Denbury Inc. (DEN): Price and Financial Metrics

DEN Price/Volume Stats

| Current price | $88.66 | 52-week high | $100.65 |

| Prev. close | $88.89 | 52-week low | $75.33 |

| Day low | $88.58 | Volume | 11,771,800 |

| Day high | $89.99 | Avg. volume | 1,011,780 |

| 50-day MA | $93.51 | Dividend yield | N/A |

| 200-day MA | $88.99 | Market Cap | 4.56B |

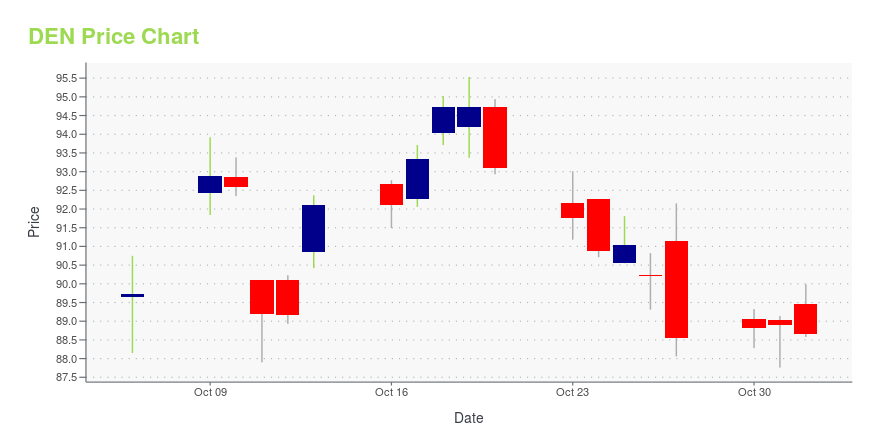

DEN Stock Price Chart Interactive Chart >

Denbury Inc. (DEN) Company Bio

Denbury Resources Inc. operates as an independent oil and natural gas company in the United States. It holds interests in various oil and natural gas properties located in Mississippi, Texas, and Louisiana in the Gulf Coast region; and in Montana, North Dakota, and Wyoming in the Rocky Mountain region. As of December 31, 2019, the company had 230.2 million barrels of oil equivalent of estimated proved oil and natural gas reserves. Denbury Resources Inc. was incorporated in 2003 and is headquartered in Plano, Texas.

Latest DEN News From Around the Web

Below are the latest news stories about DENBURY INC that investors may wish to consider to help them evaluate DEN as an investment opportunity.

Denbury Stockholders Approve Merger with ExxonMobilPLANO, Texas, October 31, 2023--Denbury Stockholders Approve Merger with ExxonMobil |

Analysts Estimate HighPeak Energy, Inc. (HPK) to Report a Decline in Earnings: What to Look Out forHighPeak Energy, Inc. (HPK) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

ExxonMobil Is Cashing In on Higher Crude Oil PricesExxonMobil (NYSE: XOM) earned an impressive $9.1 billion in the third quarter. That was up from $7.9 billion in the second quarter as the company feasted on higher oil prices. Meanwhile, cash flow was even higher at $16 billion, a whopping $6. |

Earnings Preview: Denbury (DEN) Q3 Earnings Expected to DeclineDenbury (DEN) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

Are Oils-Energy Stocks Lagging Denbury (DEN) This Year?Here is how Denbury (DEN) and Warrior Met Coal (HCC) have performed compared to their sector so far this year. |

DEN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 2.69% |

| 3-year | 41.79% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 13.62% |

| 2021 | 198.13% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...