Eagle Bancorp Montana, Inc. (EBMT): Price and Financial Metrics

EBMT Price/Volume Stats

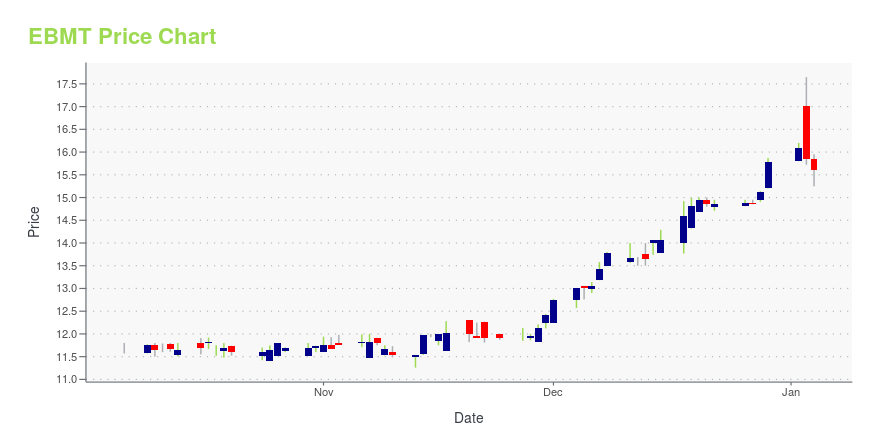

| Current price | $15.00 | 52-week high | $17.65 |

| Prev. close | $14.64 | 52-week low | $11.26 |

| Day low | $14.44 | Volume | 6,522 |

| Day high | $15.00 | Avg. volume | 8,886 |

| 50-day MA | $13.34 | Dividend yield | 3.96% |

| 200-day MA | $13.17 | Market Cap | 120.26M |

EBMT Stock Price Chart Interactive Chart >

Eagle Bancorp Montana, Inc. (EBMT) Company Bio

Eagle Bancorp Montana, Inc. operates as the bank holding company for Opportunity Bank of Montana that provides various retail banking products and services to small businesses and individuals in Montana. It accepts various deposit products, such as checking, savings, money market, and individual retirement accounts, as well as certificates of deposit accounts. The company also provides 1-4 family residential mortgage loans, such as residential mortgages and construction of residential properties; commercial real estate loans, including multi-family dwellings, nonresidential property, commercial construction and development, and farmland loans; and home equity loans. In addition, it offers consumer loans, such as loans secured by collateral other than real estate, such as automobiles, recreational vehicles, and boats; commercial business loans consisting of business loans and lines of credit on a secured and unsecured basis; construction loans; agricultural loans; and mortgage loan services. As of April 23, 2020, the company had 23 branch offices. It operates 26 automated teller machines, as well as various branches under the Dutton State Bank, Farmers State Bank of Denton, and The State Bank of Townsend brand names. The company was founded in 1922 and is headquartered in Helena, Montana.

Latest EBMT News From Around the Web

Below are the latest news stories about EAGLE BANCORP MONTANA INC that investors may wish to consider to help them evaluate EBMT as an investment opportunity.

Eagle Bancorp Montana (NASDAQ:EBMT) Is Due To Pay A Dividend Of $0.14Eagle Bancorp Montana, Inc.'s ( NASDAQ:EBMT ) investors are due to receive a payment of $0.14 per share on 1st of... |

Eagle Bancorp Montana (NASDAQ:EBMT) investors are sitting on a loss of 36% if they invested three years agoIn order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market... |

Eagle Bancorp Montana, Inc. (EBMT) Q3 Earnings and Revenues Miss EstimatesEagle Bancorp Montana, Inc. (EBMT) delivered earnings and revenue surprises of -2.86% and 0.82%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Eagle Bancorp Montana Earns $2.6 Million, or $0.34 per Diluted Share, in the Third Quarter of 2023; Declares Quarterly Cash Dividend of $0.14 Per ShareHELENA, Mont., Oct. 24, 2023 (GLOBE NEWSWIRE) -- Eagle Bancorp Montana, Inc. (NASDAQ: EBMT), (the “Company,” “Eagle”), the holding company of Opportunity Bank of Montana (the “Bank”), today reported net income of $2.6 million, or $0.34 per diluted share, in the third quarter of 2023, compared to $2.0 million, or $0.26 per diluted share, in the preceding quarter, and $3.1 million, or $0.40 per diluted share, in the third quarter of 2022. In the first nine months of 2023, net income increased 11.5 |

Here's What We Like About Eagle Bancorp Montana's (NASDAQ:EBMT) Upcoming DividendEagle Bancorp Montana, Inc. ( NASDAQ:EBMT ) stock is about to trade ex-dividend in 4 days. The ex-dividend date is one... |

EBMT Price Returns

| 1-mo | 16.91% |

| 3-mo | 18.64% |

| 6-mo | -0.60% |

| 1-year | 18.35% |

| 3-year | -26.22% |

| 5-year | 2.55% |

| YTD | -2.93% |

| 2023 | 1.93% |

| 2022 | -27.81% |

| 2021 | 10.49% |

| 2020 | 1.29% |

| 2019 | 32.41% |

EBMT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EBMT

Want to do more research on Eagle Bancorp Montana Inc's stock and its price? Try the links below:Eagle Bancorp Montana Inc (EBMT) Stock Price | Nasdaq

Eagle Bancorp Montana Inc (EBMT) Stock Quote, History and News - Yahoo Finance

Eagle Bancorp Montana Inc (EBMT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...