Diana Shipping inc. common stock (DSX): Price and Financial Metrics

DSX Price/Volume Stats

| Current price | $2.69 | 52-week high | $3.98 |

| Prev. close | $2.68 | 52-week low | $2.64 |

| Day low | $2.64 | Volume | 806,164 |

| Day high | $2.70 | Avg. volume | 675,517 |

| 50-day MA | $2.92 | Dividend yield | 10.91% |

| 200-day MA | $3.03 | Market Cap | 336.49M |

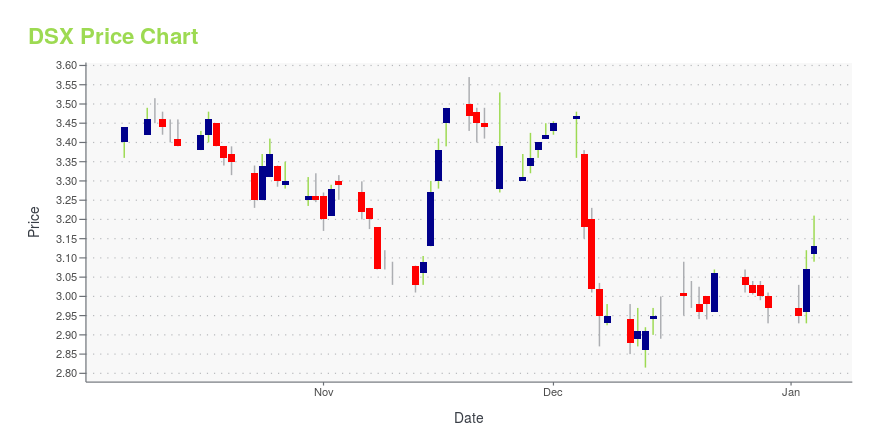

DSX Stock Price Chart Interactive Chart >

Diana Shipping inc. common stock (DSX) Company Bio

Diana Shipping is a global provider of shipping transportation services through its ownership of dry bulk vessels. The Company's vessels are employed primarily on medium to long-term time charters and transport a range of dry bulk cargoes, including such commodities as iron ore, coal, grain and other materials along worldwide shipping routes. The company was founded in 1999 and is based in Athens, Greece.

Latest DSX News From Around the Web

Below are the latest news stories about DIANA SHIPPING INC that investors may wish to consider to help them evaluate DSX as an investment opportunity.

11 Best Shipping Stocks That Pay DividendsIn this article, we discuss 11 best shipping stocks that pay dividends. You can skip our detailed analysis of the shipping and transportation industry, and go directly to read 5 Best Shipping Stocks That Pay Dividends. In today’s interconnected global economy, the movement of goods across the world holds immense significance. The World Economic Forum […] |

Diana Shipping Inc. Announces Time Charter Contract for m/v DSI Pollux With Cargill Ocean TransportationATHENS, Greece, Dec. 22, 2023 (GLOBE NEWSWIRE) -- Diana Shipping Inc. (NYSE: DSX), (the “Company”), a global shipping company specializing in the ownership and bareboat charter-in of dry bulk vessels, today announced that, through a separate wholly-owned subsidiary, it has entered into a time charter contract with Cargill Ocean Transportation (Singapore) Pte. Ltd. for one of its Ultramax dry bulk vessels, the m/v DSI Pollux. The gross charter rate is US$14,000 per day, minus a 4.75% commission p |

Diana Shipping Inc. Announces Release of Its 2022 Environmental, Social and Governance ReportATHENS, Greece, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Diana Shipping Inc. (NYSE: DSX), (the “Company”), a global shipping company specializing in the ownership and bareboat charter-in of dry bulk vessels, today announced the release of its Environmental, Social and Governance Report (the “ESG Report”), for the year ended December 31, 2022. The ESG Report provides an overview of the Company’s policies and practices relating to its environmental, social and governance commitments. The ESG Report is av |

What Is Diana Shipping Inc.'s (NYSE:DSX) Share Price Doing?While Diana Shipping Inc. ( NYSE:DSX ) might not be the most widely known stock at the moment, it received a lot of... |

Is the Options Market Predicting a Spike in Diana Shipping (DSX) Stock?Investors need to pay close attention to Diana Shipping (DSX) stock based on the movements in the options market lately. |

DSX Price Returns

| 1-mo | -4.61% |

| 3-mo | -6.43% |

| 6-mo | -8.45% |

| 1-year | -18.84% |

| 3-year | 6.01% |

| 5-year | 19.33% |

| YTD | -4.75% |

| 2023 | -11.15% |

| 2022 | 18.18% |

| 2021 | 126.28% |

| 2020 | -37.94% |

| 2019 | -2.20% |

DSX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DSX

Here are a few links from around the web to help you further your research on Diana Shipping Inc's stock as an investment opportunity:Diana Shipping Inc (DSX) Stock Price | Nasdaq

Diana Shipping Inc (DSX) Stock Quote, History and News - Yahoo Finance

Diana Shipping Inc (DSX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...