New Oriental Education & Technology Group Inc. ADR (EDU): Price and Financial Metrics

EDU Price/Volume Stats

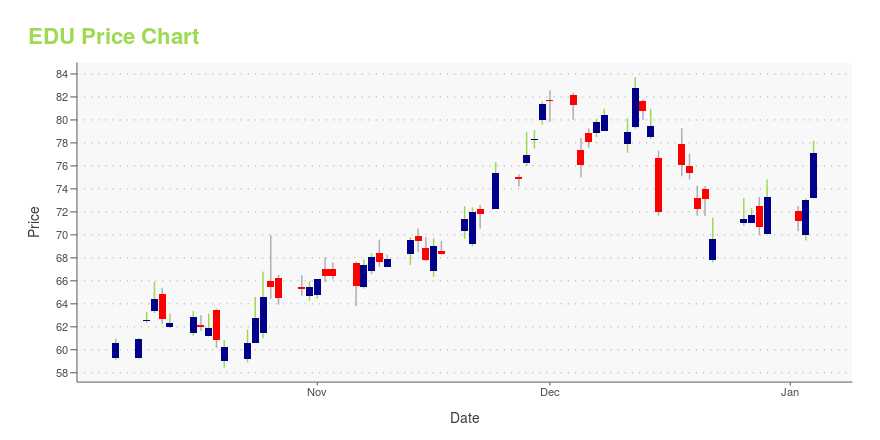

| Current price | $73.40 | 52-week high | $98.20 |

| Prev. close | $70.33 | 52-week low | $49.94 |

| Day low | $70.33 | Volume | 2,562,986 |

| Day high | $74.49 | Avg. volume | 1,704,452 |

| 50-day MA | $77.56 | Dividend yield | N/A |

| 200-day MA | $78.88 | Market Cap | 12.46B |

EDU Stock Price Chart Interactive Chart >

New Oriental Education & Technology Group Inc. ADR (EDU) Company Bio

New Oriental Education & Technology Group Inc. (Chinese: 新东方教育科技集团, NYSE: EDU, SEHK: 9901), more commonly New Oriental (Chinese: 新东方), is a provider of private educational services in China. The headquarters of New Oriental is located in Haidian District, Beijing. It is currently the largest comprehensive private educational company in China based on the number of program offerings, total student enrollments, and geographic presence. The business of New Oriental includes pre-school education, general courses for students of various age levels, online education, overseas study consulting, and textbook publishing. New Oriental was the first Chinese educational institution to enter the New York Stock Exchange in the United States, holding its IPO in 2006. As of 2016, New Oriental has built 67 short-time language educational schools, 20 book stores, 771 learning centers, and more than 5,000 third-party bookstores in 56 cities in China. New Oriental has had over 26.6 million student enrollments, including over 1.3 million enrollments in first quarter 2017. The company's market capitalization was approximately US$14 billion. (Source:Wikipedia)

Latest EDU News From Around the Web

Below are the latest news stories about NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC that investors may wish to consider to help them evaluate EDU as an investment opportunity.

New Oriental to Report Second Quarter 2024 Financial Results on January 24, 2024New Oriental Education and Technology Group Inc. (the "Company" or "New Oriental") (NYSE: EDU/ 9901.SEHK), a provider of private educational services in China, today announced that it will report its financial results for the second quarter ended November 30, 2023, before the U.S. market opens on January 24, 2024. New Oriental's management will host an earnings conference call at 8 AM on January 24, 2024, U.S. Eastern Time (9 PM on January 24, 2024, Beijing/Hong Kong Time). Participants can join |

10 Chinese Stocks Billionaires Are Crazy AboutIn this piece, we will take a look at the ten Chinese stocks that billionaires are crazy about. If you want to skip our overview of China’s economic struggles, then you can skip ahead to 5 Chinese Stocks Billionaires Are Crazy About. As 2023 heads to close, one thing is for certain: the world is […] |

How China’s Education Firms Survived the CrackdownChinese education stocks have earned a gold star in 2023: an unexpected, albeit partial, comeback after Beijing’s brutal regulatory crackdown that began in 2021. |

New Oriental Education & Technology Group (NYSE:EDU) Is Reinvesting At Lower Rates Of ReturnDid you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach... |

New Oriental Education & Technology Group Inc. Announces Results of Annual General MeetingNew Oriental Education & Technology Group Inc. ("New Oriental" or the "Company") (NYSE: EDU and SEHK: 9901), a provider of private educational services in China, today announced that the following proposed resolution submitted for shareholder approval has been adopted at its annual general meeting of shareholders held in Beijing today: |

EDU Price Returns

| 1-mo | -5.12% |

| 3-mo | -11.84% |

| 6-mo | -8.17% |

| 1-year | 39.41% |

| 3-year | 235.16% |

| 5-year | -30.10% |

| YTD | 0.16% |

| 2023 | 110.45% |

| 2022 | 65.81% |

| 2021 | -88.70% |

| 2020 | 53.25% |

| 2019 | 121.22% |

Continue Researching EDU

Want to do more research on New Oriental Education & Technology Group Inc's stock and its price? Try the links below:New Oriental Education & Technology Group Inc (EDU) Stock Price | Nasdaq

New Oriental Education & Technology Group Inc (EDU) Stock Quote, History and News - Yahoo Finance

New Oriental Education & Technology Group Inc (EDU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...