DIRTT Environmental Solutions Ltd. (DRTT): Price and Financial Metrics

DRTT Price/Volume Stats

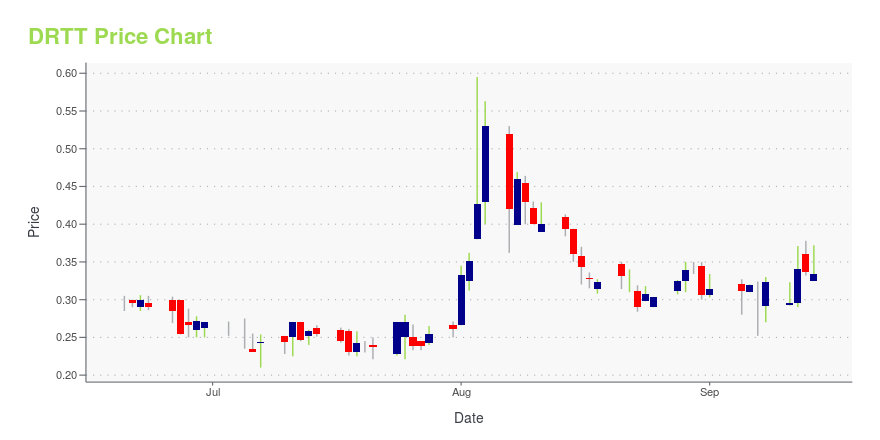

| Current price | $0.33 | 52-week high | $1.07 |

| Prev. close | $0.34 | 52-week low | $0.20 |

| Day low | $0.33 | Volume | 255,300 |

| Day high | $0.37 | Avg. volume | 165,907 |

| 50-day MA | $0.31 | Dividend yield | N/A |

| 200-day MA | $0.43 | Market Cap | 34.92M |

DRTT Stock Price Chart Interactive Chart >

DIRTT Environmental Solutions Ltd. (DRTT) Company Bio

DIRTT Environmental Solutions Ltd. designs, manufactures, and installs prefabricated interior solutions for use primarily in commercial spaces across various industries and businesses in the United States, Canada, internationally. Its ICE software interior construction technology provides integration and management, from design through engineering, manufacturing, and installation. The company's interior construction solutions include prefabricated, customized interior modular walls, ceilings, and floors; decorative and functional millwork; power infrastructure; network infrastructure; and pre-installed medical gas piping systems. It offers interior construction solutions through a network of independent distribution partners. It serves commercial, healthcare, education, hospitality, and other industries, as well as medical gas piping systems for healthcare. DIRTT Environmental Solutions Ltd. was founded in 2003 and is headquartered in Calgary, Canada.

Latest DRTT News From Around the Web

Below are the latest news stories about DIRTT ENVIRONMENTAL SOLUTIONS LTD that investors may wish to consider to help them evaluate DRTT as an investment opportunity.

Toronto Stock Exchange, Dirtt Environmental Solutions Ltd., The View From The C-SuiteRepresentatives from Dirtt Environmental Solutions Ltd. (TSX: DRT) ("DIRTT" or the "Company") share their Company's story in an interview with TMX Group. |

UPDATE -- DIRTT Environmental Solutions Ltd.CALGARY, Alberta, Sept. 11, 2023 (GLOBE NEWSWIRE) -- Explanatory Note: Updated below on September 11, 2023 pursuant to Form 8-K/A filed on September 11, 2023 with the SEC to explain the delisting DIRTT to Delist from Nasdaq Exchange; Public Trading on Toronto Stock Exchange Will Continue DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company”), a leader in industrialized construction, announced on September 6, 2023, that The Nasdaq Stock Market (“Nasdaq”) will be delisting its shares on or |

DIRTT Continues Expansion Across Construction Partner NetworkCALGARY, Alberta, Sept. 07, 2023 (GLOBE NEWSWIRE) -- DIRTT, a global leader in industrialized construction, is pleased to welcome two new DIRTT Construction Partners to its network: CMS Interiors and Al-Kaws. CMS Interiors will join Parron Hall in San Diego, California, who continue to deliver best-in-class DIRTT design and construction experiences. Teaming up with Al-Kaws reopens the Middle Eastern market where DIRTT has shipped over $50M USD in healthcare projects to date. In addition to addin |

DIRTT to Voluntarily Delist from Nasdaq Exchange; Public Trading on Toronto Stock Exchange Will ContinueCALGARY, Alberta, Sept. 06, 2023 (GLOBE NEWSWIRE) -- DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company”), a leader in industrialized construction, announced today that it will voluntarily delist from The Nasdaq Stock Market (“Nasdaq”) on or around September 15, 2023. After the voluntary delisting, all current and future DIRTT shareholders will retain their ability to publicly trade DIRTT shares on the Toronto Stock Exchange (TSX) under the symbol "DRT". The Company estimates a recurrin |

DIRTT Selected for Innovative Education Projects in Kentucky and Western PennsylvaniaCALGARY, Alberta, Aug. 15, 2023 (GLOBE NEWSWIRE) -- DIRTT and its Construction Partners Construkt in Pittsburgh, Pennsylvania, and ID+A in Louisville, Kentucky proudly announce they recently secured over $6M USD in construction projects with major education clients including Armstrong School District, Western Kentucky University, and Berea College. These projects were awarded due to Construkt and ID+A’s proven abilities to deliver dynamic and modern learning environments using DIRTT’s innovative |

DRTT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 38.42% |

| 3-year | -92.11% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -75.69% |

| 2021 | -11.74% |

| 2020 | -25.38% |

| 2019 | N/A |

Loading social stream, please wait...