Digital Ally, Inc. (DGLY): Price and Financial Metrics

DGLY Price/Volume Stats

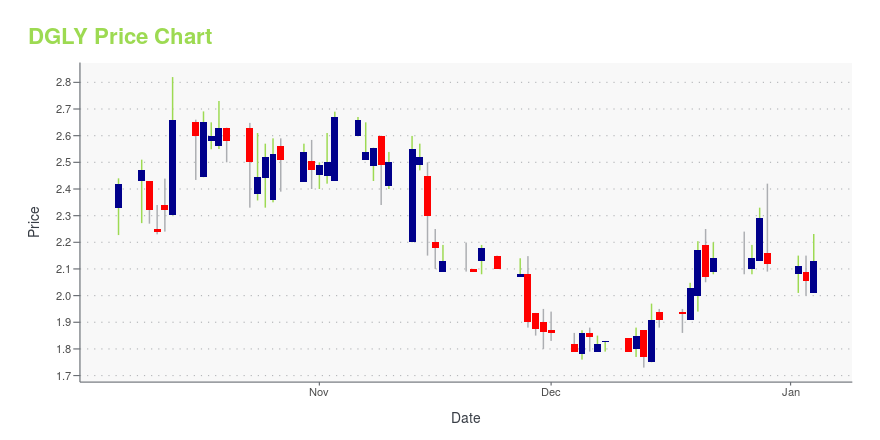

| Current price | $1.99 | 52-week high | $4.40 |

| Prev. close | $2.04 | 52-week low | $1.73 |

| Day low | $1.92 | Volume | 29,271 |

| Day high | $2.05 | Avg. volume | 15,244 |

| 50-day MA | $2.60 | Dividend yield | N/A |

| 200-day MA | $2.34 | Market Cap | 5.73M |

DGLY Stock Price Chart Interactive Chart >

Digital Ally, Inc. (DGLY) Company Bio

Digital Ally, Inc. produces and sells digital video imaging and storage products for use in law enforcement, security, and commercial applications in the United States and internationally. Its digital audio/video recording, storage, and other products include an in-car digital audio/video recorder that is contained in a rear view mirror for law enforcement vehicles and commercial fleets; and hands-free automatic activated body-worn cameras and in-car video systems, as well as provides its law enforcement customers with audio/video surveillance from multiple vantage points. The company also provides VuLink, an in-car device that enables an in-car and body worn digital audio/video camera system to automatically and simultaneously start recording; and Digital Ally, a suite of data management Web-based tools to assist fleet managers in the organization, archival, and management of videos and telematics information. In addition, its digital audio/video recording, storage, and other products comprise a miniature body-worn digital video system; VuVault.net, a law enforcement cloud storage solution, including cloud-based fleet management and driver monitoring/training applications; and FleetVU Manager, a Web-based software for commercial fleet tracking and monitoring. The company sells its products through direct sales and third-party distributors. Digital Ally, Inc. is headquartered in Lenexa, Kansas.

Latest DGLY News From Around the Web

Below are the latest news stories about DIGITAL ALLY INC that investors may wish to consider to help them evaluate DGLY as an investment opportunity.

College Football Playoff Ticket Prices Reach Record Highs2023 College Football Playoff Ticket Data Graphs showing the number of tickets available, average price and get-in price for the Sugar Bowl, Rose Bowl and CFP National Championship. OVERLAND PARK, Kan., Dec. 28, 2023 (GLOBE NEWSWIRE) -- In the final year of its four-team format, the College Football Playoff is drawing record demand. Semifinal tickets for the Sugar Bowl and Rose Bowl are averaging $491 and $948, respectively, and the average price for CFP National Championship tickets at NRG Stad |

TicketSmarter and USMTS form unique partnershipOVERLAND PARK, Kan., Dec. 20, 2023 (GLOBE NEWSWIRE) -- TicketSmarter and the United States Modified Touring Series announced an agreement today that makes TicketSmarter the Official Ticket Resale Marketplace of the USMTS, as well as the #1 Fan sponsor. As the #1 Fan sponsor, TicketSmarter will award $25-off certificates which will be distributed to the first person standing in line at the grandstand ticket booth wearing a USMTS driver shirt. The driver must be in attendance. Limitations and/or m |

Digital Ally Announces Deferred Revenue Surpasses $10 Million MarkThe Company’s subscription payment plan continues to see strong demand for its FirstVu Pro body-worn cameras and EVO-HD in-car video solution. LENEXA, KS, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Digital Ally, Inc. (NASDAQ: DGLY) (the “Company”), which develops, manufactures, and markets advanced video recording products and other critical safety products for law enforcement, emergency management, fleet safety and event security, today announced a notable milestone with its deferred revenue balance exc |

Kustom Entertainment Inc. and Clover Leaf Capital Corp. Amend the Lock-Up Agreement in their Proposed Business CombinationKANSAS CITY, KS and MIAMI, FL, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Digital Ally, Inc. (Nasdaq: DGLY) (“Digital Ally”) and Clover Leaf Capital Corp. (Nasdaq: CLOE) (“CLOE”), a publicly traded special purpose acquisition company (SPAC), and Kustom Entertainment, Inc. (“Kustom Entertainment”), a wholly-owned subsidiary of Digital Ally, today announced that CLOE and Kustom Entertainment have entered into an amendment to the Lock-Up Agreement (“Amended Lock-Up Agreement”) in connection with the propose |

KUSTOM ENTERTAINMENT NAMES ERIK DAHL CHIEF FINANCIAL OFFICERIndustry veteran adds expertise, momentum to growing Digital Ally company KANSAS CITY, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Digital Ally, Inc. (NASDAQ: DGLY) – Kustom Entertainment, Inc. (“Kustom Entertainment”), a premier live event marketing and concert production company and subsidiary of Digital Ally Inc. (“Digital Ally”) (Nasdaq: DGLY), has tapped Kansas City-native Erik Dahl as its new Chief Financial Officer (the “CFO”). The appointment, effective November 20, 2023, puts Mr. Dahl at the helm |

DGLY Price Returns

| 1-mo | -15.32% |

| 3-mo | 1.27% |

| 6-mo | 0.51% |

| 1-year | -52.39% |

| 3-year | -93.58% |

| 5-year | -92.17% |

| YTD | -6.13% |

| 2023 | -54.45% |

| 2022 | -78.25% |

| 2021 | -54.27% |

| 2020 | 129.41% |

| 2019 | -61.94% |

Continue Researching DGLY

Here are a few links from around the web to help you further your research on Digital Ally Inc's stock as an investment opportunity:Digital Ally Inc (DGLY) Stock Price | Nasdaq

Digital Ally Inc (DGLY) Stock Quote, History and News - Yahoo Finance

Digital Ally Inc (DGLY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...