Enzon Pharmaceuticals (ENZN): Price and Financial Metrics

ENZN Price/Volume Stats

| Current price | $0.15 | 52-week high | $0.24 |

| Prev. close | $0.15 | 52-week low | $0.06 |

| Day low | $0.15 | Volume | 5,301 |

| Day high | $0.15 | Avg. volume | 26,639 |

| 50-day MA | $0.15 | Dividend yield | N/A |

| 200-day MA | $0.12 | Market Cap | 11.13M |

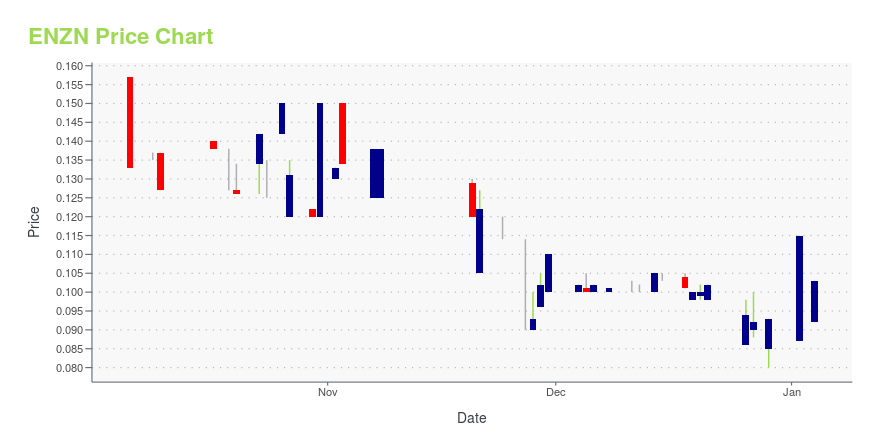

ENZN Stock Price Chart Interactive Chart >

Enzon Pharmaceuticals (ENZN) Company Bio

Enzon Pharmaceuticals, Inc., together with its subsidiaries, engages in licensing drug products. Its marketed drug products include PegIntron and Sylatron. The company was founded in 1981 and is headquartered in Cranford, New Jersey.

Latest ENZN News From Around the Web

Below are the latest news stories about ENZON PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ENZN as an investment opportunity.

7 Undervalued Biotech Stocks to Buy Before They BoomSpeculative investors should consider building a position in these undervalued biotech stocks before the market rebounds. |

ENZN Price Returns

| 1-mo | -19.48% |

| 3-mo | 79.64% |

| 6-mo | 76.26% |

| 1-year | -25.00% |

| 3-year | -72.72% |

| 5-year | N/A |

| YTD | 60.26% |

| 2023 | -62.06% |

| 2022 | -27.97% |

| 2021 | 37.88% |

| 2020 | 20.58% |

| 2019 | 284.33% |

Continue Researching ENZN

Here are a few links from around the web to help you further your research on Enzon Pharmaceuticals Inc's stock as an investment opportunity:Enzon Pharmaceuticals Inc (ENZN) Stock Price | Nasdaq

Enzon Pharmaceuticals Inc (ENZN) Stock Quote, History and News - Yahoo Finance

Enzon Pharmaceuticals Inc (ENZN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...