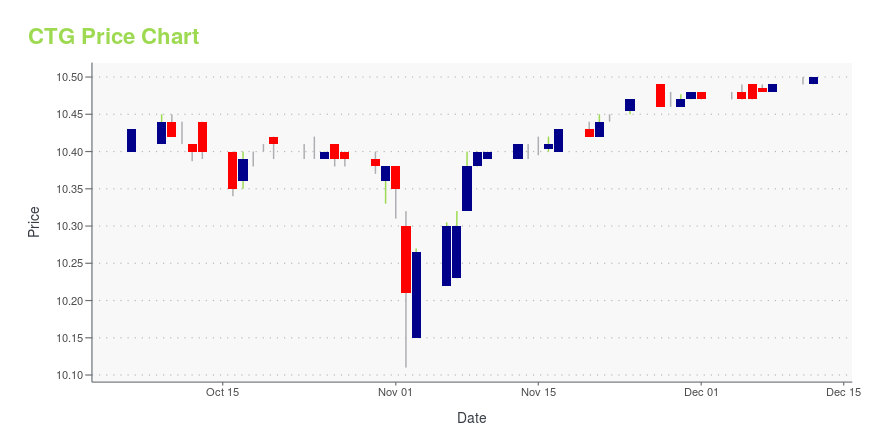

| Current price | $10.50 | 52-week high | $10.50 |

| Prev. close | $10.49 | 52-week low | $6.05 |

| Day low | $10.49 | Volume | 49,200 |

| Day high | $10.50 | Avg. volume | 76,112 |

| 50-day MA | $10.41 | Dividend yield | N/A |

| 200-day MA | $8.61 | Market Cap | 169.00M |

CTG Stock Price Chart Interactive Chart >

Computer Task Group, Incorporated (CTG) Company Bio

Computer Task Group, Incorporated operates as an information technology (IT) solutions and staffing services company in North America and Europe. The company was founded in 1966 and is based in Buffalo, New York.

Latest CTG News From Around the Web

Below are the latest news stories about COMPUTER TASK GROUP INC that investors may wish to consider to help them evaluate CTG as an investment opportunity.

Computer Task Group Inc (CTG) Reports Mixed Q3 2023 Results Amid Acquisition ProcessRevenue Declines as Company Focuses on Strategic IT Solutions and Services |

CTG IT Solutions and Services Segments Gross Margin Improved 40 Basis Points to 29.5% in Third Quarter 2023Cegeka and CTG work toward Completion of Regulatory Requirements to Complete Acquisition Cegeka and CTG signed an agreement on August 9, 2023, for Cegeka to purchase CTG for $10.50 per share in a cash transaction valued at approximately $170 million.IT Solutions and Services segments represent 87% of total revenue in the third quarter, CTG’s highest level to date. Revenue of $71.3 million reflected intentional disengagement of $11.8 million from non-strategic technology services business.Gross m |

Endava PLC Sponsored ADR (DAVA) Surges 6.0%: Is This an Indication of Further Gains?Endava PLC Sponsored ADR (DAVA) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Cegeka and CTG Announce Extension of Tender Offer for All Outstanding Shares of CTGHASSELT, Belgium and LIMBURG, The Netherlands and BUFFALO, N.Y., Nov. 03, 2023 (GLOBE NEWSWIRE) -- Cegeka Groep NV (“Cegeka”) and Computer Task Group, Incorporated (NASDAQ: CTG) (“CTG”) announced today that Chicago Merger Sub, Inc. (“Merger Sub”), a wholly owned subsidiary of Cegeka, has extended the expiration date of its offer (the “Offer”) to acquire all of the outstanding shares of common stock of CTG, par value $0.01 per share (“Shares”), for $10.50 per Share, net to the seller in cash, wit |

CTG Recognized as One of the UK’s Best Workplaces in Tech™BUFFALO, N.Y., Sept. 05, 2023 (GLOBE NEWSWIRE) -- CTG (Nasdaq: CTG) (“Company”), a leader in North America and Western Europe helping companies employ digital IT solutions and services to drive their productivity and profitability, announced today that the Company has been named to the 2023 United Kingdom’s (UK) Best Workplaces in Tech™ list in the small employer category by Great Place To Work® UK. Through an anonymous survey, CTG employees shared that the Company’s people and collaborative cul |

CTG Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 37.08% |

| 3-year | 15.38% |

| 5-year | 142.49% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -24.17% |

| 2021 | 62.91% |

| 2020 | 18.15% |

| 2019 | 26.96% |

Continue Researching CTG

Want to do more research on Computer Task Group Inc's stock and its price? Try the links below:Computer Task Group Inc (CTG) Stock Price | Nasdaq

Computer Task Group Inc (CTG) Stock Quote, History and News - Yahoo Finance

Computer Task Group Inc (CTG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...