China XD Plastics Company Limited (CXDC): Price and Financial Metrics

CXDC Price/Volume Stats

| Current price | $0.00 | 52-week high | $0.06 |

| Prev. close | $0.00 | 52-week low | $0.00 |

| Day low | $0.00 | Volume | 1,160 |

| Day high | $0.00 | Avg. volume | 2,643 |

| 50-day MA | $0.00 | Dividend yield | N/A |

| 200-day MA | $0.01 | Market Cap | 160.68K |

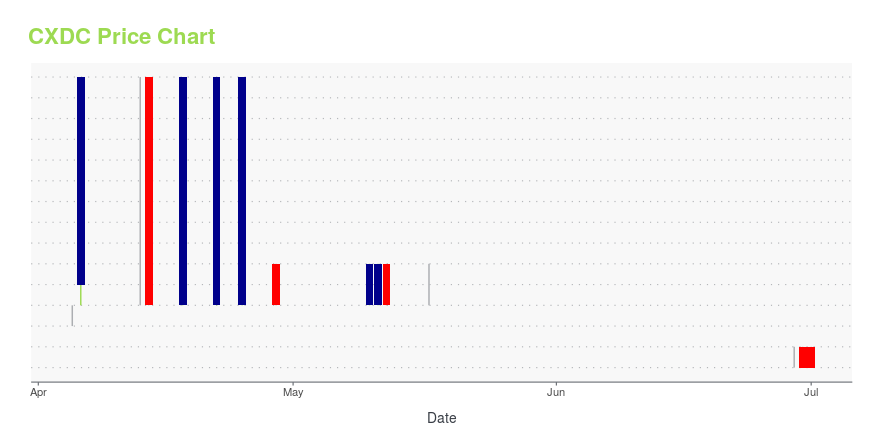

CXDC Stock Price Chart Interactive Chart >

China XD Plastics Company Limited (CXDC) Company Bio

China XD Plastics Company Limited engages in the research, development, manufacture, and sale of modified plastics primarily for automotive applications in China and the United Arab Emirates. The company was founded in 1999 and is based in Harbin, China.

Latest CXDC News From Around the Web

Below are the latest news stories about CHINA XD PLASTICS CO LTD that investors may wish to consider to help them evaluate CXDC as an investment opportunity.

CXDC Stock: Is China XD Plastics the Next Hot Meme Stock? 5 Things to KnowChina XD Plastics (CXDC) stock is rising higher on Wednesday with heavy trading but not due to any news from the company. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayGood morning, trader! We’re halfway through the week and still starting it with a breakdown of the biggest pre-market stock movers. Source: ventdusud / Shutterstock.com We’ve got loads of news moving shares today! That includes clinical trial results, upcoming presentations, earnings, and more. Let’s get into those pre-market stock movers below!InvestorPlace - Stock Market News, Stock Advice & Trading Tips Pre-Market Stock Movers: 10 Top Gainers China XD Plastics (NASDAQ:CXDC) stock is rocketing |

28 Stocks Moving in Wednesday's Pre-Market SessionGainers China XD Plastics Company Limited (NASDAQ: CXDC) rose 139% to $1.40 in pre-market trading after jumping around 30% on Tuesday. Guardion Health Sciences, Inc. (NASDAQ: GHSI) rose 53.3% to $1.81 in pre-market trading after gaining over 12% on Tuesday. Babylon Holdings Limited (NYSE: BBLN) rose 52.1% to $17.30 in pre-market trading after surging over 16% on Tuesday. ReTo Eco-Solutions, Inc. (NASDAQ: RETO) shares rose 24.7% to $1.13 in pre-market trading. Digital Ally, Inc. (NASDAQ: DGLY) ro |

Analysts Predict How High China XD Plastics Company Limited (CXDC) Will Go.China XD Plastics Company Limited (NASDAQ:CXDC) at last check was buoying at $0.48 on Thursday, October 21 with a rise of 8.37% from its closing price on previous day. Taking a look at stock we notice that its last check on previous day was $0.45 and 5Y monthly beta was reading 0.81 with its price Analysts Predict How High China XD Plastics Company Limited (CXDC) Will Go. Read More » |

may delivered a positive earnings surprise China XD Plastics Stock (NASDAQ:CXDC)Earnings results for China XD Plastics Stock , Analyst Opinion on China XD Plastics Stock , Earnings and Valuation of (NASDAQ:CXDC), Stock market Insights & financial analysis, Best stock to invest, Investment Idea, The post may delivered a positive earnings surprise China XD Plastics Stock (NASDAQ:CXDC) appeared first on . |

CXDC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 0.00% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -92.88% |

| 2021 | -96.45% |

| 2020 | -44.69% |

| 2019 | 1.70% |

Continue Researching CXDC

Want to do more research on China XD Plastics Co Ltd's stock and its price? Try the links below:China XD Plastics Co Ltd (CXDC) Stock Price | Nasdaq

China XD Plastics Co Ltd (CXDC) Stock Quote, History and News - Yahoo Finance

China XD Plastics Co Ltd (CXDC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...