Energy Focus, Inc. (EFOI): Price and Financial Metrics

EFOI Price/Volume Stats

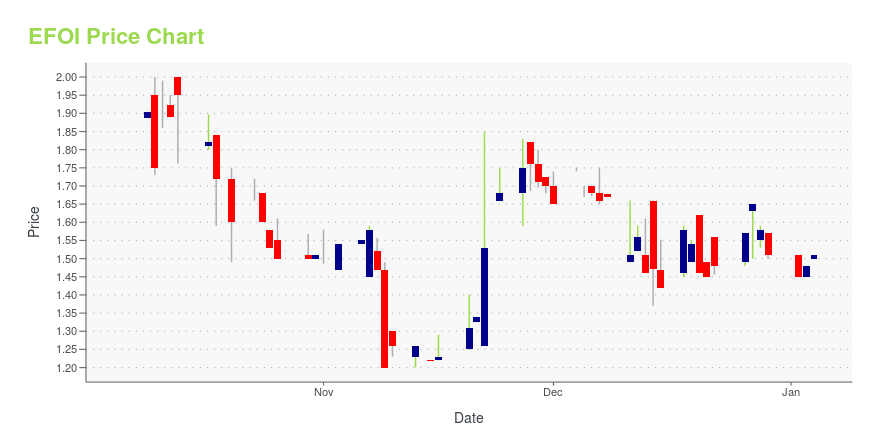

| Current price | $1.42 | 52-week high | $2.90 |

| Prev. close | $1.43 | 52-week low | $1.20 |

| Day low | $1.30 | Volume | 1,819 |

| Day high | $1.42 | Avg. volume | 114,624 |

| 50-day MA | $1.56 | Dividend yield | N/A |

| 200-day MA | $1.56 | Market Cap | 6.71M |

EFOI Stock Price Chart Interactive Chart >

Energy Focus, Inc. (EFOI) Company Bio

Energy Focus, Inc. designs, develops, manufactures, markets, and installs energy-efficient lighting systems and solutions in the United States and internationally. The company was formerly known as Fiberstars, Inc. and changed its name to Energy Focus, Inc. in May 2007. The company was founded in 1985 and is based in Solon, Ohio.

Latest EFOI News From Around the Web

Below are the latest news stories about ENERGY FOCUS INC that investors may wish to consider to help them evaluate EFOI as an investment opportunity.

Energy Focus, Inc. Reports Third Quarter 2023 Financial ResultsEnergy Focus, Inc. (NASDAQ:EFOI), a leader in energy-efficient lighting and control system products for the commercial market and military maritime market (“MMM”), today announced financial results... |

Energy Focus Appoints New CEO and Chairman of the BoardEnergy Focus, Inc. (NASDAQ: EFOI), a leader in sustainable, energy-efficient LED lighting control systems and products for the commercial, military, maritime and consumer markets, today announced t... |

Energy Focus, Inc. Reports Second Quarter 2023 Financial ResultsConference Call to be Held Today at 11 a.m. ET |

Incandescent Bulbs Now Banned: Is There An Investment Play?The global market for LED bulbs is expected to grow at a CAGR of 15% from 2022 to 2027. |

Energy Focus to Report Second Quarter 2023 Earnings Results on August 10, 2023Energy Focus, Inc. (NASDAQ:EFOI), a leader in sustainable, energy-efficient lighting and control systems products for the commercial and military maritime markets, will announce its financial resul... |

EFOI Price Returns

| 1-mo | 8.40% |

| 3-mo | -5.33% |

| 6-mo | 5.98% |

| 1-year | -29.00% |

| 3-year | -94.53% |

| 5-year | -89.87% |

| YTD | -5.96% |

| 2023 | -31.52% |

| 2022 | -92.62% |

| 2021 | 5.96% |

| 2020 | 70.33% |

| 2019 | -23.55% |

Continue Researching EFOI

Want to see what other sources are saying about Energy Focus Inc's financials and stock price? Try the links below:Energy Focus Inc (EFOI) Stock Price | Nasdaq

Energy Focus Inc (EFOI) Stock Quote, History and News - Yahoo Finance

Energy Focus Inc (EFOI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...