Duos Technologies Group Inc. (DUOT): Price and Financial Metrics

DUOT Price/Volume Stats

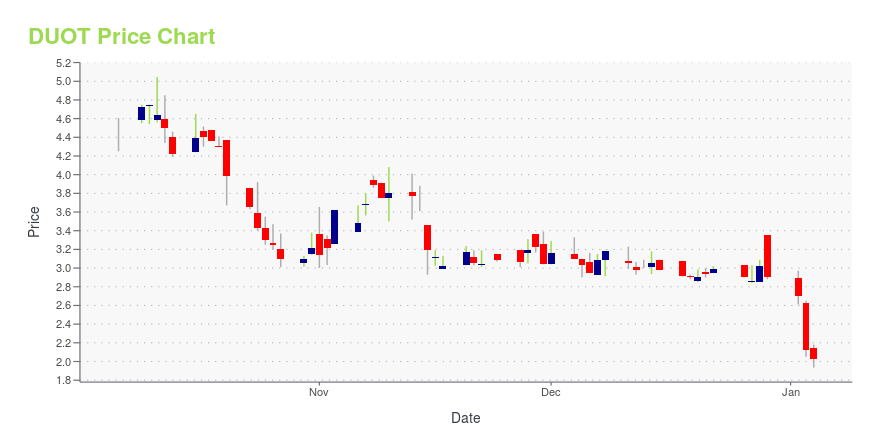

| Current price | $8.59 | 52-week high | $9.27 |

| Prev. close | $8.05 | 52-week low | $2.03 |

| Day low | $8.09 | Volume | 91,100 |

| Day high | $8.75 | Avg. volume | 129,121 |

| 50-day MA | $6.59 | Dividend yield | N/A |

| 200-day MA | $5.24 | Market Cap | 100.11M |

DUOT Stock Price Chart Interactive Chart >

Duos Technologies Group Inc. (DUOT) Company Bio

Duos Technologies provides a broad range of sophisticated intelligent technology solutions with an emphasis on mission critical applications. Based in Jacksonville, FL, duostech services customers throughout North America, integrating safety, security, situational awareness and automation platforms in all types of environments.

DUOT Price Returns

| 1-mo | 17.83% |

| 3-mo | 54.77% |

| 6-mo | 81.22% |

| 1-year | 234.24% |

| 3-year | 90.89% |

| 5-year | 59.67% |

| YTD | 43.65% |

| 2024 | 106.21% |

| 2023 | 45.00% |

| 2022 | -61.01% |

| 2021 | 20.99% |

| 2020 | -36.69% |

Loading social stream, please wait...