Emerson Electric Co. (EMR): Price and Financial Metrics

EMR Price/Volume Stats

| Current price | $146.82 | 52-week high | $147.57 |

| Prev. close | $146.88 | 52-week low | $90.06 |

| Day low | $146.19 | Volume | 3,024,472 |

| Day high | $147.57 | Avg. volume | 3,066,554 |

| 50-day MA | $129.87 | Dividend yield | 1.46% |

| 200-day MA | $0.00 | Market Cap | 82.59B |

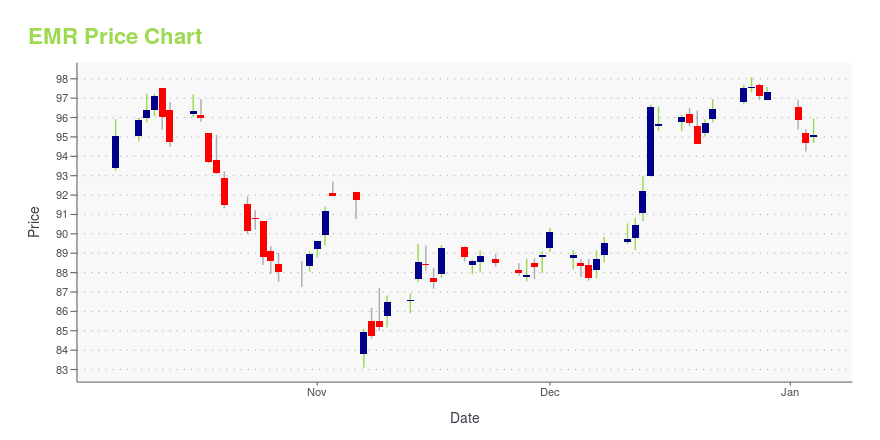

EMR Stock Price Chart Interactive Chart >

Emerson Electric Co. (EMR) Company Bio

Emerson Electric Co. is an American multinational corporation headquartered in Ferguson, Missouri. The Fortune 500 company manufactures products and provides engineering services for industrial, commercial, and consumer markets. Emerson has approximately 83,500 employees and 200 manufacturing locations. (Source:Wikipedia)

EMR Price Returns

| 1-mo | 12.31% |

| 3-mo | 40.07% |

| 6-mo | 13.39% |

| 1-year | 31.00% |

| 3-year | 85.66% |

| 5-year | 158.50% |

| YTD | 19.49% |

| 2024 | 29.73% |

| 2023 | 3.75% |

| 2022 | 5.74% |

| 2021 | 18.20% |

| 2020 | 8.61% |

EMR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EMR

Want to see what other sources are saying about Emerson Electric Co's financials and stock price? Try the links below:Emerson Electric Co (EMR) Stock Price | Nasdaq

Emerson Electric Co (EMR) Stock Quote, History and News - Yahoo Finance

Emerson Electric Co (EMR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...