electroCore, Inc. (ECOR): Price and Financial Metrics

ECOR Price/Volume Stats

| Current price | $6.03 | 52-week high | $8.08 |

| Prev. close | $6.02 | 52-week low | $3.92 |

| Day low | $6.02 | Volume | 16,547 |

| Day high | $6.14 | Avg. volume | 11,565 |

| 50-day MA | $6.43 | Dividend yield | N/A |

| 200-day MA | $6.28 | Market Cap | 36.22M |

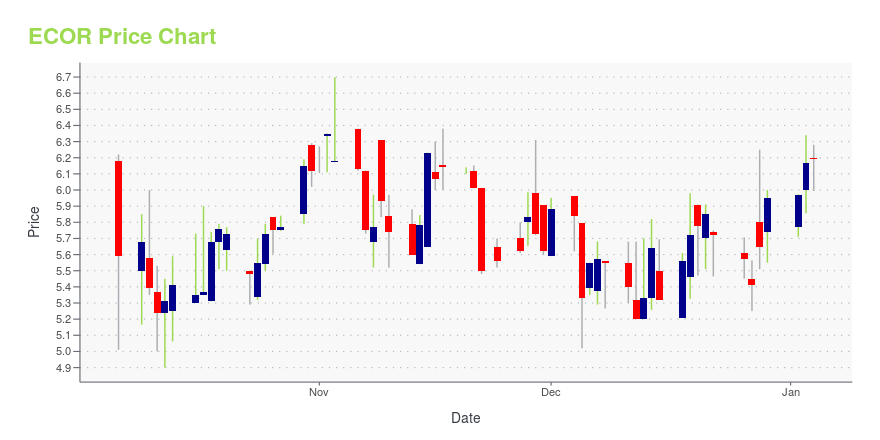

ECOR Stock Price Chart Interactive Chart >

electroCore, Inc. (ECOR) Company Bio

electroCore, LLC, a bioelectronic medicine company, engages in developing a range of patient-administered non-invasive vagus nerve stimulation therapies for the treatment of various conditions in neurology, rheumatology, and other fields. It is developing gammaCore, a prescription-only vagus nerve stimulation therapy, for the acute treatment of pain associated with migraine and episodic cluster headache in adults. The company was founded in 2005 and is based in Basking Ridge, New Jersey.

Latest ECOR News From Around the Web

Below are the latest news stories about ELECTROCORE INC that investors may wish to consider to help them evaluate ECOR as an investment opportunity.

electroCore Expands Intellectual Property PortfolioelectroCore Granted Two New U.S. PatentsROCKAWAY, N.J., Dec. 26, 2023 (GLOBE NEWSWIRE) -- electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic medicine and wellness company, today announced that it has received patent issue notifications from the United States Patent and Trademark Office (USPTO). The two patents were issued on December 26, 2023, and relate to electroCore’s non-invasive vagus nerve stimulation (nVNS) technology: US Patent No. 11,850,056 entitled “Devices and Methods |

These Stocks under $10 Are Poised To ExplodeIn this piece, we will take a look at these stocks under $10 are poised to explode. If you want to skip our introduction to these tricky stocks, jump to These 5 Stocks Under $10 Are Poised To Explode. The US equity markets remain on track for a strong finish in 2023 as major indices […] |

electroCore Expands Intellectual Property Portfolio for Nerve Stimulation TechnologyROCKAWAY, N.J., Dec. 12, 2023 (GLOBE NEWSWIRE) -- electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic medicine and wellness company, today announced the United States Patent and Trademark Office has issued a patent related to a system for stimulating a nerve target in the head or neck of a patient for treatment of various disorders, such as primary headache. U.S. Patent No. 11,839,764 entitled “Systems and Methods for Treating a Medical Condition with an Electrical Stimulation Tre |

Dr. Peter Staats to Host Analyst Day on the Science Behind gammaCore™ Non-Invasive Vagus Nerve Stimulation (nVNS) on Tuesday, November 21, 2023ROCKAWAY, N.J., Nov. 15, 2023 (GLOBE NEWSWIRE) -- electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic medicine and wellness company, announced today that the Company’s Chief Medical Officer, Dr. Peter Staats will host an analyst day entitled “Accessing the Power of Vagus Nerve Stimulation with gammaCore™” on November 21, 2023 at 1:30pm EST. The webinar will cover the nVNS mechanism of action and potential pipeline of indications using the company’s proprietary nVNS technology plat |

electroCore, Inc. (NASDAQ:ECOR) Q3 2023 Earnings Call TranscriptelectroCore, Inc. (NASDAQ:ECOR) Q3 2023 Earnings Call Transcript November 8, 2023 electroCore, Inc. misses on earnings expectations. Reported EPS is $-0.68 EPS, expectations were $-0.64. Operator: Greetings, and welcome to the electroCore Third Quarter 2023 Earnings Conference Call. At this time, all participants on a listen only mode. Please make sure to mute yourself. A […] |

ECOR Price Returns

| 1-mo | -4.59% |

| 3-mo | 4.69% |

| 6-mo | -18.95% |

| 1-year | 50.37% |

| 3-year | -58.41% |

| 5-year | -71.29% |

| YTD | 1.31% |

| 2023 | 54.51% |

| 2022 | -55.91% |

| 2021 | -62.66% |

| 2020 | -1.89% |

| 2019 | -74.60% |

Continue Researching ECOR

Want to do more research on electroCore Inc's stock and its price? Try the links below:electroCore Inc (ECOR) Stock Price | Nasdaq

electroCore Inc (ECOR) Stock Quote, History and News - Yahoo Finance

electroCore Inc (ECOR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...