Dunxin Financial Holdings Limited (DXF): Price and Financial Metrics

DXF Price/Volume Stats

| Current price | $0.16 | 52-week high | $1.55 |

| Prev. close | $0.16 | 52-week low | $0.13 |

| Day low | $0.16 | Volume | 192,604 |

| Day high | $0.16 | Avg. volume | 1,018,933 |

| 50-day MA | $0.22 | Dividend yield | N/A |

| 200-day MA | $0.30 | Market Cap | 3.60M |

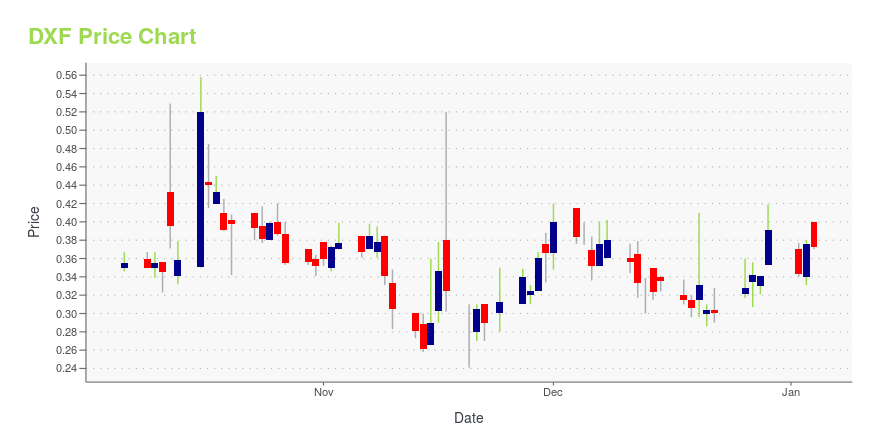

DXF Stock Price Chart Interactive Chart >

Dunxin Financial Holdings Limited (DXF) Company Bio

Dunxin Financial Holdings Limited engages in the microfinance lending business in Hubei, China. It provides consumer, commercial, collateral-backed, and enterprise loans that are secured by assets as collateral or guaranteed by a third party to individuals; micro, small, and medium sized enterprises; and sole proprietors. The company was formerly known as China Xiniya Fashion Limited and changed its name to Dunxin Financial Holdings Limited in March 2018. Dunxin Financial Holdings Limited was incorporated in 2010 and is headquartered in Wuhan, China.

Latest DXF News From Around the Web

Below are the latest news stories about DUNXIN FINANCIAL HOLDINGS LTD that investors may wish to consider to help them evaluate DXF as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to close out this week of trading with an overview of the biggest pre-market stock movers to watch Friday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start off the week with a breakdown of the biggest pre-market stock movers worth reading about on Monday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time to dive into the biggest pre-market stock movers for Wednesday as we check out all the latest news this morning! |

Dunxin Financial Holdings Announces Pricing of $1.09 Million Registered Direct OfferingDunxin Financial Holdings Limited ("Dunxin" or the "Company") (NYSE American: DXF), a licensed microfinance lender servicing individuals and small and medium enterprises ("SMEs") in Hubei Province, China, today announced that it entered into a securities purchase agreement with an institutional investors to purchase $1.09 million worth of its American Depositary Shares ("ADS") in a registered direct offering. |

Why Is Bellerophon Therapeutics (BLPH) Stock Down 34% Today?Bellerophon Therapeutics (BLPH) stock is losing value on Tuesday after the clinical-stage therapeutics company was sent a delisting notice. |

DXF Price Returns

| 1-mo | -8.57% |

| 3-mo | -37.28% |

| 6-mo | -55.85% |

| 1-year | -82.42% |

| 3-year | -99.00% |

| 5-year | -99.18% |

| YTD | -59.08% |

| 2023 | -79.14% |

| 2022 | -82.32% |

| 2021 | -20.30% |

| 2020 | 17.70% |

| 2019 | -36.87% |

Continue Researching DXF

Want to see what other sources are saying about Dunxin Financial Holdings Ltd's financials and stock price? Try the links below:Dunxin Financial Holdings Ltd (DXF) Stock Price | Nasdaq

Dunxin Financial Holdings Ltd (DXF) Stock Quote, History and News - Yahoo Finance

Dunxin Financial Holdings Ltd (DXF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...