Datasea Inc. (DTSS): Price and Financial Metrics

DTSS Price/Volume Stats

| Current price | $2.75 | 52-week high | $20.29 |

| Prev. close | $2.76 | 52-week low | $1.42 |

| Day low | $2.67 | Volume | 21,278 |

| Day high | $2.86 | Avg. volume | 1,040,990 |

| 50-day MA | $4.23 | Dividend yield | N/A |

| 200-day MA | $4.72 | Market Cap | 9.87M |

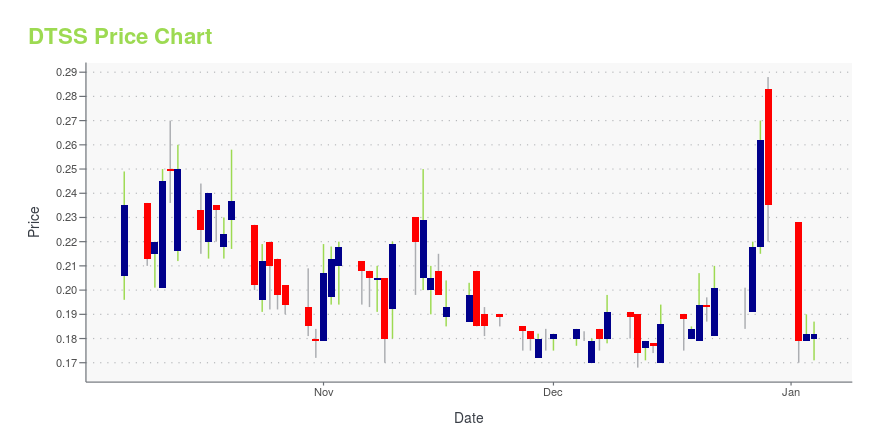

DTSS Stock Price Chart Interactive Chart >

Datasea Inc. (DTSS) Company Bio

Datasea, Inc. engages in the development and distribution of electronic and web-based security solutions. The company focuses on development, manufacture, and trade of security equipment. It offers media advertising, big data, smart education security solution, internet security products, cyber security system & equipment, data analysis and data integration services. The company was founded by Zhi Xin Liu, Fu Liu, and Xing Zhong Sun on September 26, 2014 and is headquartered in Beijing, China.

Latest DTSS News From Around the Web

Below are the latest news stories about DATASEA INC that investors may wish to consider to help them evaluate DTSS as an investment opportunity.

Datasea Inc.'s (NASDAQ:DTSS) Shares Not Telling The Full StoryYou may think that with a price-to-sales (or "P/S") ratio of 0.5x Datasea Inc. ( NASDAQ:DTSS ) is definitely a stock... |

Datasea Reports First Quarter Fiscal Year 2024 Financial Results and Operations UpdateDatasea Inc. (NASDAQ: DTSS) ("Datasea" or the "Company"), a global technology company that develops and provides products utilizing intelligent acoustics including ultrasound, infrasound and directional sound, and provides 5G messaging, today announced its financial results for the first quarter ended September 30, 2023. |

Datasea Announces September 2023 Revenue of $2.5 million from its 5G Messaging BusinessDatasea Inc., (NASDAQ: DTSS) ("Datasea" or the "Company"), a Nevada incorporated digital technology corporation engaged in converging and innovative business segments for intelligent acoustics and 5G messaging technology in China, today announced that it recorded revenue of RMB 17.8 million (US $2.5 million) in the month of September 2023, attributable to three of its 5G business segment operating entities. The Company's September 2023 5G messaging revenue was 12x greater than 5G messaging reven |

Datasea Reports Full Fiscal Year 2023 Financial Results, maintaining a continued focus on Intelligent Acoustics and 5G Messaging businessDatasea Inc., (NASDAQ: DTSS) ("Datasea" or the "Company"), a Nevada incorporated digital technology corporation engaged in converging and innovative business segments for intelligent acoustics and 5G messaging technology in China, today announced financial results for its full fiscal year ended June 30, 2023, and provided an update on its key strategic and operational initiatives. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting the final day of trading this week with a breakdown of the biggest pre-market stock movers for Friday morning! |

DTSS Price Returns

| 1-mo | -36.78% |

| 3-mo | -66.42% |

| 6-mo | 61.76% |

| 1-year | -75.62% |

| 3-year | -92.39% |

| 5-year | -84.27% |

| YTD | -21.89% |

| 2023 | -84.35% |

| 2022 | -3.85% |

| 2021 | -22.00% |

| 2020 | -34.43% |

| 2019 | -24.69% |

Loading social stream, please wait...