Eiger BioPharmaceuticals, Inc. (EIGR): Price and Financial Metrics

EIGR Price/Volume Stats

| Current price | $1.73 | 52-week high | $43.35 |

| Prev. close | $1.90 | 52-week low | $1.10 |

| Day low | $1.66 | Volume | 137,800 |

| Day high | $1.90 | Avg. volume | 103,866 |

| 50-day MA | $5.29 | Dividend yield | N/A |

| 200-day MA | $11.59 | Market Cap | 2.55M |

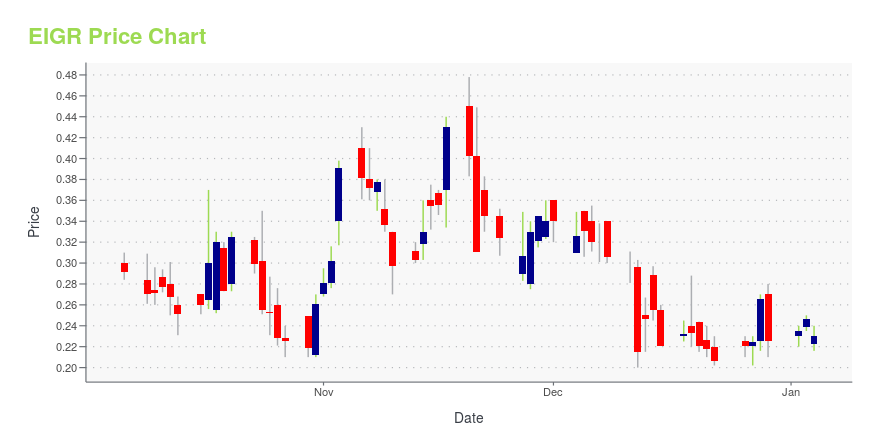

EIGR Stock Price Chart Interactive Chart >

Eiger BioPharmaceuticals, Inc. (EIGR) Company Bio

Eiger BioPharmaceutical Inc, formerly Celladon Corporation, is a clinical-stage biotechnology company engaged in the development of cardiovascular gene therapy. The company was founded in 2008 and is based in Palo Alto, California.

Latest EIGR News From Around the Web

Below are the latest news stories about EIGER BIOPHARMACEUTICALS INC that investors may wish to consider to help them evaluate EIGR as an investment opportunity.

Eiger BioPharmaceuticals Insiders US$2.1m Short Of Breakeven On Stock PurchaseInsiders who purchased US$3.42m worth of Eiger BioPharmaceuticals, Inc. ( NASDAQ:EIGR ) shares over the past year... |

Eiger BioPharmaceuticals Reports Third Quarter 2023 Financial Results and Provides Business UpdateEiger BioPharmaceuticals, Inc. (Nasdaq:EIGR), a commercial-stage biopharmaceutical company focused on the development of innovative therapies for rare metabolic diseases, today reported financial results for the third quarter 2023 and provided a business update. |

Why Is Eiger BioPharmaceuticals (EIGR) Stock Down 31% Today?Eiger BioPharmaceuticals (EIGR) stock is falling on Wednesday after the biopharmaceutical company halted a Phase 3 clinical trial. |

Why Is Sigma Lithium (SGML) Stock Up 14% Today?Sigma Lithium (SGML) stock is climbing higher on Wednesday after confirming it has received multiple strategic proposals. |

WKHS Stock Alert: The $40,000 Reason Workhorse Is Up TodayWorkhorse (WKHS) stock is on the rise Wednesday thanks to a new update from the IRS concerning its electric vehicle (EV) manufacturer status. |

EIGR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -70.58% |

| 1-year | -91.76% |

| 3-year | -99.27% |

| 5-year | -99.48% |

| YTD | -74.31% |

| 2023 | -80.97% |

| 2022 | -77.26% |

| 2021 | -57.77% |

| 2020 | -17.52% |

| 2019 | 46.65% |

Loading social stream, please wait...