Dynagas LNG Partners LP (DLNG): Price and Financial Metrics

DLNG Price/Volume Stats

| Current price | $3.88 | 52-week high | $4.24 |

| Prev. close | $3.83 | 52-week low | $2.27 |

| Day low | $3.80 | Volume | 42,759 |

| Day high | $3.96 | Avg. volume | 45,592 |

| 50-day MA | $3.93 | Dividend yield | N/A |

| 200-day MA | $3.16 | Market Cap | 142.94M |

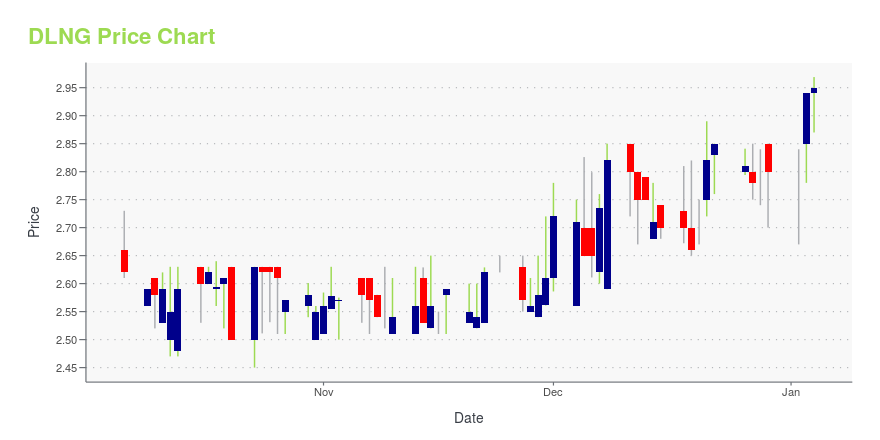

DLNG Stock Price Chart Interactive Chart >

Dynagas LNG Partners LP (DLNG) Company Bio

Dynagas LNG Partners LP is focused on owning and operating liquefied natural gas carriers. The company was founded in 2013 and is based in Monaco.

Latest DLNG News From Around the Web

Below are the latest news stories about DYNAGAS LNG PARTNERS LP that investors may wish to consider to help them evaluate DLNG as an investment opportunity.

Dynagas LNG Partners LP (DLNG) Q3 2023 Earnings Call TranscriptDynagas LNG Partners LP (DLNG) Q3 2023 Earnings Call Transcript December 08, 2023, 10:00 AM ET Company Participants Tony Lauritzen - CEO Michael Gregos - CFO Conference Call Participants Ben Nolan - Stifel Presentation Operator Thank you for standing by ladies and gentlemen, and welcome to Dynagas LNG Partners Conference Call on the third quarter 2023 financial results. We have with us Mr. Tony Lauritzen, Chief Executive Officer, and Mr. Michael Gregos, Chief Financial Officer of the company. At this time, all participants are in a listen-only mode. [Operator Instructions]. I must advise that this conference is being recorded today. Please be reminded that t... |

DLNG Stock Earnings: Dynagas LNG Partners Misses EPS, Beats Revenue for Q3 2023DLNG stock results show that Dynagas LNG Partners missed analyst estimates for earnings per share but beat on revenue for the third quarter of 2023. |

Dynagas LNG Partners LP Reports Results For the Three and Nine Months Ended September 30, 2023ATHENS, Greece, Dec. 07, 2023 (GLOBE NEWSWIRE) -- Dynagas LNG Partners LP (NYSE: “DLNG”) (“the “Partnership”), an owner and operator of liquefied natural gas (“LNG”) carriers, today announced its results for the three and nine months ended September 30, 2023. Nine months Highlights: Net Income and Earnings per common unit (basic and diluted) of $25.4 million and $0.45, respectively;Adjusted Net Income(1) of $15.5 million and Adjusted Earnings per common unit (1) (basic and diluted) of $0.18;Adju |

Dynagas LNG Partners LP Announces Date for the Release of the Third Quarter 2023 Results, Conference Call and WebcastATHENS, Greece, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Dynagas LNG Partners LP (NYSE: “DLNG”) (“Dynagas Partners” or the “Partnership”), an owner and operator of LNG carriers, today announced that it will release its financial results for the third quarter ended September 30, 2023, after market closes in New York on Thursday, December 7, 2023. The next day, Friday, December 8, 2023 at 10:00 a.m. Eastern Time, the Company's management will host a conference call and webcast to discuss the earnings res |

Dynagas LNG Partners LP Announces Results of 2023 Annual Meeting of Limited PartnersATHENS, Greece, Dec. 01, 2023 (GLOBE NEWSWIRE) -- Dynagas LNG Partners LP (the “Partnership”) (NYSE: “DLNG”), an owner and operator of liquefied natural gas carriers, conducted its Annual Meeting of Limited Partners on November 30, 2023, in Athens, Greece. The following resolutions were approved: To elect Dimitris Anagnostopoulos as a Class III Director to serve for a three-year term until the 2026 Annual Meeting of Limited Partners; andTo ratify the appointment of Ernst & Young (Hellas) Certifi |

DLNG Price Returns

| 1-mo | -3.48% |

| 3-mo | 10.54% |

| 6-mo | 41.09% |

| 1-year | 36.14% |

| 3-year | 29.77% |

| 5-year | 165.75% |

| YTD | 38.57% |

| 2023 | 6.87% |

| 2022 | -9.34% |

| 2021 | 15.60% |

| 2020 | 18.46% |

| 2019 | -34.11% |

Continue Researching DLNG

Want to see what other sources are saying about Dynagas LNG Partners LP's financials and stock price? Try the links below:Dynagas LNG Partners LP (DLNG) Stock Price | Nasdaq

Dynagas LNG Partners LP (DLNG) Stock Quote, History and News - Yahoo Finance

Dynagas LNG Partners LP (DLNG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...