Deswell Industries, Inc. (DSWL): Price and Financial Metrics

DSWL Price/Volume Stats

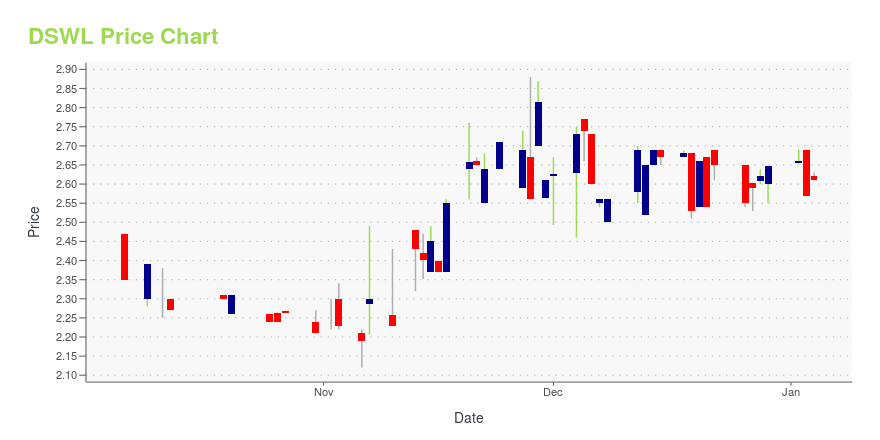

| Current price | $2.42 | 52-week high | $2.88 |

| Prev. close | $2.50 | 52-week low | $2.12 |

| Day low | $2.42 | Volume | 12,550 |

| Day high | $2.51 | Avg. volume | 8,461 |

| 50-day MA | $2.45 | Dividend yield | 8.03% |

| 200-day MA | $2.40 | Market Cap | 38.57M |

DSWL Stock Price Chart Interactive Chart >

Latest DSWL News From Around the Web

Below are the latest news stories about DESWELL INDUSTRIES INC that investors may wish to consider to help them evaluate DSWL as an investment opportunity.

Deswell Industries, Inc. (NASDAQ:DSWL) Pays A US$0.10 Dividend In Just Three DaysRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Deswell... |

Deswell Industries (NASDAQ:DSWL) Has Affirmed Its Dividend Of $0.10Deswell Industries, Inc. ( NASDAQ:DSWL ) will pay a dividend of $0.10 on the 21st of December. Based on this payment... |

Deswell Announces First Half 2024 ResultsMACAO, November 17, 2023--Deswell Industries, Inc. (Nasdaq: DSWL) today announced its unaudited financial results for the first six months of fiscal 2023, ended September 30, 2023. |

Calculating The Fair Value Of Deswell Industries, Inc. (NASDAQ:DSWL)Key Insights Using the Dividend Discount Model, Deswell Industries fair value estimate is US$2.68 Deswell Industries... |

Deswell Announces Filing of Form 20-F/A an Amendment to the Annual Report on Form 20-FMACAO, September 28, 2023--Deswell Industries, Inc. (Nasdaq: DSWL) today announced that the Company has filed an Amendment to its Annual Report on Form 20-F of Deswell Industries, Inc. ("Company," "our," "us," or "we") for the fiscal year ended March 31, 2023 filed on July 28, 2023 (the "Original Filing"). The amendment is being filed solely to amend and restate in its entirety Item 16I, "Disclosure Regarding Foreign Jurisdictions that Prevent Inspections" in order to provide the items required |

DSWL Price Returns

| 1-mo | 1.22% |

| 3-mo | 9.58% |

| 6-mo | 0.02% |

| 1-year | 2.48% |

| 3-year | -36.41% |

| 5-year | N/A |

| YTD | -4.82% |

| 2023 | -8.46% |

| 2022 | -14.09% |

| 2021 | 37.77% |

| 2020 | 16.05% |

| 2019 | -5.73% |

DSWL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DSWL

Here are a few links from around the web to help you further your research on Deswell Industries Inc's stock as an investment opportunity:Deswell Industries Inc (DSWL) Stock Price | Nasdaq

Deswell Industries Inc (DSWL) Stock Quote, History and News - Yahoo Finance

Deswell Industries Inc (DSWL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...