Community West Bancshares (CWBC): Price and Financial Metrics

CWBC Price/Volume Stats

| Current price | $20.20 | 52-week high | $24.47 |

| Prev. close | $20.15 | 52-week low | $13.55 |

| Day low | $19.92 | Volume | 77,100 |

| Day high | $20.51 | Avg. volume | 53,548 |

| 50-day MA | $18.08 | Dividend yield | 2.24% |

| 200-day MA | $18.34 | Market Cap | 381.17M |

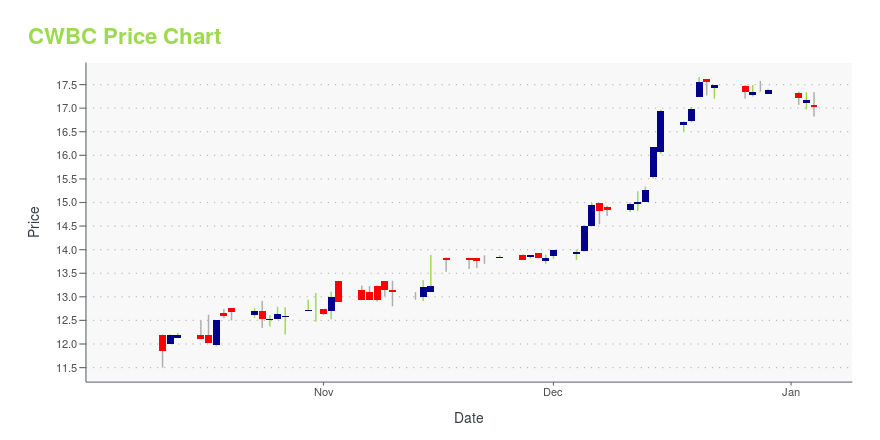

CWBC Stock Price Chart Interactive Chart >

Community West Bancshares (CWBC) Company Bio

Community West Bancshares operates as the bank holding company for Community West Bank, N.A. that provides various financial products and services in California. The company offers deposit products, such as checking accounts, savings accounts, money market accounts, and fixed rate and fixed maturity certificates of deposit, as well as cash management products. It also provides commercial, commercial real estate, consumer, manufactured housing, and small business administration loans, as well as agricultural loans for real estate and operating lines; home equity lines of credit collateralized by residential real estate; single family real estate loans; and installment loans consisting of automobile and general-purpose loans. The company serves small to medium-sized businesses and their owners, professionals, high-net worth individuals, and non-profit organizations. It operates a network of eight branch banking offices in Goleta, Oxnard, San Luis Obispo, Santa Barbara, Santa Maria, Ventura, Paso Robles, and Westlake Village. Community West Bancshares was founded in 1989 and is headquartered in Goleta, California.

Latest CWBC News From Around the Web

Below are the latest news stories about COMMUNITY WEST BANCSHARES that investors may wish to consider to help them evaluate CWBC as an investment opportunity.

Community West Bancshares (CWBC) Q3 Earnings Surpass EstimatesCommunity West Bancshares (CWBC) delivered earnings and revenue surprises of 4.17% and 0%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Community West Bancshares Reports Third Quarter 2023 Earnings of $2.3 Million, or $0.25 Per Diluted Share; Declares Quarterly Cash Dividend of $0.08 Per Common ShareGOLETA, Calif., Oct. 27, 2023 (GLOBE NEWSWIRE) -- Community West Bancshares (“Community West” or the “Company”), (NASDAQ: CWBC), parent company of Community West Bank (the “Bank”), today reported net income of $2.3 million, or $0.25 per diluted share, for the third quarter of 2023, compared to $2.1 million, or $0.24 per diluted share, for the preceding quarter, and $3.5 million, or $0.39 per diluted share, for the third quarter of 2022. For the first nine months of 2023, the Company reported net |

Zions (ZION) Surpasses Q3 Earnings and Revenue EstimatesZions (ZION) delivered earnings and revenue surprises of 2.73% and 0.85%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

California community banks to merge in $99M dealCentral Valley Community Bancorp's agreement to buy Community West Bancshares, slated to close in the second quarter, would create a $3.6 billion-asset bank in the Greater Sacramento region. |

Central Valley Community Bancorp and Community West Bancshares to MergeFRESNO, Calif. & GOLETA, Calif., October 11, 2023--Central Valley Community Bancorp (Central Valley), (NASDAQ: CVCY), headquartered in Fresno, California, together with its banking subsidiary, Central Valley Community Bank (CVCB) and Community West Bancshares (Community West) (NASDAQ: CWBC), parent company of Community West Bank (CWB), headquartered in Goleta, California, announced today the signing of an Agreement of Reorganization and Merger, dated October 10, 2023, pursuant to which the compa |

CWBC Price Returns

| 1-mo | 15.03% |

| 3-mo | 14.08% |

| 6-mo | 3.27% |

| 1-year | 25.03% |

| 3-year | 3.26% |

| 5-year | 16.13% |

| YTD | -8.00% |

| 2023 | 10.33% |

| 2022 | 5.88% |

| 2021 | 44.79% |

| 2020 | -28.62% |

| 2019 | 18.55% |

CWBC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CWBC

Here are a few links from around the web to help you further your research on Community West Bancshares's stock as an investment opportunity:Community West Bancshares (CWBC) Stock Price | Nasdaq

Community West Bancshares (CWBC) Stock Quote, History and News - Yahoo Finance

Community West Bancshares (CWBC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...