CVR Energy Inc. (CVI): Price and Financial Metrics

CVI Price/Volume Stats

| Current price | $27.40 | 52-week high | $39.36 |

| Prev. close | $26.58 | 52-week low | $23.93 |

| Day low | $26.37 | Volume | 1,939,569 |

| Day high | $27.69 | Avg. volume | 965,998 |

| 50-day MA | $26.85 | Dividend yield | 8.05% |

| 200-day MA | $31.12 | Market Cap | 2.75B |

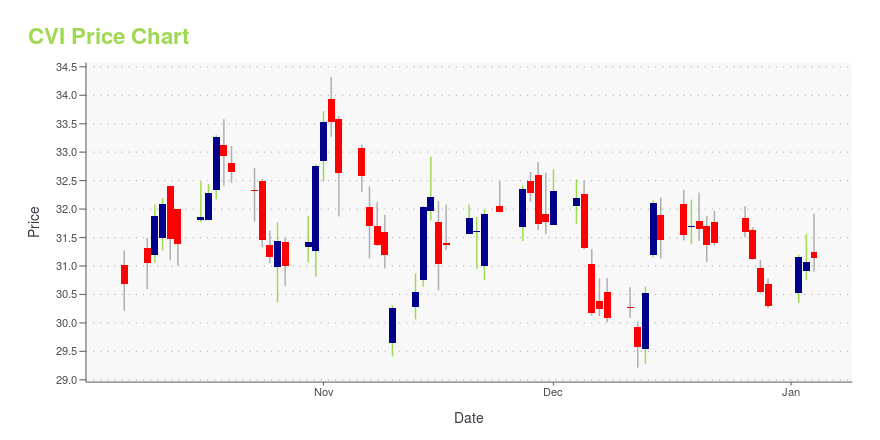

CVI Stock Price Chart Interactive Chart >

CVR Energy Inc. (CVI) Company Bio

CVR Energy engages in petroleum refining and nitrogen fertilizer manufacturing activities in the United States. The company operates through two segments, Petroleum and Nitrogen Fertilizer. The company was founded in 2007 and is based in Sugar Land, Texas.

Latest CVI News From Around the Web

Below are the latest news stories about CVR ENERGY INC that investors may wish to consider to help them evaluate CVI as an investment opportunity.

CVR Energy, Inc.'s (NYSE:CVI) Business And Shares Still Trailing The MarketWith a price-to-earnings (or "P/E") ratio of 4x CVR Energy, Inc. ( NYSE:CVI ) may be sending very bullish signals at... |

CVR Energy Announces Pricing of Private Placement of $600 Million of 8.500% Senior Notes due 2029SUGAR LAND, Texas, Dec. 08, 2023 (GLOBE NEWSWIRE) -- CVR Energy, Inc. (the “Company” or “CVR Energy”) (NYSE: CVI) announced today the pricing of its private placement (the “Offering”) pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the “Securities Act”), of $600 million in aggregate principal amount of 8.500% senior unsecured notes due 2029 (the “Notes”). The Notes mature on January 15, 2029, and will be issued at par. The Notes will be jointly and severally |

CVR Energy Announces Private Placement of $600 Million of Senior NotesSUGAR LAND, Texas, Dec. 07, 2023 (GLOBE NEWSWIRE) -- CVR Energy, Inc. (the “Company” or “CVR Energy”) (NYSE: CVI) announced today that, subject to market conditions, it intends to offer (the “Offering”) for sale in a private placement pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the “Securities Act”), $600 million in aggregate principal amount of senior unsecured notes due 2029 (the “Notes”). The Notes are expected to be jointly and severally guaranteed on |

Ovintiv (OVV) Q3 Earnings Miss Estimates, Revenues BeatOvintiv (OVV) anticipates capital spending in the $660-$700 million range for the fourth quarter of 2023, and in the band of $2.75-$2.79 billion for the full year. |

Targa's (TRGP) Q3 Earnings and Revenues Miss EstimatesTarga (TRGP) expects 2023 adjusted EBITDA to be in the $3.5-$3.7 billion range, with capital expenditures between $2 billion and $2.2 billion, and net maintenance capital spending of $200 million. |

CVI Price Returns

| 1-mo | 2.32% |

| 3-mo | -16.11% |

| 6-mo | -12.75% |

| 1-year | -10.76% |

| 3-year | 185.02% |

| 5-year | -23.86% |

| YTD | -6.62% |

| 2023 | 11.51% |

| 2022 | 121.45% |

| 2021 | 12.82% |

| 2020 | -61.31% |

| 2019 | 25.44% |

CVI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CVI

Here are a few links from around the web to help you further your research on Cvr Energy Inc's stock as an investment opportunity:Cvr Energy Inc (CVI) Stock Price | Nasdaq

Cvr Energy Inc (CVI) Stock Quote, History and News - Yahoo Finance

Cvr Energy Inc (CVI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...