Carvana Co. (CVNA): Price and Financial Metrics

CVNA Price/Volume Stats

| Current price | $346.60 | 52-week high | $364.00 |

| Prev. close | $343.67 | 52-week low | $118.50 |

| Day low | $342.81 | Volume | 1,021,982 |

| Day high | $354.53 | Avg. volume | 4,346,530 |

| 50-day MA | $313.81 | Dividend yield | N/A |

| 200-day MA | $243.13 | Market Cap | 74.22B |

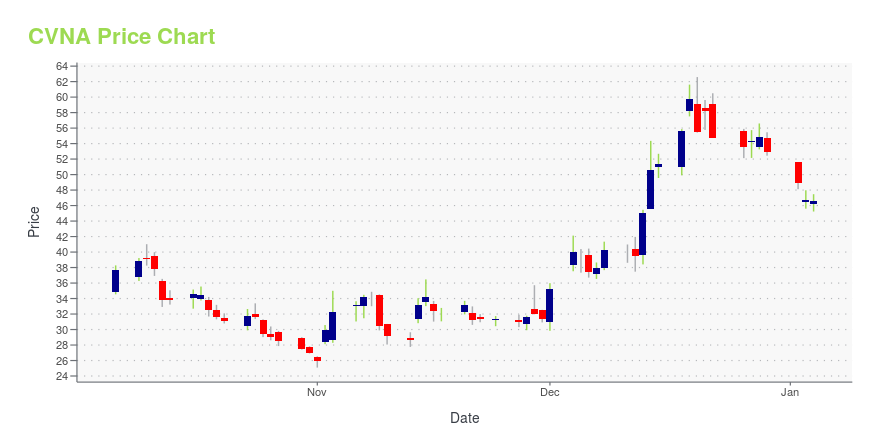

CVNA Stock Price Chart Interactive Chart >

Carvana Co. (CVNA) Company Bio

Carvana sells used cars online. It has distribution centers in Atlanta, Georgia; Nashville, Tennessee; and Charlotte, North Carolina. It also has physical presence in Houston, Austin, Dallas, San Antonio, and Pittsburgh, Texas; and St. Louis, Missouri. Carvana, LLC operates as a subsidiary of DriveTime Automotive Group, Inc. The company was founded in 2012 and is based in Phoenix, Arizona.

CVNA Price Returns

| 1-mo | 16.69% |

| 3-mo | 62.11% |

| 6-mo | 61.93% |

| 1-year | 154.40% |

| 3-year | 1,531.06% |

| 5-year | 153.94% |

| YTD | 70.44% |

| 2024 | 284.13% |

| 2023 | 1,016.88% |

| 2022 | -97.96% |

| 2021 | -3.24% |

| 2020 | 160.23% |

Continue Researching CVNA

Here are a few links from around the web to help you further your research on Carvana Co's stock as an investment opportunity:Carvana Co (CVNA) Stock Price | Nasdaq

Carvana Co (CVNA) Stock Quote, History and News - Yahoo Finance

Carvana Co (CVNA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...