CareTrust REIT, Inc. (CTRE): Price and Financial Metrics

CTRE Price/Volume Stats

| Current price | $26.54 | 52-week high | $27.32 |

| Prev. close | $26.25 | 52-week low | $19.43 |

| Day low | $26.38 | Volume | 1,580,926 |

| Day high | $26.63 | Avg. volume | 1,358,591 |

| 50-day MA | $25.65 | Dividend yield | 4.28% |

| 200-day MA | $23.53 | Market Cap | 3.77B |

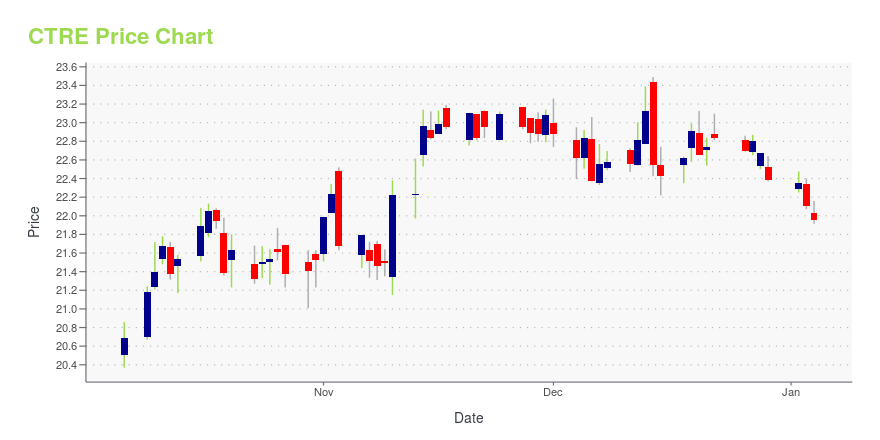

CTRE Stock Price Chart Interactive Chart >

CareTrust REIT, Inc. (CTRE) Company Bio

Caretrust REIT is engaged in the ownership, acquisition and leasing of seniors housing and healthcare-related properties. The company was established in 2014 and is based in San Clemente, California.

Latest CTRE News From Around the Web

Below are the latest news stories about CARETRUST REIT INC that investors may wish to consider to help them evaluate CTRE as an investment opportunity.

The 7 Best REITs Stocks to Buy in DecemberInvest in the these seven best REITs to buy offering strong upside and shining bright in 2023's tough real estate market. |

CareTrust REIT Announces Third Quarter 2023 Operating ResultsSAN CLEMENTE, Calif., November 09, 2023--CareTrust REIT Announces Third Quarter 2023 Operating Results |

CareTrust REIT Sets Third Quarter Earnings Call for Friday, November 10, 2023SAN CLEMENTE, Calif., November 03, 2023--CareTrust REIT Sets Third Quarter Earnings Call for Friday, November 10, 2023 |

The 7 Best REITs To Buy Now: October 2023These are seven different REITs that investors should be looking to buy. |

7 Affordable Stocks to Invest in as America’s Population AgesStocks for an aging population include some surprisingly youthful products and firms not commonly associated with seniors. |

CTRE Price Returns

| 1-mo | 8.98% |

| 3-mo | 10.46% |

| 6-mo | 26.23% |

| 1-year | 33.37% |

| 3-year | 28.72% |

| 5-year | 47.78% |

| YTD | 21.43% |

| 2023 | 27.31% |

| 2022 | -13.67% |

| 2021 | 7.91% |

| 2020 | 13.67% |

| 2019 | 16.31% |

CTRE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CTRE

Want to do more research on CareTrust REIT Inc's stock and its price? Try the links below:CareTrust REIT Inc (CTRE) Stock Price | Nasdaq

CareTrust REIT Inc (CTRE) Stock Quote, History and News - Yahoo Finance

CareTrust REIT Inc (CTRE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...