Daqo New Energy Corp. ADR (DQ): Price and Financial Metrics

DQ Price/Volume Stats

| Current price | $17.61 | 52-week high | $40.13 |

| Prev. close | $17.23 | 52-week low | $14.21 |

| Day low | $17.30 | Volume | 490,600 |

| Day high | $17.84 | Avg. volume | 1,117,220 |

| 50-day MA | $18.27 | Dividend yield | N/A |

| 200-day MA | $22.20 | Market Cap | 1.16B |

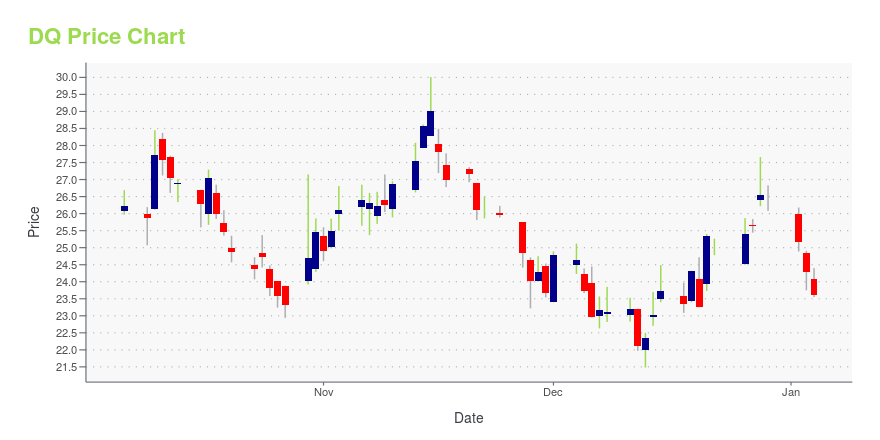

DQ Stock Price Chart Interactive Chart >

Daqo New Energy Corp. ADR (DQ) Company Bio

Daqo New Energy Corp. is a holding company, which engages in the manufacture and sale of polysilicon products for the solar cell and module manufacturers. It operates through the Polysilicon and Wafer segment. The company was founded by Guang Fu Xu on November 22, 2007 and is headquartered in Chongqing, China.

Latest DQ News From Around the Web

Below are the latest news stories about DAQO NEW ENERGY CORP that investors may wish to consider to help them evaluate DQ as an investment opportunity.

12 Best Tech Stocks To Buy On the DipIn this article, we discuss the 12 best tech stocks to buy on the dip. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Tech Stocks To Buy On the Dip. Technology stocks were the winners of the pandemic, climbing to record highs during lockdowns as businesses scrambled […] |

Daqo (DQ) Inks Investment Agreement to Integrate Upstream SupplyThe project by Daqo (DQ) is anticipated to acquire certificates for renewable energy and green power as well as green electricity. |

Here's What Daqo New Energy's (NYSE:DQ) Strong Returns On Capital MeanIf you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'd want to identify a... |

Daqo New Energy's Subsidiary Xinjiang Daqo Announces Investment Agreement to Establish Polysilicon and Silicon Metal Project to Integrate Upstream SupplyDaqo New Energy Corp. (NYSE: DQ) ("Daqo New Energy", the "Company" or "we"), a leading manufacturer of high-purity polysilicon for the global solar PV industry, today announced that its subsidiary Xinjiang Daqo has signed an investment agreement to create a silicon-based new materials industrial park. Located in Shihezi, China, the project covers two phases. The first phase of the project consists of 150,000MT of silicon metal production, 50,000MT of polysilicon, and 1.2 million pieces of silico |

12 Solar Energy Stocks Billionaires Are Piling IntoIn this piece, we will take a look at the 12 solar energy stocks that billionaires are piling into. If you want to skip our overview of the solar energy industry and the latest trends, then check out 5 Solar Energy Stocks That Billionaires Are Piling Into. The solar energy industry is one of the most […] |

DQ Price Returns

| 1-mo | 15.02% |

| 3-mo | -25.82% |

| 6-mo | -8.19% |

| 1-year | -52.90% |

| 3-year | -67.24% |

| 5-year | 104.29% |

| YTD | -33.80% |

| 2023 | -31.11% |

| 2022 | -4.24% |

| 2021 | -29.71% |

| 2020 | 460.16% |

| 2019 | 118.80% |

Continue Researching DQ

Want to see what other sources are saying about Daqo New Energy Corp's financials and stock price? Try the links below:Daqo New Energy Corp (DQ) Stock Price | Nasdaq

Daqo New Energy Corp (DQ) Stock Quote, History and News - Yahoo Finance

Daqo New Energy Corp (DQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...