Tritium Pty Ltd. (DCFC): Price and Financial Metrics

DCFC Price/Volume Stats

| Current price | $1.35 | 52-week high | $304.00 |

| Prev. close | $3.64 | 52-week low | $1.35 |

| Day low | $1.35 | Volume | 383,394 |

| Day high | $1.35 | Avg. volume | 36,167 |

| 50-day MA | $16.33 | Dividend yield | N/A |

| 200-day MA | $81.64 | Market Cap | 1.14M |

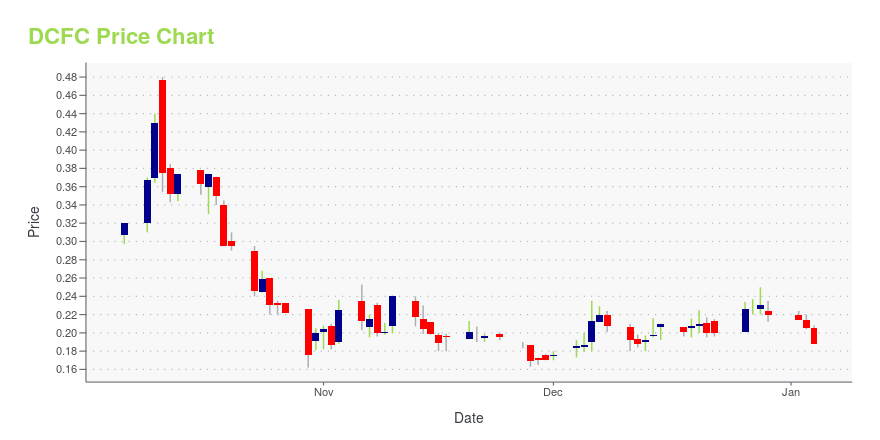

DCFC Stock Price Chart Interactive Chart >

Tritium Pty Ltd. (DCFC) Company Bio

Tritium Pty Ltd. designs, manufactures, and supplies DC chargers for electric vehicles, power-electronic systems, and battery energy-storage applications for customers in the United States, Europe, Australia, and internationally. The company offers also offers CAN-Ethernet bridge products that allow to access from a PC application to the vehicle CAN bus. It serves customers in Europe and the United States. The company was incorporated in 2001 and is based in Murarrie, Australia with sales and manufacturing facilities in Amsterdam, the Netherlands; and Los Angeles, California.

Latest DCFC News From Around the Web

Below are the latest news stories about TRITIUM DCFC LTD that investors may wish to consider to help them evaluate DCFC as an investment opportunity.

Tritium Completes Installation of North America’s First Mechanized Large-Scale Port EV Charging Program at Port of Long Beach33 Tritium ultrafast chargers power terminal tractor fleet at California’s Port of Long Beach Tritium DCFC and the Port of Long Beach Chargers Photo courtesy of the Port of Long Beach. TORRANCE, Calif., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Tritium DCFC Limited (Tritium) (Nasdaq: DCFC), a global leader in direct current (DC) fast chargers for electric vehicles (EVs), today announced that the company has completed the installation and operationalization of 33 of its chargers at the SSA Terminals, LLC |

Tritium Supplies Rapid Chargers for Wales’ Largest EV Charging FacilityTritium Supplies Chargers for National Library of Wales Tritium Supplies Chargers for National Library of Wales New retail EV charging site at the National Library of Wales in Aberystwyth – Wales’ largest EV charging site – will enable up to 40 electric vehicles to charge simultaneously.The retail site located at the National Library of Wales brings much-needed charging capacity to Wales, as the country aims to establish 4,000 EV chargers by 2030.It includes five rapid Tritium 75kW DC chargers w |

3 EV Charging Stocks You’ll Regret Not Buying Soon: November 2023With U.S. |

Tritium Implements Strategic Plan to Achieve 2024 ProfitabilityCompany takes strategic steps toward profitabilityBRISBANE, Australia, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Tritium DCFC Limited (Tritium) (Nasdaq: DCFC), a global leader in direct current (DC) fast chargers for electric vehicles (EVs), today announced the implementation of business measures designed to achieve a path to profitability in 2024 and reduce external capital requirements. The plan sees Tritium improve operational efficiency and margins to drive profitability and shareholder value by con |

Tritium Receives Nasdaq Notice Regarding Minimum Bid Price RequirementBRISBANE, Australia, Oct. 18, 2023 (GLOBE NEWSWIRE) -- Tritium DCFC Limited (Nasdaq: DCFC) (“Tritium” or the “Company”), a global developer and manufacturer of direct current (“DC”) fast chargers for electric vehicles (“EVs”), today announced that on October 12, 2023 the Company received a notice (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company is not in compliance with the minimum bid price requirement ("Minimum Bid Requirement") of US$1.00 per share under the |

DCFC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -94.07% |

| 1-year | -99.38% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -96.93% |

| 2023 | -86.90% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...