EMCORE Corporation (EMKR): Price and Financial Metrics

EMKR Price/Volume Stats

| Current price | $1.22 | 52-week high | $8.50 |

| Prev. close | $1.18 | 52-week low | $0.78 |

| Day low | $1.13 | Volume | 203,257 |

| Day high | $1.22 | Avg. volume | 422,757 |

| 50-day MA | $1.08 | Dividend yield | N/A |

| 200-day MA | $3.40 | Market Cap | 10.09M |

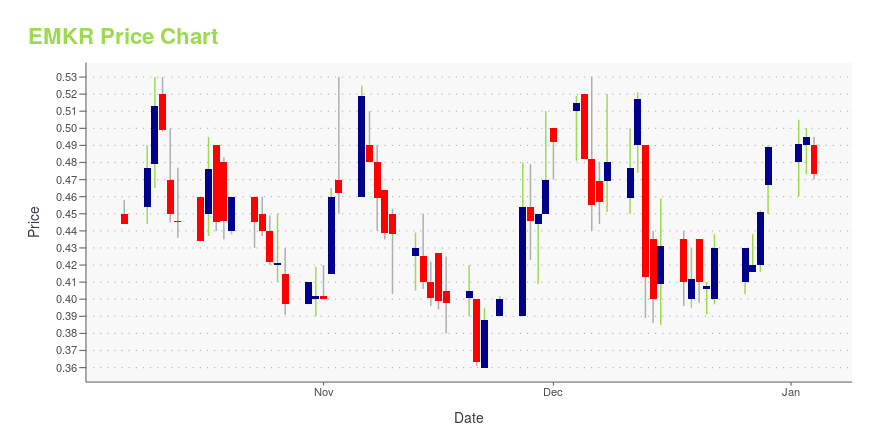

EMKR Stock Price Chart Interactive Chart >

EMCORE Corporation (EMKR) Company Bio

EMCORE Corporation designs and manufactures Indium Phosphide optical chips, components, subsystems, and systems for the broadband and specialty fiber optics market. The company was founded in 1984 and is based in Alhambra, California.

Latest EMKR News From Around the Web

Below are the latest news stories about EMCORE CORP that investors may wish to consider to help them evaluate EMKR as an investment opportunity.

EMCORE Corporation (NASDAQ:EMKR) Q4 2023 Earnings Call TranscriptEMCORE Corporation (NASDAQ:EMKR) Q4 2023 Earnings Call Transcript December 12, 2023 EMCORE Corporation beats earnings expectations. Reported EPS is $-0.03, expectations were $-0.1. Operator: Thank you for standing by, and welcome to EMCORE Corporation’s Fiscal 2023 Fourth Quarter Results Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, […] |

EMCORE Corporation (NASDAQ:EMKR) Shares Could Be 48% Below Their Intrinsic Value EstimateKey Insights Using the 2 Stage Free Cash Flow to Equity, EMCORE fair value estimate is US$0.79 EMCORE's US$0.41 share... |

EMKR Stock Earnings: EMCORE Beats EPS, Beats Revenue for Q4 2023EMKR stock results show that EMCORE beat analyst estimates for earnings per share and beat on revenue for the fourth quarter of 2023. |

EMCORE Reports Fiscal 2023 Fourth Quarter ResultsALHAMBRA, CA, Dec. 12, 2023 (GLOBE NEWSWIRE) -- EMCORE Corporation (Nasdaq: EMKR), the world’s largest independent provider of inertial navigation solutions to the aerospace and defense industry, today announced results for the fiscal 2023 fourth quarter (4Q23) ended September 30, 2023. Management will host a conference call to discuss 4Q23 financial and business results on December 12, 2023 at 5:00 p.m. Eastern Time (ET).For 4Q23, EMCORE’s consolidated revenue was $26.8 million. Net loss was $4 |

EMCORE Q4 2023 Earnings PreviewMore on EMCORE |

EMKR Price Returns

| 1-mo | 0.83% |

| 3-mo | -55.31% |

| 6-mo | -80.70% |

| 1-year | -81.45% |

| 3-year | -98.54% |

| 5-year | -95.93% |

| YTD | -75.05% |

| 2023 | -49.19% |

| 2022 | -86.21% |

| 2021 | 28.07% |

| 2020 | 79.28% |

| 2019 | -27.62% |

Continue Researching EMKR

Want to see what other sources are saying about Emcore Corp's financials and stock price? Try the links below:Emcore Corp (EMKR) Stock Price | Nasdaq

Emcore Corp (EMKR) Stock Quote, History and News - Yahoo Finance

Emcore Corp (EMKR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...