Eastern Bankshares Inc. (EBC): Price and Financial Metrics

EBC Price/Volume Stats

| Current price | $16.88 | 52-week high | $17.26 |

| Prev. close | $16.32 | 52-week low | $10.65 |

| Day low | $16.19 | Volume | 3,476,123 |

| Day high | $17.26 | Avg. volume | 986,532 |

| 50-day MA | $14.15 | Dividend yield | 2.66% |

| 200-day MA | $13.35 | Market Cap | 2.98B |

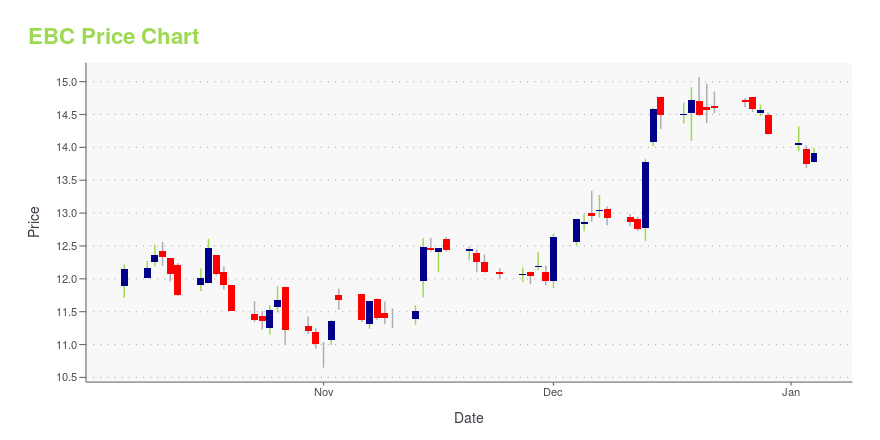

EBC Stock Price Chart Interactive Chart >

Eastern Bankshares Inc. (EBC) Company Bio

Eastern Bankshares, Inc. operates as a holding company, which engages in the provision of financial and banking services. It operates through the Banking and Insurance segments. The Banking segment provides commercial, retail, lending, deposits, and wealth management services. The Insurance segment offers commercial, personal, and employee benefits insurance products. The company was founded in 2020 and is headquartered in Boston, MA.

Latest EBC News From Around the Web

Below are the latest news stories about EASTERN BANKSHARES INC that investors may wish to consider to help them evaluate EBC as an investment opportunity.

Eastern Bank Named #1 SBA Lender in Massachusetts for the 15th Year in a RowBOSTON, December 12, 2023--Eastern Bank has been named by the U.S. Small Business Administration (SBA) as the top lender to small businesses for SBA 7(a) loans in Massachusetts for the 15th consecutive year. |

Eastern Bank Earns Top Score for 10th Consecutive Year in Human Rights Campaign Foundation’s 2023-2024 Corporate Equality IndexBOSTON, December 05, 2023--Eastern Bank is pleased to announce that for the tenth consecutive year, it received a score of 100 on the Human Rights Campaign Foundation’s 2023-2024 Corporate Equality Index (CEI), the nation’s foremost benchmarking survey and report measuring corporate policies and practices related to LGBTQ+ workplace equality. Eastern joins 545 U.S. businesses that also earned top marks this year. |

Eastern Bankshares (NASDAQ:EBC) Will Pay A Larger Dividend Than Last Year At $0.11The board of Eastern Bankshares, Inc. ( NASDAQ:EBC ) has announced that it will be paying its dividend of $0.11 on the... |

Eastern Bank Welcomes Avedis Zildjian Co. As A Commercial Banking CustomerBOSTON, November 15, 2023--Eastern Bank is pleased to announce Avedis Zildjian Co. (Zildjian), the oldest family-owned business in the United States and the world’s largest maker of cymbals, drumsticks and percussion mallets, as a new commercial customer. Founded in 1623 and headquartered in Norwell, MA, Zildjian’s products are sold globally, inspiring people to express themselves through music. Eastern Bank’s credit solution includes traditional working capital and real estate financing and gro |

Eastern Bankshares (NASDAQ:EBC) Is Increasing Its Dividend To $0.11Eastern Bankshares, Inc. ( NASDAQ:EBC ) has announced that it will be increasing its dividend from last year's... |

EBC Price Returns

| 1-mo | 27.30% |

| 3-mo | 31.57% |

| 6-mo | 24.31% |

| 1-year | 24.67% |

| 3-year | 1.07% |

| 5-year | N/A |

| YTD | 21.86% |

| 2023 | -14.99% |

| 2022 | -12.73% |

| 2021 | 25.56% |

| 2020 | N/A |

| 2019 | N/A |

EBC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...