Electro-Sensors, Inc. (ELSE): Price and Financial Metrics

ELSE Price/Volume Stats

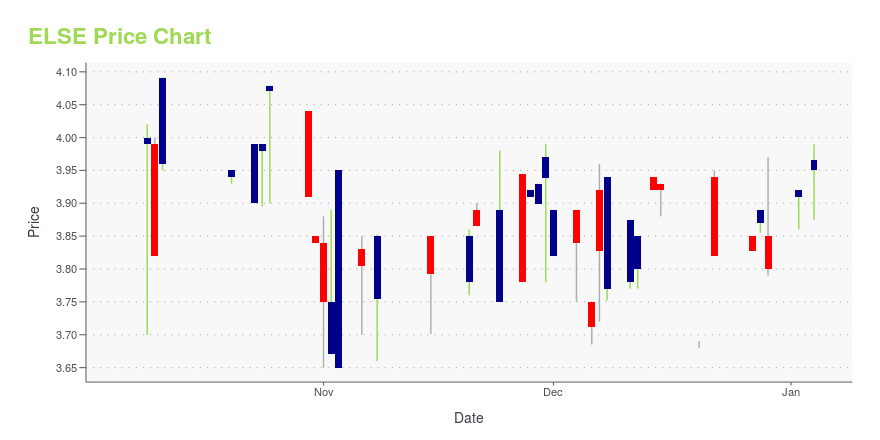

| Current price | $3.92 | 52-week high | $4.48 |

| Prev. close | $3.93 | 52-week low | $3.65 |

| Day low | $3.91 | Volume | 11,961 |

| Day high | $3.94 | Avg. volume | 2,813 |

| 50-day MA | $4.04 | Dividend yield | N/A |

| 200-day MA | $4.02 | Market Cap | 13.44M |

ELSE Stock Price Chart Interactive Chart >

Electro-Sensors, Inc. (ELSE) Company Bio

Electro-Sensors, Inc. manufactures and sells industrial production monitoring and process control systems. The company manufactures and sells various monitoring systems that measure machine production and operation rates, as well as systems, which regulate the speed of related machines in production processes. Its speed monitoring systems include a line of products that measure production counts or rates, such as parts, gallons, or board feet; and alarm systems, tachometers, and other devices that translate impulses from the sensors into alarm signals, computer inputs, or digital displays. The company's temperature application products consist of bearing, gear box, and motor temperature monitoring sensors. It also offers production monitoring devices that include a belt alignment and slide gate position monitors; vibration monitoring products; and tilt switches. In addition, the company provides hazard monitoring systems, such as Electro-Sentry, which integrates its sensors for monitoring temperature, belt alignment, and shaft speed; and HazardPRO, a wireless hazard technology monitoring system, as well as HazardPRO software. It serves customers in various industries, including grain/feed/milling, bulk material, manufacturing, food product, ethanol, power generation, and other processing industries. The company sells its products through internal sales team, manufacturer's representatives, and distributors in the United States, Canada, Mexico, Bolivia, Chile, Colombia, Guatemala, Peru, the United Kingdom, Ukraine, Egypt, Saudi Arabia, India, Indonesia, Australia, New Zealand, China, Taiwan, Korea, Vietnam, Malaysia, the Philippines, and Singapore. Electro-Sensors, Inc. was founded in 1968 and is based in Minnetonka, Minnesota.

Latest ELSE News From Around the Web

Below are the latest news stories about ELECTRO SENSORS INC that investors may wish to consider to help them evaluate ELSE as an investment opportunity.

Electro-Sensors, Inc. Announces Third Quarter 2023 Financial ResultsElectro-Sensors, Inc. (NASDAQ: ELSE), a leading global provider of machine monitoring sensors and hazard monitoring systems, today announced financial results for the third quarter ended September 30, 2023. |

Electro-Sensors, Inc. Announces Second Quarter 2023 Financial ResultsElectro-Sensors, Inc. (NASDAQ: ELSE), a leading global provider of machine monitoring sensors and hazard monitoring systems, today announced financial results for the second quarter ended June 30, 2023. |

Electro-Sensors, Inc. Announces First Quarter 2023 Financial ResultsElectro-Sensors, Inc. (NASDAQ: ELSE), a leading global provider of machine monitoring sensors and hazard monitoring systems, today announced financial results for the first quarter ended March 31, 2023. |

Electro-Sensors, Inc. Announces 2022 Year-End Financial ResultsElectro-Sensors, Inc. (NASDAQ: ELSE), a leading global provider of machine monitoring sensors and hazard monitoring systems, today announced financial results for the year ended December 31, 2022. |

Electro-Sensors and Mobile X Global, Inc. Agree to Terminate Merger AgreementElectro-Sensors, Inc. (Nasdaq: ELSE) and privately held Mobile X Global, Inc. announced today that the two companies have terminated the definitive merger agreement the parties entered into on June 10, 2022. |

ELSE Price Returns

| 1-mo | -1.01% |

| 3-mo | -5.45% |

| 6-mo | -4.54% |

| 1-year | -12.50% |

| 3-year | -16.60% |

| 5-year | 15.46% |

| YTD | 3.16% |

| 2023 | -15.93% |

| 2022 | -28.08% |

| 2021 | 30.65% |

| 2020 | 32.51% |

| 2019 | 6.76% |

Continue Researching ELSE

Want to see what other sources are saying about Electro Sensors Inc's financials and stock price? Try the links below:Electro Sensors Inc (ELSE) Stock Price | Nasdaq

Electro Sensors Inc (ELSE) Stock Quote, History and News - Yahoo Finance

Electro Sensors Inc (ELSE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...