Dynatronics Corporation (DYNT): Price and Financial Metrics

DYNT Price/Volume Stats

| Current price | $0.26 | 52-week high | $0.91 |

| Prev. close | $0.28 | 52-week low | $0.15 |

| Day low | $0.23 | Volume | 2,300 |

| Day high | $0.28 | Avg. volume | 345,805 |

| 50-day MA | $0.32 | Dividend yield | N/A |

| 200-day MA | $0.47 | Market Cap | 1.39M |

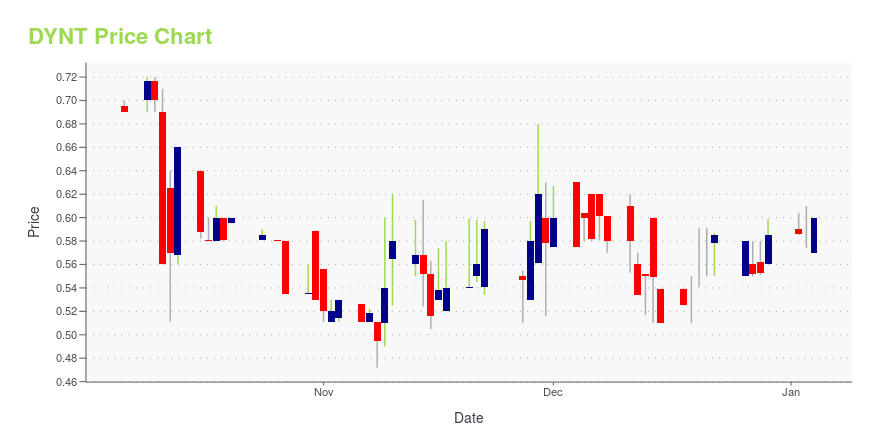

DYNT Stock Price Chart Interactive Chart >

Dynatronics Corporation (DYNT) Company Bio

Dynatronics Corporation, a medical device company, designs, manufactures, and sells physical therapy, rehabilitation, orthopedics, pain management, and athletic training products in the United States. It offers orthopedic soft bracing products, which include cervical collars, shoulder immobilizers, arm slings, wrist and elbow supports, abdominal and lumbosacral supports, maternity supports, knee immobilizers and supports, ankle walkers and supports, plantar fasciitis splints, and cold therapy products. The company also provides power and manually operated treatment tables, mat platforms, work tables, parallel bars, training stairs, weight racks, treadmills, recumbent bikes, and other related equipment. In addition, it offers therapeutic modality devices, such as electrotherapy, ultrasound, phototherapy, therapeutic lasers, shortwave diathermy, radial pulse therapy, hot and cold therapy, compression therapy, and electrodes. Further, the company provides clinical supplies, including exercise bands and tubing, topical analgesics, lotions and gels, orthopedic bracing, paper products, athletic tapes, and other related supplies. It markets its products under the Bird & Cronin, Solaris, Hausmann, Physician's Choice, and PROTEAM brands. The company sells its products to orthopedists, physical therapists, chiropractors, and athletic trainers, sports medicine practitioners, hospitals, clinics, and consumers, as well as online. It also exports its products to approximately 30 countries. The company was founded in 1979 and is headquartered in Eagan, Minnesota.

Latest DYNT News From Around the Web

Below are the latest news stories about DYNATRONICS CORP that investors may wish to consider to help them evaluate DYNT as an investment opportunity.

Dynatronics Corporation (NASDAQ:DYNT) Q1 2024 Earnings Call TranscriptDynatronics Corporation (NASDAQ:DYNT) Q1 2024 Earnings Call Transcript November 9, 2023 Dynatronics Corporation beats earnings expectations. Reported EPS is $-0.12, expectations were $-0.26. Operator: Good morning ladies and gentlemen and welcome to the Dynatronics First Quarter Results for Fiscal 2024 Conference Call. It is now my pleasure to turn the floor over to your host, […] |

Dynatronics Corporation Reports First Quarter Fiscal Year 2024 Financial ResultsEagan, Minnesota--(Newsfile Corp. - November 9, 2023) - Dynatronics Corporation (NASDAQ: DYNT) ("Dynatronics" or the "Company"), a leading manufacturer of athletic training, physical therapy, and rehabilitation products, today reported financial results for its first quarter of fiscal year 2024 ended September 30, 2023.CEO Commentary"We met our sales expectations and were profitable on an EBITDA basis in the first quarter," said Brian Baker, Chief Executive Officer of Dynatronics. "We must conti |

Dynatronics Corporation (DYNT) Expected to Beat Earnings Estimates: What to Know Ahead of Q1 ReleaseDynatronics Corporation (DYNT) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

Dynatronics Appoints Gabe Ellwein as Chief Financial OfficerEagan, Minnesota--(Newsfile Corp. - October 30, 2023) - Dynatronics Corporation (NASDAQ: DYNT), a leading manufacturer of athletic training, physical therapy, and rehabilitation products, today announced the appointment of Gabe Ellwein as Chief Financial Officer ("CFO"), effective October 30, 2023. Ellwein will report to the company's President and Chief Executive Officer, Brian Baker, and will lead the company's finance, accounting, and investor relations teams. He succeeds John Krier whose res |

Dynatronics Corporation Schedules Conference Call to Report Results for First Quarter Fiscal Year 2024Eagan, Minnesota--(Newsfile Corp. - October 26, 2023) - Dynatronics Corporation (NASDAQ: DYNT), a leading manufacturer of athletic training, physical therapy, and rehabilitation products, today announced that the company will release financial results for its fiscal year first quarter ended September 30, 2023 on Thursday, November 9, 2023.The company will subsequently hold a conference call, consisting of prepared remarks by management, and a question-and-answer session with analysts, at 11:00 A |

DYNT Price Returns

| 1-mo | -22.46% |

| 3-mo | -53.14% |

| 6-mo | -50.00% |

| 1-year | -67.41% |

| 3-year | -96.36% |

| 5-year | -96.58% |

| YTD | -55.56% |

| 2023 | -70.01% |

| 2022 | -60.99% |

| 2021 | 23.46% |

| 2020 | -2.42% |

| 2019 | -69.59% |

Continue Researching DYNT

Want to see what other sources are saying about Dynatronics Corp's financials and stock price? Try the links below:Dynatronics Corp (DYNT) Stock Price | Nasdaq

Dynatronics Corp (DYNT) Stock Quote, History and News - Yahoo Finance

Dynatronics Corp (DYNT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...