Denali Therapeutics Inc. (DNLI): Price and Financial Metrics

DNLI Price/Volume Stats

| Current price | $24.10 | 52-week high | $28.75 |

| Prev. close | $24.09 | 52-week low | $14.56 |

| Day low | $23.86 | Volume | 543,073 |

| Day high | $24.88 | Avg. volume | 1,182,949 |

| 50-day MA | $21.47 | Dividend yield | N/A |

| 200-day MA | $19.54 | Market Cap | 3.44B |

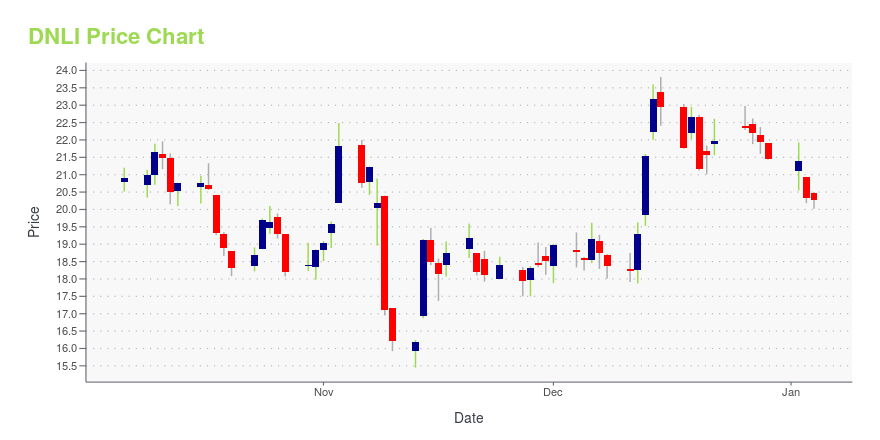

DNLI Stock Price Chart Interactive Chart >

Denali Therapeutics Inc. (DNLI) Company Bio

Denali Therapeutics Inc. engages in discovering and developing therapeutics for neurodegenerative diseases in the United States. The company’s lead LRRK2 product candidates includes the DNL201, a small molecule inhibitor that is in Phase I clinical trials, as well as DNL151, a small molecule inhibitor, which is in preclinical development stage for the treatment of Parkinson’s disease. It is also developing therapeutics for the treatment of Parkinson’s, dementia with Lewy bodies, and multiple system atrophy; amyotrophic lateral sclerosis; and mucopolysaccharidosis type II patients. The company was formerly known as SPR Pharma Inc. and changed its name to Denali Therapeutics Inc. in March 2015. Denali Therapeutics Inc. was founded in 2013 and is based in South San Francisco, California.

Latest DNLI News From Around the Web

Below are the latest news stories about DENALI THERAPEUTICS INC that investors may wish to consider to help them evaluate DNLI as an investment opportunity.

Fluor Corporation and Align Technology have been highlighted as Zacks Bull and Bear of the DayFluor Corporation and Align Technology are part of the Zacks Bull and Bear of the Day article. |

3 Beaten-Down Biotech Stocks to Buy for a Turnaround in 2024Here we present three biotech stocks, SRPT, DNLI and VRNA, which took a beating in 2023 but have upside potential for 2024. |

40 Cities with the Highest Life Expectancy in the USIn this article, we look at 40 Cities With The Highest Life Expectancy In The US. You can skip our detailed analysis on companies that are working on longevity enhancement and improved health facilities by heading over directly to the 10 Cities With The Highest Life Expectancy In The US. Life expectancy of a newborn […] |

Does Denali Therapeutics Inc. (DNLI) Have the Potential to Rally 123.38% as Wall Street Analysts Expect?The consensus price target hints at a 123.4% upside potential for Denali Therapeutics Inc. (DNLI). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term. |

Why Is Denali Therapeutics Inc. (DNLI) Down 5.2% Since Last Earnings Report?Denali Therapeutics Inc. (DNLI) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

DNLI Price Returns

| 1-mo | 9.55% |

| 3-mo | 56.19% |

| 6-mo | 42.86% |

| 1-year | -13.37% |

| 3-year | -50.82% |

| 5-year | 13.79% |

| YTD | 12.30% |

| 2023 | -22.83% |

| 2022 | -37.65% |

| 2021 | -46.75% |

| 2020 | 380.83% |

| 2019 | -15.68% |

Continue Researching DNLI

Here are a few links from around the web to help you further your research on Denali Therapeutics Inc's stock as an investment opportunity:Denali Therapeutics Inc (DNLI) Stock Price | Nasdaq

Denali Therapeutics Inc (DNLI) Stock Quote, History and News - Yahoo Finance

Denali Therapeutics Inc (DNLI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...