Cyxtera Technologies, Inc. (CYXT): Price and Financial Metrics

CYXT Price/Volume Stats

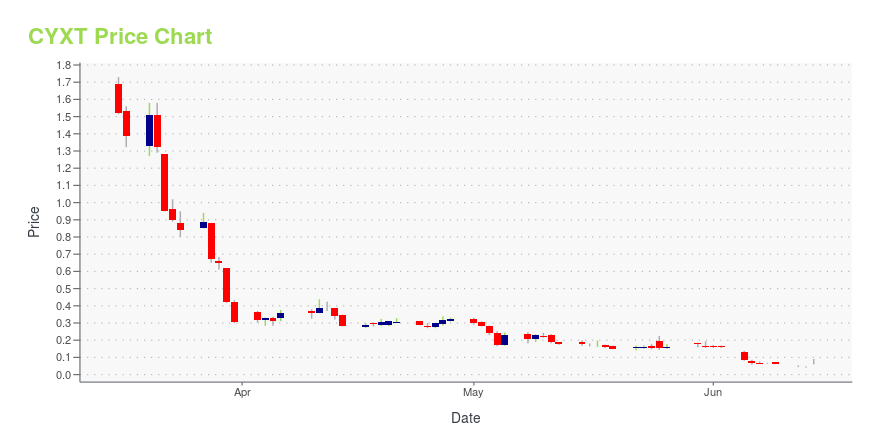

| Current price | $0.07 | 52-week high | $15.16 |

| Prev. close | $0.04 | 52-week low | $0.04 |

| Day low | $0.06 | Volume | 375,714,900 |

| Day high | $0.09 | Avg. volume | 6,690,794 |

| 50-day MA | $0.22 | Dividend yield | N/A |

| 200-day MA | $2.07 | Market Cap | 11.72M |

CYXT Stock Price Chart Interactive Chart >

Cyxtera Technologies, Inc. (CYXT) Company Bio

Cyxtera Technologies, Inc. provides data center, colocation, enterprise application cloud computing, hybrid cloud, cyber security, and analytics solutions to government, enterprises, and service providers. It offers Cyxtera Portal, enabling customers to monitor, manage, and control their digital infrastructure from a single, dedicated platform; colocation services; data center services; Cyxtera Extensible Data Center platform (CXD), a platform that transforms IT infrastructure design, configuration, and deployment. The company also provides AppGate SDP, a network security platform to secure any application; and AppGate Insight, which provides cloud and network architects visibility into all of the network traffic. In addition, it offers threat analytics, safe browsing, and detect monitoring services. Cyxtera Technologies, Inc. was incorporated in 2017 and is headquartered in Coral Gables, Florida.

Latest CYXT News From Around the Web

Below are the latest news stories about CYXTERA TECHNOLOGIES INC that investors may wish to consider to help them evaluate CYXT as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time for another dive into the biggest pre-market stock movers as investors get ready to trade shares on Wednesday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayWe're starting off the week with a breakdown of the biggest pre-market stock movers traders need to know about for Monday morning! |

BIIB Stock Alert: Biogen Resumes Trading With New FDA BackingBiogen (BIIB) stock is a hot topic among traders Monday as the company's share resumed trading following a halt that was in effect on Friday. |

NDAQ Stock: What to Know About Nasdaq’s $10.5 Billion Adenza BuyNasdaq (NDAQ) stock is on the move Monday after the company announced plans to acquire Adenza in a massive $10.5 billion deal. |

Why Is Cyxtera Technologies (CYXT) Stock Down 19% Today?Cyxtera Technologies (CYXT) stock is falling Monday as the company continues with its bankruptcy filing and heavy trading pulls shares down. |

CYXT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -99.28% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -84.77% |

| 2021 | 21.72% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...