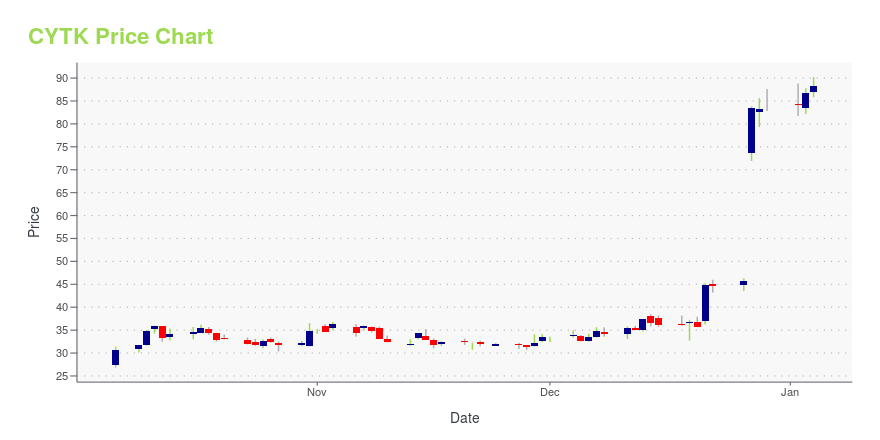

Cytokinetics, Incorporated (CYTK): Price and Financial Metrics

CYTK Price/Volume Stats

| Current price | $59.69 | 52-week high | $110.25 |

| Prev. close | $58.50 | 52-week low | $25.98 |

| Day low | $58.50 | Volume | 1,166,200 |

| Day high | $61.38 | Avg. volume | 2,530,910 |

| 50-day MA | $54.49 | Dividend yield | N/A |

| 200-day MA | $58.51 | Market Cap | 6.26B |

CYTK Stock Price Chart Interactive Chart >

Cytokinetics, Incorporated (CYTK) Company Bio

Cytokinetics, Incorporated, a clinical stage biopharmaceutical company, focuses on the discovery and development of novel small molecule therapeutics that modulate muscle function for the treatment of serious diseases and medical conditions. The company was founded in 1997 and is based in South San Francisco, California.

Latest CYTK News From Around the Web

Below are the latest news stories about CYTOKINETICS INC that investors may wish to consider to help them evaluate CYTK as an investment opportunity.

Cytokinetics Stock Jumps To Higher RS Level; Shoots Up On Heart Drug StudyOn Thursday, Cytokinetics cleared a key performance benchmark, with its Relative Strength (RS) Rating entering into the 90-plus percentile with an improvement to 99, an increase from 89 the day before. The clinical-stage biotech company shot up 83% on Wednesday after announcing positive results from a Phase 3 study of its experimental drug to treat heart disease. The drug, Aficamten, which treats symptomatic obstructive hypertrophic cardiomyopathy (HCM) is a contender to challenge Bristol Myer Squibb's Camzyos drug. |

Cytokinetics (CYTK) Up 83% as Cardiomyopathy Drug Meets GoalsCytokinetics (CYTK) reports positive results from its pivotal late-stage study of aficamten in symptomatic obstructive hypertrophic cardiomyopathy patients. The stock rallies 83% in response. |

Biotech Stock Roundup: BMY's KRTX and RYZB Acquisition, CYTK Surges on Study DataBristol Myers (BMY) and Cytokinetics (CYTK) are in the news on acquisition announcements and study updates, respectively. |

Company News for Dec 28, 2023Companies In The Article Are:CYTK,TSLA, NYT, MSFT, IOVA |

Stocks Static As Post-Holiday Doldrums HitStocks are struggling for direction today, as the post-holiday doldrums take full effect. |

CYTK Price Returns

| 1-mo | 15.34% |

| 3-mo | -8.65% |

| 6-mo | -27.86% |

| 1-year | 85.20% |

| 3-year | 112.34% |

| 5-year | 391.68% |

| YTD | -28.51% |

| 2023 | 82.21% |

| 2022 | 0.53% |

| 2021 | 119.35% |

| 2020 | 95.85% |

| 2019 | 67.88% |

Continue Researching CYTK

Want to see what other sources are saying about Cytokinetics Inc's financials and stock price? Try the links below:Cytokinetics Inc (CYTK) Stock Price | Nasdaq

Cytokinetics Inc (CYTK) Stock Quote, History and News - Yahoo Finance

Cytokinetics Inc (CYTK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...