Crexendo, Inc. (CXDO): Price and Financial Metrics

CXDO Price/Volume Stats

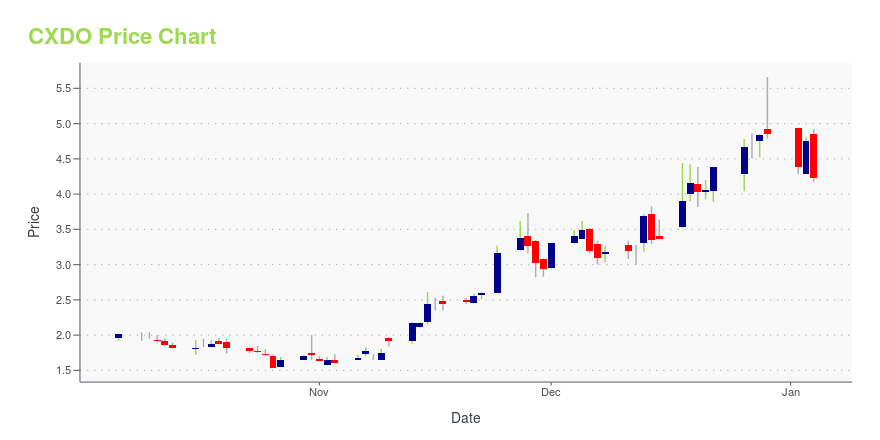

| Current price | $3.98 | 52-week high | $7.59 |

| Prev. close | $3.95 | 52-week low | $1.54 |

| Day low | $3.74 | Volume | 97,635 |

| Day high | $4.09 | Avg. volume | 185,264 |

| 50-day MA | $3.45 | Dividend yield | N/A |

| 200-day MA | $4.03 | Market Cap | 106.27M |

CXDO Stock Price Chart Interactive Chart >

Crexendo, Inc. (CXDO) Company Bio

Crexendo, Inc. provides unified cloud communication, communications as a service, call center, collaboration, and other cloud business services for businesses in the United States, Canada, and internationally. It operates in two segments, Cloud Telecommunications and Web Services. The Cloud Telecommunications segment provides telecommunications services that transmit calls using IP or cloud technology, which converts voice signals into digital data packets for transmission over the Internet or cloud; and broadband Internet services. This segment is also involved in the sale and lease of cloud telecommunications equipment. It offers hardware, software, and unified communication solutions for businesses using IP or cloud technology over high-speed Internet connection through various devices and user interfaces, such as desktop phones, and/or mobile and desktop applications. The Web Services segment provides Website hosting and other professional services. The company was formerly known as iMergent, Inc. and changed its name to Crexendo, Inc. in May 2011. Crexendo, Inc. was incorporated in 1995 and is based in Tempe, Arizona.

Latest CXDO News From Around the Web

Below are the latest news stories about CREXENDO INC that investors may wish to consider to help them evaluate CXDO as an investment opportunity.

Crexendo Continues Rapid Growth, Surpasses Four Million UsersOver 500k End Users Added Since Mid-September 2023 PHOENIX, AZ / ACCESSWIRE / December 19, 2023 / Crexendo, Inc. (NASDAQ:CXDO) ("Crexendo" or the "Company"), an award-winning, premier platform and provider of cloud communication services, video collaboration ... |

Is Crexendo, Inc. (NASDAQ:CXDO) Trading At A 48% Discount?Key Insights The projected fair value for Crexendo is US$6.50 based on 2 Stage Free Cash Flow to Equity Crexendo's... |

Crexendo, Inc. (NASDAQ:CXDO) Q3 2023 Earnings Call TranscriptCrexendo, Inc. (NASDAQ:CXDO) Q3 2023 Earnings Call Transcript November 12, 2023 Operator: Greetings. Welcome to the Crexendo Third Quarter 2023 Earnings Call. [Operator Instructions] Please note, this conference is being recorded. I will now turn the conference over to your host, Jeff Korn. You may begin. Jeff Korn: Thank you, Mike, and good afternoon, everybody. […] |

Crexendo Announces Third Quarter 2023 ResultsPHOENIX, AZ / ACCESSWIRE / November 9, 2023 / Crexendo, Inc. (NASDAQ:CXDO), an award-winning premier provider of cloud communication platform and services, video collaboration and managed IT services designed to provide enterprise-class cloud solutions ... |

Crexendo Sets Attendance Records and Introduces New CPaaS Capabilities with API 2.0 at the 2023 User Group MeetingPHOENIX, AZ / ACCESSWIRE / October 26, 2023 / Crexendo, Inc. (NASDAQ:CXDO) ("Crexendo" or the "Company"), an award-winning premier provider of cloud communication platform and services, video collaboration, and managed IT services, today announced ... |

CXDO Price Returns

| 1-mo | 35.84% |

| 3-mo | -4.78% |

| 6-mo | -34.75% |

| 1-year | 137.61% |

| 3-year | -36.48% |

| 5-year | N/A |

| YTD | -17.94% |

| 2023 | 156.07% |

| 2022 | -61.73% |

| 2021 | -27.85% |

| 2020 | 63.06% |

| 2019 | 112.50% |

Loading social stream, please wait...