Cognizant Technology Solutions Corp. (CTSH): Price and Financial Metrics

CTSH Price/Volume Stats

| Current price | $74.57 | 52-week high | $80.09 |

| Prev. close | $73.21 | 52-week low | $62.14 |

| Day low | $72.83 | Volume | 5,127,055 |

| Day high | $74.97 | Avg. volume | 4,111,115 |

| 50-day MA | $68.82 | Dividend yield | 1.62% |

| 200-day MA | $71.16 | Market Cap | 37.08B |

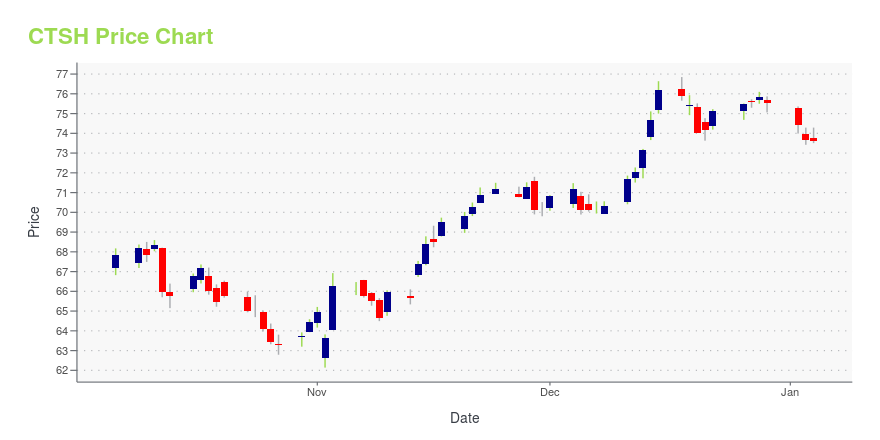

CTSH Stock Price Chart Interactive Chart >

Cognizant Technology Solutions Corp. (CTSH) Company Bio

Cognizant is an American multinational information technology services and consulting company. It is headquartered in Teaneck, New Jersey, United States. Cognizant is part of the NASDAQ-100 and trades under CTSH. It was founded as an in-house technology unit of Dun & Bradstreet in 1994,and started serving external clients in 1996. (Source:Wikipedia)

Latest CTSH News From Around the Web

Below are the latest news stories about COGNIZANT TECHNOLOGY SOLUTIONS CORP that investors may wish to consider to help them evaluate CTSH as an investment opportunity.

Returns On Capital At Cognizant Technology Solutions (NASDAQ:CTSH) Have Hit The BrakesIf you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an... |

Cognizant Technology Solutions Corporation's (NASDAQ:CTSH) P/E Is On The MarkIt's not a stretch to say that Cognizant Technology Solutions Corporation's ( NASDAQ:CTSH ) price-to-earnings (or... |

25 Best Online MBA Degree Programs Heading Into 2024In this article, we will be looking at the 25 best online MBA degree programs heading into 2024. If you want to skip our detailed analysis, you can go directly to the 5 Best Online MBA Degree Programs Heading Into 2024. MBA Career Spotlight: Consulting Services Market According to a report by the Graduate Management […] |

Despite the downward trend in earnings at Cognizant Technology Solutions (NASDAQ:CTSH) the stock grows 4.4%, bringing one-year gains to 28%Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than... |

Cognizant to acquire Thirdera to enhance cross-industry digital transformation with ServiceNow and create one of the world's largest, most credentialed ServiceNow partnersCognizant (NASDAQ: CTSH) has entered into an agreement to acquire Broomfield, CO-based Thirdera, an Elite ServiceNow Partner specializing in advisory, implementation and optimization solutions related to the ServiceNow platform, with a strong focus on emerging enterprise workflow products. As part of the acquisition, Thirdera's ServiceNow training platform, Thirdera University – one of the world's largest – is expected to play a central role in credentialing resources to fulfill growing demand i |

CTSH Price Returns

| 1-mo | 9.18% |

| 3-mo | 11.88% |

| 6-mo | -2.72% |

| 1-year | 14.36% |

| 3-year | 13.05% |

| 5-year | 20.85% |

| YTD | -0.47% |

| 2023 | 34.38% |

| 2022 | -34.54% |

| 2021 | 9.64% |

| 2020 | 33.93% |

| 2019 | -1.07% |

CTSH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CTSH

Want to see what other sources are saying about Cognizant Technology Solutions Corp's financials and stock price? Try the links below:Cognizant Technology Solutions Corp (CTSH) Stock Price | Nasdaq

Cognizant Technology Solutions Corp (CTSH) Stock Quote, History and News - Yahoo Finance

Cognizant Technology Solutions Corp (CTSH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...