Deutsche Bank AG (DB): Price and Financial Metrics

DB Price/Volume Stats

| Current price | $15.67 | 52-week high | $17.95 |

| Prev. close | $15.62 | 52-week low | $10.00 |

| Day low | $15.58 | Volume | 1,781,100 |

| Day high | $15.75 | Avg. volume | 2,667,960 |

| 50-day MA | $16.42 | Dividend yield | N/A |

| 200-day MA | $14.28 | Market Cap | 32.39B |

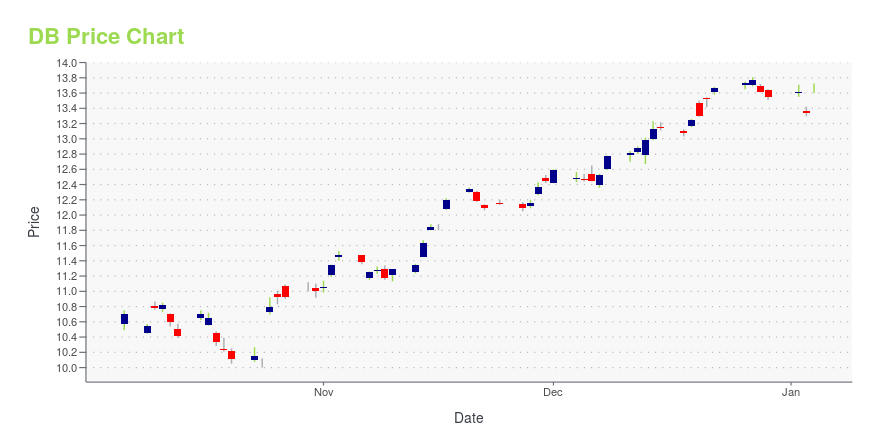

DB Stock Price Chart Interactive Chart >

Deutsche Bank AG (DB) Company Bio

Deutsche Bank AG (German pronunciation: [ˈdɔʏtʃə ˈbaŋk ʔaːˈɡeː] (listen)) is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. (Source:Wikipedia)

Latest DB News From Around the Web

Below are the latest news stories about DEUTSCHE BANK AKTIENGESELLSCHAFT that investors may wish to consider to help them evaluate DB as an investment opportunity.

Deutsche Bank discovers thousands of unresolved customer complaintsLatest setback after botched IT project key reason for delay to CEO Sewing’s promise of fixing Postbank issues this year |

Deutsche Bank appointed as depositary bank for the sponsored American Depositary Receipt program of DSM-Firmenich AGNEW YORK, December 21, 2023--Deutsche Bank announced today its appointment as depositary bank for the American Depositary Receipt program of DSM-Firmenich AG. |

Deutsche Bank Appointed as Depositary Bank for the Global Depositary Receipt Program of Shenzhen Senior Technology Material Co., Ltd.NEW YORK, December 19, 2023--Deutsche Bank announced today its appointment as depositary bank for the Global Depositary Receipt ("GDR") program of Shenzhen Senior Technology Material Co., Ltd. The GDRs are listed on the SIX Swiss Exchange under the symbol "SENIOR". |

C3.ai Stock Alert: Should You Invest Before 2023 Ends?This top AI stock is among the few pure-play options for investors considering this space. |

Deutsche Bank Set to Offer $1.9 Billion Loan to Turkey’s Ziraat(Bloomberg) -- Turkey’s largest lender by assets secured a 1.75 billion euro ($1.92 billion) loan from Deutsche Bank AG, an early sign of international firms’ willingness to do business in the country amid the government’s push to return to more orthodox economic policies. Most Read from BloombergMike Johnson May Be the Next House Speaker to Lose His JobCiti Shuts Muni Business That Once Was Envy of RivalsShipping Giants Pause Red Sea Route as Houthi Attacks IntensifyNasdaq 100 Caps Pivotal Fed |

DB Price Returns

| 1-mo | -0.25% |

| 3-mo | -11.82% |

| 6-mo | 19.53% |

| 1-year | 41.68% |

| 3-year | 31.88% |

| 5-year | 108.21% |

| YTD | 15.65% |

| 2023 | 21.36% |

| 2022 | -5.88% |

| 2021 | 14.68% |

| 2020 | 40.10% |

| 2019 | -2.89% |

Continue Researching DB

Here are a few links from around the web to help you further your research on Deutsche Bank Aktiengesellschaft's stock as an investment opportunity:Deutsche Bank Aktiengesellschaft (DB) Stock Price | Nasdaq

Deutsche Bank Aktiengesellschaft (DB) Stock Quote, History and News - Yahoo Finance

Deutsche Bank Aktiengesellschaft (DB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...