Dorel Industries Inc. (DIIBF): Price and Financial Metrics

DIIBF Price/Volume Stats

| Current price | $5.03 | 52-week high | $5.52 |

| Prev. close | $5.02 | 52-week low | $3.29 |

| Day low | $5.02 | Volume | 9,900 |

| Day high | $5.03 | Avg. volume | 4,668 |

| 50-day MA | $4.91 | Dividend yield | N/A |

| 200-day MA | $4.55 | Market Cap | 163.76M |

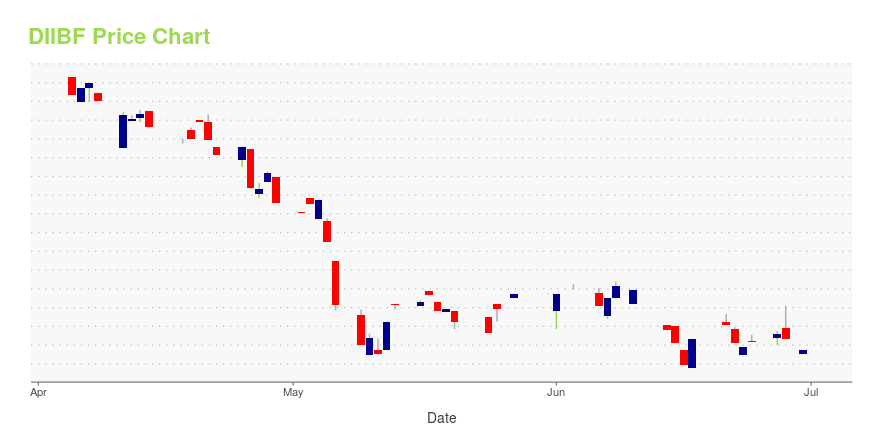

DIIBF Stock Price Chart Interactive Chart >

Dorel Industries Inc. (DIIBF) Company Bio

Dorel Industries Inc. designs, manufactures, sources, markets, and distributes juvenile products, bicycles, and furniture worldwide. The company's Dorel Home segment engages in the design, manufacture, sourcing, and distribution of ready-to assemble furniture and home furnishings, including metal folding furniture, children's furniture, step stool, hand truck, ladder, outdoor furniture, and other imported furniture and futon products. This segment markets its products under the Ameriwood, Altra, System Build, Ridgewood, DHP, Dorel Fine Furniture, Dorel Living, Signature Sleep, Cosmo Living, Novagratz, Little Seeds, Baby Relax, Cosco Home & Office, and Alphason. This Dorel Juvenile segment offers designs, manufactures, sources, distributes, and retails children's accessories, such as infant car seats, strollers, high chairs, and infant health and safety aids primarily under the Maxi-Cosi, Quinny, Tiny Love, Safety 1st, Bébé Confort, Cosco, Mother's Choice, Disney, and Infanti brands. The company's Dorel Sports segment designs, manufactures, sources, and distributes recreational and leisure products and accessories, including bicycles, children's electric ride-ons, jogging strollers, electric bikes and bicycle trailers, scooters, and other recreational products. This segment markets its products primarily under the Cannondale, Mongoose, Schwinn, Charge, KidTrax, Fabric, Guru, Caloi, IronHorse, and GT brands. The company sells its products to mass merchant discount chains, department stores, club format outlets, and hardware/home centers; Internet retailers; independent boutiques and juvenile specialty stores; and sporting goods chains. It also owns and operates 100 retail stores in Chile and Peru, as well as various factory outlet retail locations in Europe and Australia. The company was formerly known as Dorel Co. Ltd. and changed its name to Dorel Industries Inc. in May 1987. Dorel Industries Inc. was founded in 1962 and is headquartered in Westmount, Canada.

Latest DIIBF News From Around the Web

Below are the latest news stories about DOREL INDUSTRIES INC that investors may wish to consider to help them evaluate DIIBF as an investment opportunity.

Dorel Industries Announces Results of Annual MeetingMONTREAL, May 25, 2022 (GLOBE NEWSWIRE) -- Dorel Industries Inc. (TSX: DII.B, DII.A) is pleased to announce that all of the nominees listed in its Management Proxy Circular dated April 12, 2022 were re-elected as directors at the Company’s Annual Meeting of Shareholders held today in Montréal. At the meeting, a ballot was conducted for the election of directors. According to proxies received and ballots cast, the following individuals were elected as directors of Dorel, with the following result |

REMINDER/Dorel Industries Inc. Announces Virtual Annual Meeting of ShareholdersWednesday, May 25, 2022 at 10:00 A.M.MONTREAL, May 24, 2022 (GLOBE NEWSWIRE) -- Shareholders are invited to participate by live audio webcast at https://www.dorel.com/pages/shareholder-information Shareholders will have the ability to interact with Dorel Industries Inc. Senior Management by submitting questions to [email protected]. To be sure your questions are addressed during the Q&A portion of the annual meeting, it is recommended that you submit them no later than 5 p.m. on Friday, May 20, 2022. |

Dorel Industries Inc. Announces Virtual Annual Meeting of ShareholdersWednesday, May 25, 2022 at 10:00 A.M.MONTREAL, May 17, 2022 (GLOBE NEWSWIRE) -- Shareholders are invited to participate by live audio webcast at https://www.dorel.com/pages/shareholder-information Shareholders will have the ability to interact with Dorel Industries Inc. Senior Management by submitting questions to [email protected]. To be sure your questions are addressed during the Q&A portion of the annual meeting, it is recommended that you submit them no later than 5 p.m. on Friday, May 20, 2022. |

Dorel Reports First Quarter 2022 ResultsDorel Juvenile revenue increases in most marketsDorel Home impacted by reduced demandProfitability reduced by pressure on margins MONTREAL, May 06, 2022 (GLOBE NEWSWIRE) -- Dorel Industries Inc. (TSX: DII.B, DII.A) today released results for the first quarter ended March 31, 2022.“First quarter challenges generally mirrored those of the previous quarter. Supply chain issues, high inflation as well as its impact on pricing and our consumers and uncertainty in Europe all contributed to lower earni |

REMINDER: Dorel Industries Will Hold a Conference Call to Discuss Its First Quarter ResultsMONTREAL, May 05, 2022 (GLOBE NEWSWIRE) -- Dorel Industries, Inc. (TSX: DII.B, DII.A) CONFERENCE CALL:OPEN TO: Analysts, investors and all interested parties DATE: Friday, May 6, 2022 TIME: 1:00 PM Eastern Time CALL: 1-888-440-3307 THE PRESS RELEASE WILL BE PUBLISHED BEFORE MARKETS OPEN THE SAME DAY THROUGH GLOBENEWSWIRE. Please dial in 15 minutes before the conference begins. If you are unable to call in at this time, you may access a recording of the meeting by calling 1-800-770-2030 and enter |

DIIBF Price Returns

| 1-mo | 4.35% |

| 3-mo | 14.76% |

| 6-mo | 1.62% |

| 1-year | 13.33% |

| 3-year | -55.59% |

| 5-year | -26.09% |

| YTD | 6.57% |

| 2023 | 24.21% |

| 2022 | -76.57% |

| 2021 | 38.04% |

| 2020 | 154.33% |

| 2019 | -60.78% |

Loading social stream, please wait...