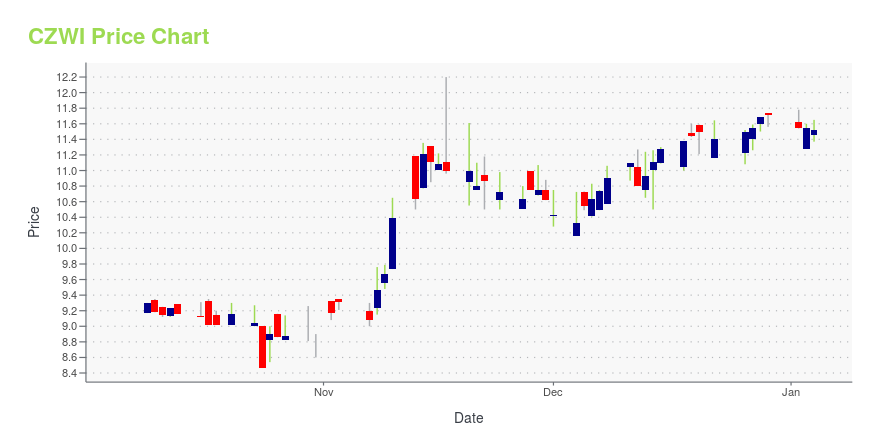

Citizens Community Bancorp, Inc. (CZWI): Price and Financial Metrics

CZWI Price/Volume Stats

| Current price | $13.09 | 52-week high | $13.34 |

| Prev. close | $13.07 | 52-week low | $8.47 |

| Day low | $13.07 | Volume | 4,662 |

| Day high | $13.10 | Avg. volume | 17,148 |

| 50-day MA | $11.55 | Dividend yield | 2.57% |

| 200-day MA | $11.20 | Market Cap | 136.21M |

CZWI Stock Price Chart Interactive Chart >

Citizens Community Bancorp, Inc. (CZWI) Company Bio

Citizens Community Bancorp, Inc. provides various consumer, and commercial and agricultural banking products and services primarily in Wisconsin, Minnesota, and Michigan. The company was founded in 1938 and is based in Eau Claire, Wisconsin.

Latest CZWI News From Around the Web

Below are the latest news stories about CITIZENS COMMUNITY BANCORP INC that investors may wish to consider to help them evaluate CZWI as an investment opportunity.

Zacks Industry Outlook Highlights Citizens Community, First Savings Financial and Provident Financial ServicesCitizens Community, First Savings Financial and Provident Financial Services are part of the Zacks Industry Outlook article. |

Zacks Value Trader Highlights: Citizens Community Bancorp, FinWise Bancorp, First Bank, NorthEast Community Bancorp and OP BancorCitizens Community Bancorp, FinWise Bancorp, First Bank, NorthEast Community Bancorp and OP Bancor are part of the Zacks Value Trader blog. |

5 Cheap Strong Buy Bank Stocks in 2023Are you ready to look at the community banks again? |

Compared to Estimates, Citizens Community Bancorp, Inc. (CZWI) Q3 Earnings: A Look at Key MetricsAlthough the revenue and EPS for Citizens Community Bancorp, Inc. (CZWI) give a sense of how its business performed in the quarter ended September 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

Citizens Community Bancorp Inc (CZWI) Reports 3Q2023 Earnings of $0.24 Per Share Amid Tax ChangesLower Future Effective Tax Rate Expected; Non-Performing Assets Decline: Net Interest Margin Expands |

CZWI Price Returns

| 1-mo | 13.33% |

| 3-mo | 26.35% |

| 6-mo | 10.51% |

| 1-year | 29.07% |

| 3-year | 3.28% |

| 5-year | 35.16% |

| YTD | 14.85% |

| 2023 | -0.34% |

| 2022 | -11.21% |

| 2021 | 29.13% |

| 2020 | -9.32% |

| 2019 | 14.03% |

CZWI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CZWI

Want to do more research on Citizens Community Bancorp Inc's stock and its price? Try the links below:Citizens Community Bancorp Inc (CZWI) Stock Price | Nasdaq

Citizens Community Bancorp Inc (CZWI) Stock Quote, History and News - Yahoo Finance

Citizens Community Bancorp Inc (CZWI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...