Cullman Bancorp, Inc. (CULL): Price and Financial Metrics

CULL Price/Volume Stats

| Current price | $9.01 | 52-week high | $11.59 |

| Prev. close | $9.03 | 52-week low | $8.56 |

| Day low | $9.01 | Volume | 7,567 |

| Day high | $9.10 | Avg. volume | 8,788 |

| 50-day MA | $10.11 | Dividend yield | 1.33% |

| 200-day MA | $10.44 | Market Cap | 65.30M |

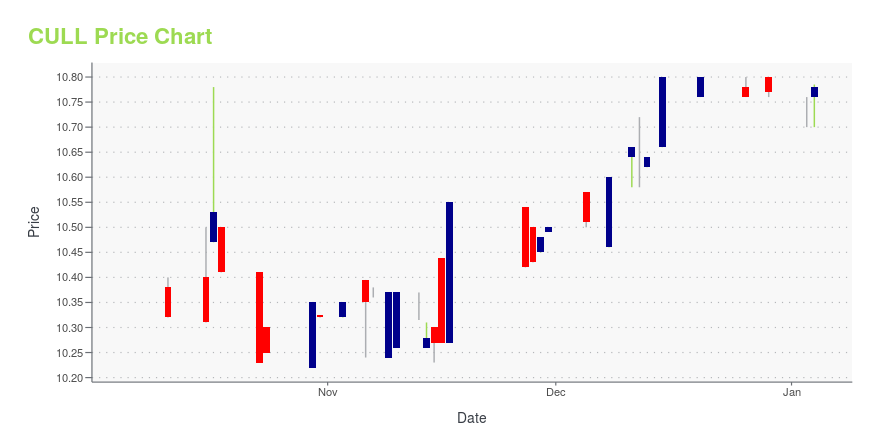

CULL Stock Price Chart Interactive Chart >

Cullman Bancorp, Inc. (CULL) Company Bio

Cullman Bancorp, Inc. operates as the holding company for Cullman Savings Bank that provides various banking products and services in Cullman County. It offers checking, savings, and individual retirement accounts, as well as certificates of deposit accounts. The company also provides one- to four-family residential real estate, commercial real estate, commercial and industrial, construction, multi-family real estate, and consumer loans; and invests in securities. It operates three full-service offices in Cullman, Alabama and one full-service office in Hanceville, Alabama. The company was founded in 1887 and is headquartered in Cullman, Alabama.

Latest CULL News From Around the Web

Below are the latest news stories about CULLMAN BANCORP INC that investors may wish to consider to help them evaluate CULL as an investment opportunity.

Cullman Bancorp, Inc. Announces Payment of Annual Cash Dividend of $0.12 Per ShareCULLMAN, Ala., January 18, 2023--Cullman Bancorp, Inc. (the "Company") (Nasdaq: CULL), the holding company for Cullman Savings Bank, announced that the Company has declared the payment of an annual cash dividend. The dividend of $0.12 per share will be paid on February 22, 2023 to stockholders of record as of February 1, 2023. |

CULL Price Returns

| 1-mo | N/A |

| 3-mo | -12.35% |

| 6-mo | -21.40% |

| 1-year | -15.10% |

| 3-year | -19.38% |

| 5-year | N/A |

| YTD | -15.41% |

| 2023 | -5.31% |

| 2022 | -5.50% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

CULL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...