EuroDry Ltd. (EDRY): Price and Financial Metrics

EDRY Price/Volume Stats

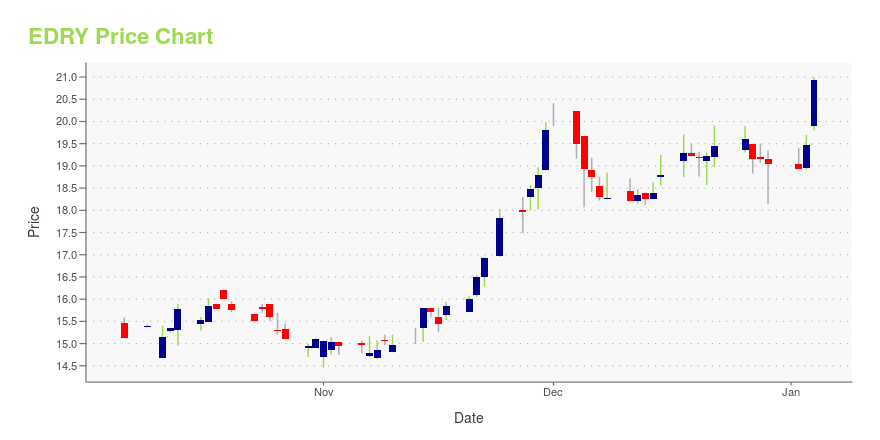

| Current price | $22.30 | 52-week high | $24.84 |

| Prev. close | $22.70 | 52-week low | $13.83 |

| Day low | $22.30 | Volume | 4,061 |

| Day high | $22.79 | Avg. volume | 10,520 |

| 50-day MA | $22.85 | Dividend yield | N/A |

| 200-day MA | $20.26 | Market Cap | 63.24M |

EDRY Stock Price Chart Interactive Chart >

EuroDry Ltd. (EDRY) Company Bio

EuroDry Ltd., through its subsidiaries, provides ocean-going transportation services worldwide. The company owns and operates drybulk carriers that transport major bulks, such as iron ore, coal, and grains; and minor bulks comprising bauxite, phosphate, and fertilizers. As of March 31, 2020, it operated a fleet of seven drybulk vessels, including four Panamax drybulk carriers, one Ultramax drybulk carrier, and two Kamsarmax carriers with a cargo capacity of 528,931 deadweight tons. EuroDry Ltd. was founded in 2018 and is based in Maroussi, Greece.

Latest EDRY News From Around the Web

Below are the latest news stories about EURODRY LTD that investors may wish to consider to help them evaluate EDRY as an investment opportunity.

Here's What Could Help EuroDry (EDRY) Maintain Its Recent Price StrengthEuroDry (EDRY) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen. |

Are Investors Undervaluing EuroDry (EDRY) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

What Makes EuroDry (EDRY) a Good Fit for 'Trend Investing'If you are looking for stocks that are well positioned to maintain their recent uptrend, EuroDry (EDRY) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen. |

EuroDry (NASDAQ:EDRY) rallies 12% this week, taking three-year gains to 254%The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a... |

EuroDry (EDRY)'s Technical Outlook is Bright After Key Golden CrossWhen a stock experiences a golden cross technical event, good things could be on the horizon. How should investors react? |

EDRY Price Returns

| 1-mo | -9.96% |

| 3-mo | 8.36% |

| 6-mo | 6.89% |

| 1-year | 58.83% |

| 3-year | 1.64% |

| 5-year | 171.41% |

| YTD | 17.06% |

| 2023 | 10.85% |

| 2022 | -9.74% |

| 2021 | 247.45% |

| 2020 | -29.74% |

| 2019 | -9.20% |

Continue Researching EDRY

Want to do more research on EuroDry Ltd's stock and its price? Try the links below:EuroDry Ltd (EDRY) Stock Price | Nasdaq

EuroDry Ltd (EDRY) Stock Quote, History and News - Yahoo Finance

EuroDry Ltd (EDRY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...