Enanta Pharmaceuticals, Inc. (ENTA): Price and Financial Metrics

ENTA Price/Volume Stats

| Current price | $15.52 | 52-week high | $20.04 |

| Prev. close | $15.33 | 52-week low | $8.08 |

| Day low | $15.19 | Volume | 92,271 |

| Day high | $15.82 | Avg. volume | 220,808 |

| 50-day MA | $13.33 | Dividend yield | N/A |

| 200-day MA | $12.32 | Market Cap | 328.70M |

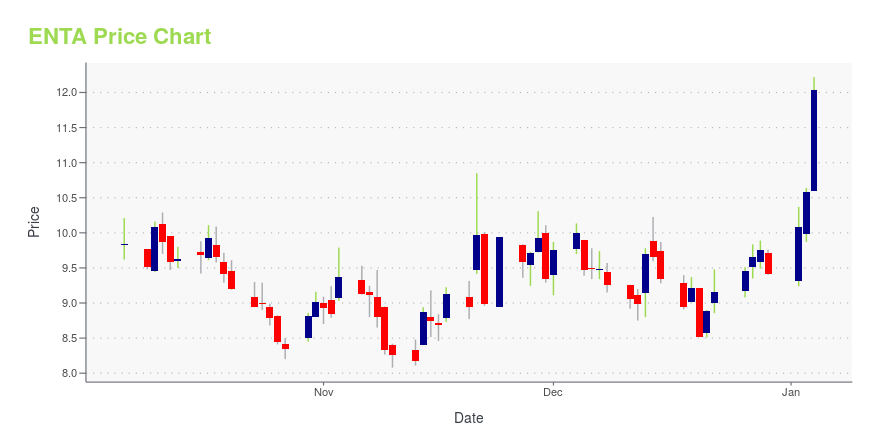

ENTA Stock Price Chart Interactive Chart >

Enanta Pharmaceuticals, Inc. (ENTA) Company Bio

Enanta Pharmaceuticals is a research and development-focused biotechnology company that uses a chemistry-driven approach and drug discovery capabilities to create small molecule drugs for viral infections and liver diseases. The company was founded in 1995 and is based in Watertown, Massachusetts.

Latest ENTA News From Around the Web

Below are the latest news stories about ENANTA PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ENTA as an investment opportunity.

The Zacks Analyst Blog Highlights Enanta, OneConnect Financial, KNOT Offshore, Hippo Holdings and H WorldEnanta, OneConnect Financial, KNOT Offshore, Hippo Holdings and H World are included in this Analyst Blog. |

Insider Sell Alert: Director Terry Vance Sells 15,295 Shares of Enanta Pharmaceuticals Inc (ENTA)In a notable insider transaction, Director Terry Vance has parted with 15,295 shares of Enanta Pharmaceuticals Inc (NASDAQ:ENTA), a significant move that warrants a closer look by investors and market analysts. |

Wall Street Analysts Predict a 108.12% Upside in Enanta Pharmaceuticals (ENTA): Here's What You Should KnowThe average of price targets set by Wall Street analysts indicates a potential upside of 108.1% in Enanta Pharmaceuticals (ENTA). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock. |

How Much Upside is Left in Enanta Pharmaceuticals (ENTA)? Wall Street Analysts Think 88.23%The mean of analysts' price targets for Enanta Pharmaceuticals (ENTA) points to an 88.2% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock. |

Enanta Pharmaceuticals to Participate at Evercore ISI HealthCONx ConferenceWATERTOWN, Mass., November 22, 2023--Enanta Pharmaceuticals, Inc. (NASDAQ: ENTA), a clinical-stage biotechnology company dedicated to creating small molecule drugs with an emphasis on treatments for viral infections, today announced that Jay R. Luly, Ph.D., President and Chief Executive Officer, will participate in a fireside chat at Evercore ISI HealthCONx Conference on November 29, 2023 at 7:55 a.m. ET in Miami, FL. |

ENTA Price Returns

| 1-mo | 27.11% |

| 3-mo | 25.46% |

| 6-mo | 26.90% |

| 1-year | -14.35% |

| 3-year | -62.57% |

| 5-year | -80.07% |

| YTD | 64.93% |

| 2023 | -79.77% |

| 2022 | -37.79% |

| 2021 | 77.62% |

| 2020 | -31.85% |

| 2019 | -12.78% |

Continue Researching ENTA

Want to do more research on Enanta Pharmaceuticals Inc's stock and its price? Try the links below:Enanta Pharmaceuticals Inc (ENTA) Stock Price | Nasdaq

Enanta Pharmaceuticals Inc (ENTA) Stock Quote, History and News - Yahoo Finance

Enanta Pharmaceuticals Inc (ENTA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...