Enservco Corporation (ENSV): Price and Financial Metrics

ENSV Price/Volume Stats

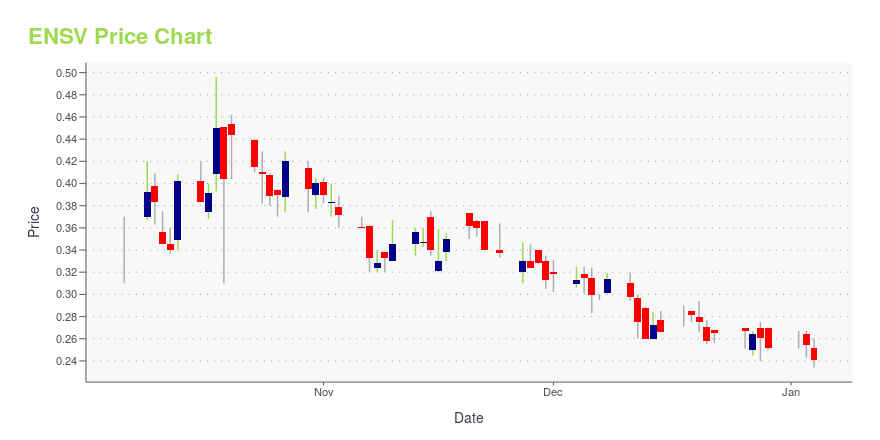

| Current price | $0.20 | 52-week high | $0.50 |

| Prev. close | $0.20 | 52-week low | $0.15 |

| Day low | $0.19 | Volume | 261,100 |

| Day high | $0.21 | Avg. volume | 578,600 |

| 50-day MA | $0.23 | Dividend yield | N/A |

| 200-day MA | $0.26 | Market Cap | 5.53M |

ENSV Stock Price Chart Interactive Chart >

Enservco Corporation (ENSV) Company Bio

Enservco Corporation, through its subsidiaries, provides oil field services to the onshore oil and natural gas industry in the United States. The company operates through Production Services and Completion Services segments. It offers frac water heating, hot oiling, pressure testing, acidizing, water transfer, bacteria and scale treatment, freshwater and saltwater hauling, fluid disposal, frac tank rental, well site construction, and other general oil field services. The company owns and operates a fleet of approximately 390 specialized trucks, trailers, frac tanks, and other well-site related equipment. It operates in the Rocky Mountain region consisting of eastern Colorado and southern Wyoming, central Wyoming, northwestern New Mexico, and western North Dakota and eastern Montana; eastern United States region comprising the southern region of the Marcellus Shale formation and the Utica Shale formation in eastern Ohio; and the Central United States region, Texas panhandle, northwestern Oklahoma, and the Eagle Ford Shale in south Texas. The company was incorporated in 1980 and is headquartered in Denver, Colorado.

Latest ENSV News From Around the Web

Below are the latest news stories about ENSERVCO CORP that investors may wish to consider to help them evaluate ENSV as an investment opportunity.

Enservco Corporation Reports 2023 Third Quarter Financial ResultsNine-month revenue up 3% year over year to $15.6 million from $15.1 millionQ3 revenue down 6% year over year to $2.9 million from $3.1 million due to Company’s earlier exit from North Dakota market to focus on more profitable basinsQ3 acquisition of Rapid Hot strengthens position in Marcellus Shale and adds new revenue and management depthRecent $1,625,000 convertible debt financing that included participation from lead investors of Rapid Hot, an Enservco board member and Cross River PartnersYea |

Enservco Corporation Schedules Third Quarter Earnings CallLONGMONT, Colo., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Enservco Corporation (NYSE American: ENSV), a diversified national provider of specialized well-site services to the domestic onshore conventional and unconventional oil and gas industries, today announced it has scheduled its 2023 third quarter earnings call for Thursday November 16, 2023, at 9:30 a.m. ET. The conference call will be accessible by dialing 888-506-0062 (973-528-0011 for international callers), access code 577898. A telephonic re |

Enservco Corporation Names Veteran Executive Mike Lade Senior Vice President & Chief of StaffLONGMONT, Colo., Sept. 15, 2023 (GLOBE NEWSWIRE) -- Enservco Corporation (NYSE American: ENSV), a diversified national provider of specialized well-site services to the domestic onshore conventional and unconventional oil and gas industries, today announced the appointment of veteran executive Mike Lade as senior vice president and chief of staff. Lade is the former president and CFO of Rapid Hot, an oilfield services company recently acquired by Enservco. A certified public account licensed in |

Q2 2023 Enservco Corp Earnings CallQ2 2023 Enservco Corp Earnings Call |

Enservco Corporation Reports 2023 Second Quarter Financial Results9th consecutive quarter of YOY revenue growth, continued improvement in profit metricsQ2 revenue up 8% year over year to $3.7 million from $3.5 millionQ2 adjusted EBITDA improves to $1.0 million loss from $1.6 million lossSix-month revenue up 5% year over year to $12.6 million from $12.0 millionSix-month adjusted EBITDA loss of $14,000 vs. loss of $1.4 millionCompany continues to de-lever balance sheet, reducing long-term debt to $4.6 million from $7.6 million since 2022 year-end and from $36 mi |

ENSV Price Returns

| 1-mo | -4.99% |

| 3-mo | -13.04% |

| 6-mo | 6.95% |

| 1-year | -46.29% |

| 3-year | -83.74% |

| 5-year | -97.21% |

| YTD | -20.63% |

| 2023 | -84.54% |

| 2022 | 91.09% |

| 2021 | -54.39% |

| 2020 | -33.05% |

| 2019 | -49.68% |

Continue Researching ENSV

Want to do more research on Enservco Corp's stock and its price? Try the links below:Enservco Corp (ENSV) Stock Price | Nasdaq

Enservco Corp (ENSV) Stock Quote, History and News - Yahoo Finance

Enservco Corp (ENSV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...