Eagle Pharmaceuticals, Inc. (EGRX): Price and Financial Metrics

EGRX Price/Volume Stats

| Current price | $5.72 | 52-week high | $23.52 |

| Prev. close | $5.74 | 52-week low | $3.21 |

| Day low | $5.63 | Volume | 33,700 |

| Day high | $5.94 | Avg. volume | 199,029 |

| 50-day MA | $4.73 | Dividend yield | N/A |

| 200-day MA | $6.28 | Market Cap | 74.29M |

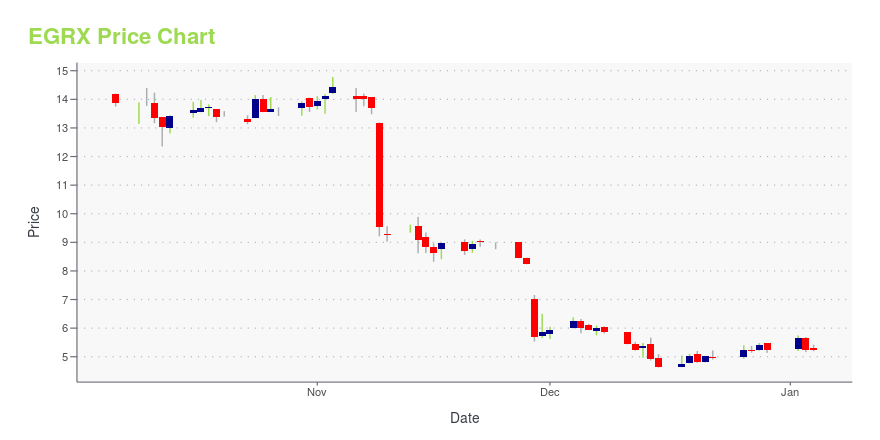

EGRX Stock Price Chart Interactive Chart >

Eagle Pharmaceuticals, Inc. (EGRX) Company Bio

Eagle Pharmaceuticals focuses on developing and commercializing injectable products primarily in the critical care and oncology areas in the United States. The company was founded in 2007 and is based in Woodcliff Lake, New Jersey.

Latest EGRX News From Around the Web

Below are the latest news stories about EAGLE PHARMACEUTICALS INC that investors may wish to consider to help them evaluate EGRX as an investment opportunity.

Eagle Pharmaceuticals to Present Abstract on Post-hoc Analysis of Amisulpride at the 77th PGA (PostGraduate Assembly in Anesthesiology) in New York CityBarhemsys Barhemsys -- BARHEMSYS® (amisulpride) Injection is the first and only antiemetic approved by the U.S. Food and Drug Administration (“FDA”) for rescue treatment of postoperative nausea and vomiting (“PONV”) despite prophylaxis1 and is also approved for the treatment of PONV in patients who have not received prophylaxis and for the prevention of PONV -- -- In patients who experience PONV, the incidence of nausea is substantially greater than the incidence of vomiting2,3 -- -- This post-h |

Eagle Pharmaceuticals Announces Receipt of Notification of Deficiency from Nasdaq Regarding Requirement to Timely File Quarterly Report on Form 10-QWOODCLIFF LAKE, N.J., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Eagle Pharmaceuticals, Inc. (Nasdaq: EGRX) (the “Company”) today announced that it received a notice (the “Notice”) on November 27, 2023 from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) advising the Company that it is not currently in compliance with Nasdaq’s continued listing requirements under the Nasdaq Listing Rule 5250(c)(1) (the “Rule”), which requires timely filing of all required periodic financia |

Eagle Pharmaceuticals Announces Management Change– CEO and Founder Scott Tarriff Retires – – Chairman Michael Graves to Serve as Interim Executive Chairman – WOODCLIFF LAKE, N.J., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Eagle Pharmaceuticals, Inc. (Nasdaq: EGRX) (“Eagle” or the “Company”) today announced a change in management. Effective immediately Scott Tarriff, Founder, President and Chief Executive Officer of the Company, has announced his resignation and retirement from his positions with the Company as President, Chief Executive Officer and Di |

Down -33.75% in 4 Weeks, Here's Why Eagle Pharmaceuticals (EGRX) Looks Ripe for a TurnaroundEagle Pharmaceuticals (EGRX) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term. |

Down -26.73% in 4 Weeks, Here's Why Eagle Pharmaceuticals (EGRX) Looks Ripe for a TurnaroundThe heavy selling pressure might have exhausted for Eagle Pharmaceuticals (EGRX) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal. |

EGRX Price Returns

| 1-mo | 13.94% |

| 3-mo | 37.50% |

| 6-mo | 3.81% |

| 1-year | -69.25% |

| 3-year | -88.13% |

| 5-year | -89.69% |

| YTD | 9.37% |

| 2023 | -82.11% |

| 2022 | -42.60% |

| 2021 | 9.34% |

| 2020 | -22.49% |

| 2019 | 49.12% |

Continue Researching EGRX

Want to do more research on Eagle Pharmaceuticals Inc's stock and its price? Try the links below:Eagle Pharmaceuticals Inc (EGRX) Stock Price | Nasdaq

Eagle Pharmaceuticals Inc (EGRX) Stock Quote, History and News - Yahoo Finance

Eagle Pharmaceuticals Inc (EGRX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...