Esports Technologies Inc. (EBET): Price and Financial Metrics

EBET Price/Volume Stats

| Current price | $0.10 | 52-week high | $3.36 |

| Prev. close | $0.11 | 52-week low | $0.03 |

| Day low | $0.10 | Volume | 29,703 |

| Day high | $0.12 | Avg. volume | 148,839 |

| 50-day MA | $0.15 | Dividend yield | N/A |

| 200-day MA | $0.18 | Market Cap | 999.60K |

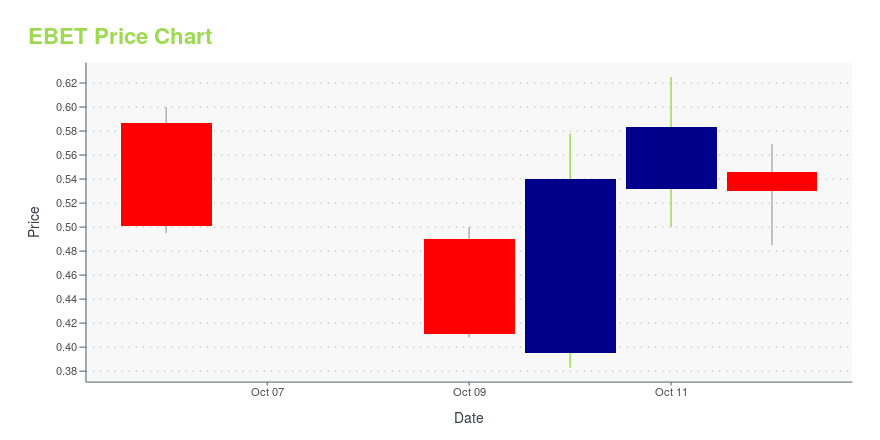

EBET Stock Price Chart Interactive Chart >

Esports Technologies Inc. (EBET) Company Bio

Esports Technologies, Inc., a technology company, develops and operates platforms that focuses on esports and competitive gaming worldwide. The company operates gogawi.com, a licensed online gambling platform, which is an esports/sportsbook that focuses on bettors located in Asia and Latin America. It also offers iGaming, which include online casino and table games, such as blackjack, virtual sport computer simulated games, and slot machines, as well as traditional sports betting. The company is based in Las Vegas, Nevada.

Latest EBET News From Around the Web

Below are the latest news stories about EBET INC that investors may wish to consider to help them evaluate EBET as an investment opportunity.

EBET Common Stock to Begin Trading on the OTC Pink Sheets on October 13EBET to Cease from Trading on NasdaqLAS VEGAS, NV / ACCESSWIRE / October 12, 2023 / EBET, Inc. ("EBET" or the "Company"), a global online i-gaming casino website operator, today announced that on October 12, 2023 it received formal notice from the ... |

EBET Announces Structural Amendment and Expansion of its Senior Secured Credit FacilityExtends Forbearance Through June 2025Defers Monthly Cash Interest ExpenseIncreases Revolving Loan Capacity to $4,000,000LAS VEGAS, NV / ACCESSWIRE / October 2, 2023 / EBET, Inc. ("EBET" or the "Company") (NASDAQ:EBET), a global online i-gaming casino ... |

EBET Announces Reverse Stock SplitLAS VEGAS, NV / ACCESSWIRE / September 29, 2023 / EBET, Inc., (NASDAQ:EBET) a leading global provider of advanced wagering products and technology, announced, today announced that it filed an amendment to articles of incorporation with the Secretary ... |

BestGrowthStocks.Com Provides Potential Outcomes and Extensive Comprehensive Analysis on EBET Inc.NEW YORK, NY / NewsDirect / September 21st, 2023 / Best Growth Stocks, a leading independent equity research and corporate access firm focused on finding and reporting on the best growth stocks uti... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayPre-market stock movers are a hot topic worth checking out on Friday with a look at the biggest winners and losers today! |

EBET Price Returns

| 1-mo | 6.38% |

| 3-mo | -62.83% |

| 6-mo | -58.51% |

| 1-year | -96.12% |

| 3-year | -99.98% |

| 5-year | N/A |

| YTD | -38.08% |

| 2023 | -99.15% |

| 2022 | -96.93% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...