Dillard's, Inc. (DDS): Price and Financial Metrics

DDS Price/Volume Stats

| Current price | $425.73 | 52-week high | $510.00 |

| Prev. close | $439.11 | 52-week low | $282.24 |

| Day low | $425.24 | Volume | 77,532 |

| Day high | $440.27 | Avg. volume | 146,243 |

| 50-day MA | $406.99 | Dividend yield | 0.23% |

| 200-day MA | $405.88 | Market Cap | 6.66B |

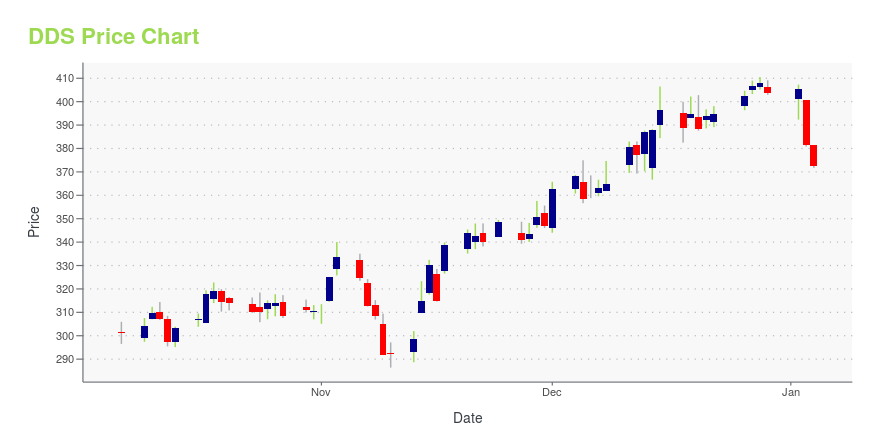

DDS Stock Price Chart Interactive Chart >

Dillard's, Inc. (DDS) Company Bio

Dillard's Inc. operates as a fashion apparel, cosmetics, and home furnishing retailer in the United States. The company was founded in 1938 and is based in Little Rock, Arkansas.

DDS Price Returns

| 1-mo | 6.53% |

| 3-mo | 35.64% |

| 6-mo | -5.44% |

| 1-year | 6.60% |

| 3-year | 149.51% |

| 5-year | 1,931.28% |

| YTD | -1.26% |

| 2024 | 13.47% |

| 2023 | 32.05% |

| 2022 | 38.66% |

| 2021 | 290.27% |

| 2020 | -12.71% |

DDS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DDS

Want to see what other sources are saying about Dillard'S Inc's financials and stock price? Try the links below:Dillard'S Inc (DDS) Stock Price | Nasdaq

Dillard'S Inc (DDS) Stock Quote, History and News - Yahoo Finance

Dillard'S Inc (DDS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...