Cyanotech Corp. (CYAN): Price and Financial Metrics

CYAN Price/Volume Stats

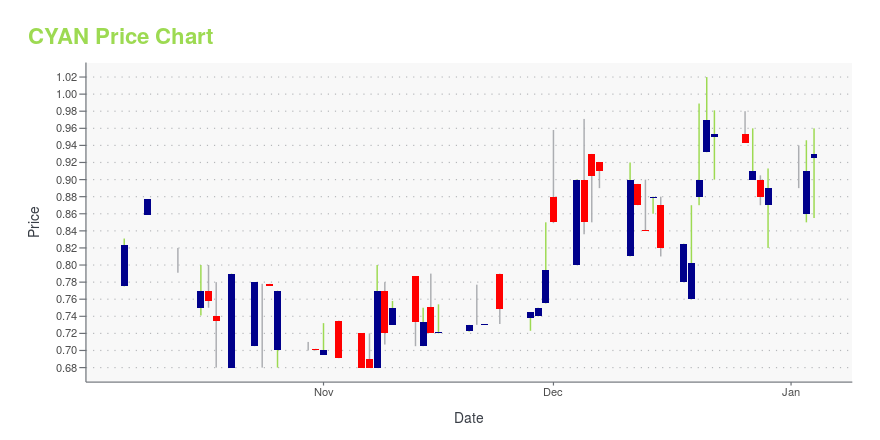

| Current price | $0.55 | 52-week high | $1.04 |

| Prev. close | $0.59 | 52-week low | $0.12 |

| Day low | $0.55 | Volume | 11,000 |

| Day high | $0.64 | Avg. volume | 16,719 |

| 50-day MA | $0.37 | Dividend yield | N/A |

| 200-day MA | $0.60 | Market Cap | 3.82M |

CYAN Stock Price Chart Interactive Chart >

Cyanotech Corp. (CYAN) Company Bio

Cyanotech Corp. engages in the development and commercialization of natural products derived from microalgae. Its products include BioAstin natural astaxanthin, a dietary antioxidant shown to support and maintain the body's natural inflammatory response, to enhance skin, and to support eye and joint health; and Spirulina Pacifica, a dietary supplement used for extra energy, a strengthened immune system, cardiovascular benefits, and as a source of antioxidant carotenoids. The company was founded by Gerald R. Cysewski in 1983 and is headquartered in Kailua-Kona, HI.

Latest CYAN News From Around the Web

Below are the latest news stories about CYANOTECH CORP that investors may wish to consider to help them evaluate CYAN as an investment opportunity.

Cyanotech Reports Financial Results for the Second Quarter and First Six Months of Fiscal 2024KAILUA KONA, Hawaii, November 08, 2023--Cyanotech Reports Financial Results for the Second Quarter and First Six Months of Fiscal 2024 |

Is Cyanotech Corp Set to Underperform? Analyzing the Factors Limiting GrowthUnraveling the Financial Metrics of Cyanotech Corp |

Cyanotech Reports Financial Results for the First Quarter of Fiscal 2024KAILUA KONA, Hawaii, August 11, 2023--Cyanotech Reports Financial Results for the First Quarter of Fiscal 2024 |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time to start Wednesday with an overview of all the biggest pre-market stock movers traders need to know about this morning! |

Cyanotech Corporation Positions for Accelerated Global Growth in Microalgae Market with Key Leadership AppointmentKAILUA KONA, Hawaii, August 01, 2023--Cyanotech Corporation Positions for Accelerated Global Growth in Microalgae Market with Key Leadership Appointment |

CYAN Price Returns

| 1-mo | 69.02% |

| 3-mo | 83.39% |

| 6-mo | -36.78% |

| 1-year | -34.58% |

| 3-year | -81.23% |

| 5-year | -78.09% |

| YTD | -38.20% |

| 2023 | -19.10% |

| 2022 | -66.05% |

| 2021 | 6.58% |

| 2020 | 32.75% |

| 2019 | -24.17% |

Continue Researching CYAN

Here are a few links from around the web to help you further your research on Cyanotech Corp's stock as an investment opportunity:Cyanotech Corp (CYAN) Stock Price | Nasdaq

Cyanotech Corp (CYAN) Stock Quote, History and News - Yahoo Finance

Cyanotech Corp (CYAN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...