Daimler AG (DDAIF): Price and Financial Metrics

DDAIF Price/Volume Stats

| Current price | $62.22 | 52-week high | $103.78 |

| Prev. close | $62.50 | 52-week low | $50.10 |

| Day low | $62.20 | Volume | 25,000 |

| Day high | $63.44 | Avg. volume | 29,672 |

| 50-day MA | $61.02 | Dividend yield | N/A |

| 200-day MA | $74.78 | Market Cap | 66.56B |

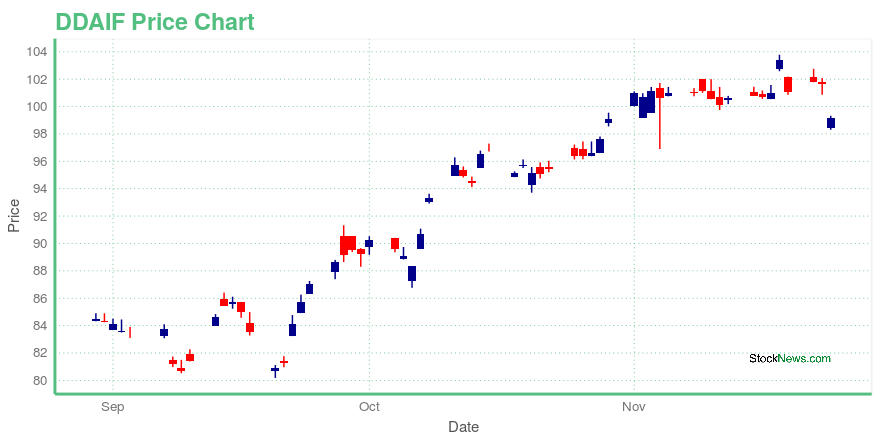

DDAIF Stock Price Chart Interactive Chart >

Daimler AG (DDAIF) Company Bio

Daimler AG, together its subsidiaries, develops and manufactures passenger cars, trucks, vans, and buses in Germany and internationally. It operates through Mercedes-Benz Cars, Daimler Trucks, Mercedes-Benz Vans, Daimler Buses, and Daimler Mobility divisions. The Mercedes-Benz Cars division offers premium vehicles of the Mercedes-Benz brand, including the Mercedes-AMG and Mercedes-Maybach brands; and small cars under the Mercedes me and smart brands, as well as electric mobility products under the EQ brand. The Daimler Trucks division distributes its trucks and special vehicles under the Mercedes-Benz, Freightliner, Western Star, FUSO, and BharatBenz brands; and buses under the Thomas Built Buses and FUSO brands. The Mercedes-Benz Vans division supplies vans and related services under the MercedesBenz and Freightliner brands. The Daimler Buses division sells completely built-up buses under the MercedesBenz and Setra brands, as well as produces and sells bus chassis. The Daimler Mobility division offers tailored financing and leasing packages for end-customers and dealers; and automotive insurance brokerage, banking, investment and credit card, and fleet management services, as well as mobility services primarily under the Athlon brands. The company also sells vehicle related spare parts and accessories. Daimler AG was founded in 1886 and is headquartered in Stuttgart, Germany.

Latest DDAIF News From Around the Web

Below are the latest news stories about Daimler Ag that investors may wish to consider to help them evaluate DDAIF as an investment opportunity.

Ticker: Woburn firm in battery deal with Mercedes, Stellantis; Maine groups take aim at fed permits for hydro linesAutomakers Mercedes-Benz and Stellantis announced agreements with Woburn-based Factorial Energy on Tuesday to help develop solid-state battery technology that they hope could make electric cars more attractive to a mass market. Mercedes-Benz, part of Daimler AG, said it is joining forces with Factorial to jointly develop batteries with the aim of testing prototype cells as [] |

Factorial Energy Battery Maker sign agreement with Daimler, StellantisFactorial Energy based in the United States, announced on Tuesday that it has reached agreements with Daimler AGs Mercedes-Benz and Stellantis NV to commercialize its battery technology. Daimler and Stellantis will each make a strategic investment in the solid-state battery company as part of the agreements, Factorial Energy said in a statement, without disclosing financial [] The post Factorial Energy Battery Maker sign agreement with Daimler, Stellantis appeared first on BOL News . |

Infosys Collaborates with One of Europe’s Greenest Datacenters to Accelerate Daimler’s Transition to Sustainable MobilitySTUTTGART, Germany, Nov. 30, 2021 — Infosys, a global leader in next-generation digital services and consulting, today announced that it will transfer Daimler’s High Performance Computing (HPC) workloads used to design vehicles and automated driving technologies to one of Europe’s greenest data centers, Lefdal Mine Datacenter in Norway. The shift to Green Data Center as […] The post Infosys Collaborates with One of Europe’s Greenest Datacenters to Accelerate Daimler’s Transition to Sustainable Mobility appeared first on HPCwire . |

Stellantis, Mercedes-Benz invest in solid-state battery developer Factorial Energy TechCrunchFactorial Energy, a startup working on solid-state batteries for electric vehicles, has added two more major automakers to its investor sheet: Mercedes-Benz and Stellantis, both of which plan to co-develop batteries in separate joint collaboration agreements. Mercedes, a brand of Daimler AG, said it invested a double-digit million dollar amount in Factorial. Stellantis declined to [] |

Battery maker Factorial Energy enters investment deal with Daimler, StellantisU.S. based Factorial Energy said on Tuesday it had entered into agreements with Daimler AG owned Mercedes-Benz and Stellantis NV, in a bid to commercialize its battery technology.Under the partnerships, both Daimler and Stellantis will make a strategic investment in the solid-state battery maker, Factoria |

DDAIF Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -29.13% |

| 5-year | 15.52% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 9.67% |

| 2020 | 29.04% |

| 2019 | 3.24% |

Loading social stream, please wait...